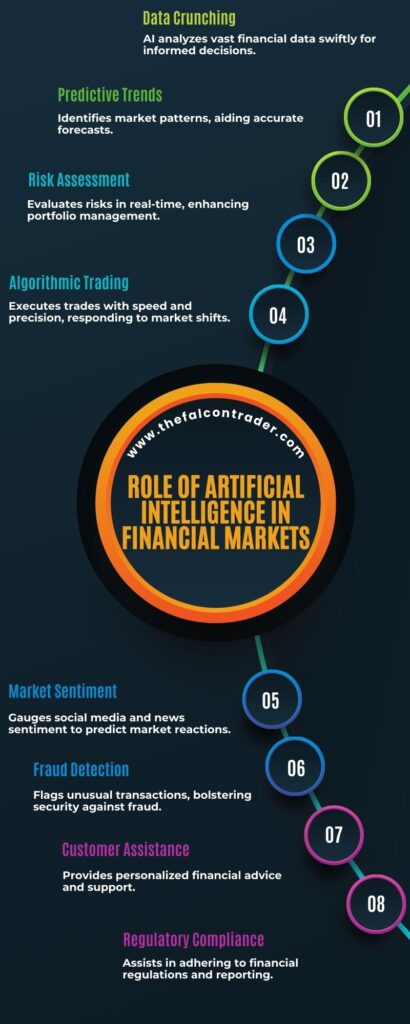

Revolutionizing Markets: Role of Artificial Intelligence in Financial Markets – Insights 2023

Dive into the cutting-edge landscape of finance with a comprehensive exploration of the “Role of Artificial Intelligence in Financial Markets.” In today’s dynamic world, the integration of AI has revolutionized the way financial markets operate. From predictive analytics and algorithmic trading to risk management and fraud detection, AI has become a driving force behind informed decision-making and market efficiency.

This guide delves into the multifaceted applications of AI, highlighting its transformative impact on investment strategies and market trends. Join us on this enlightening journey as we unravel the intricate relationship between artificial intelligence and the ever-evolving financial landscape.

Key Takeaways

- AI is revolutionizing financial markets by integrating into various areas such as algorithmic trading, risk management, predictive analytics, portfolio management, fraud detection, customer service, regulatory compliance, and market research.

- AI-driven algorithmic trading removes human emotion and biases from decision-making, taking advantage of market inefficiencies, but also poses risks such as programming errors and flash crashes caused by interconnected algorithms.

- Risk management plays a crucial role in algorithmic trading by assessing and mitigating potential risks, minimizing losses through informed decision-making, and implementing risk management techniques to protect against excessive losses.

- AI in financial markets enables real-time monitoring and analysis of market conditions, identifies and manages potential risks by analyzing data, and enhances efficiency by improving analysis and decision-making processes, minimizing errors and biases, and optimizing resources and reducing costs.

Role Of Artificial Intelligence In Financial Markets

Artificial Intelligence (AI) has revolutionized the landscape of financial markets by bringing advanced analytical capabilities and automation. AI algorithms analyze vast amounts of data, spotting patterns, and making predictions with unprecedented accuracy. This technology empowers traders and investors with real-time insights, aiding in informed decision-making.

AI-driven trading systems execute orders swiftly and efficiently, responding to market fluctuations faster than human traders can. Additionally, AI can assess market sentiment from social media and news, providing a holistic view of market dynamics.

In conclusion, AI plays a pivotal role in financial markets by enhancing data analysis, automation, and predictive capabilities. It transforms the way trading is conducted, allowing for more efficient, data-driven, and informed decision-making.

Algorithmic Trading

Algorithmic trading, a prominent application of artificial intelligence in financial markets, has revolutionized the way trades are executed by using complex mathematical models and algorithms to make high-speed decisions. This automated trading strategy involves the use of pre-programmed instructions that analyze vast amounts of data and execute trades based on predetermined criteria.

One key aspect of algorithmic trading is its ability to conduct high frequency trading, where large volumes of trades are executed within milliseconds.

The main advantage of algorithmic trading is its ability to remove human emotion from the decision-making process. By relying on mathematical models and algorithms, this approach eliminates biases and makes objective decisions based solely on market data. Additionally, the speed at which these algorithms operate allows for quick execution of trades, taking advantage of even the smallest market inefficiencies.

However, algorithmic trading also comes with certain risks. The reliance on complex algorithms means that any errors in their programming can lead to significant losses. Moreover, as more participants engage in algorithmic trading strategies, there is an increased risk of flash crashes or other unexpected market events caused by interconnected algorithms.

In order to mitigate these risks, effective risk management techniques need to be implemented alongside algorithmic trading strategies. These techniques may include setting limits on trade sizes and frequencies or implementing stop-loss orders to protect against excessive losses.

By incorporating robust risk management practices into algorithmic trading strategies, investors can harness the power of artificial intelligence while minimizing potential downsides associated with this approach.

Risk Management

Risk management plays a crucial role in algorithmic trading. It involves assessing and mitigating potential risks that can arise from various factors such as market volatility, liquidity issues, or system failures.

Real-time monitoring and analysis of market conditions allow traders to make informed decisions. By constantly tracking market movements and adjusting their strategies accordingly, they can minimize potential losses.

Identifying and managing potential risks

One must recognize the significance of effectively identifying and mitigating potential risks when considering the role of artificial intelligence in financial markets, for doing so is paramount in ensuring stability and safeguarding against detrimental consequences.

AI can play a crucial role in managing market volatility by analyzing vast amounts of data and detecting patterns or correlations that human analysts might overlook. By utilizing advanced algorithms, AI systems can identify investment opportunities and make informed decisions based on historical data, market trends, and other relevant factors. This enables investors to capitalize on potential gains while minimizing losses.

Furthermore, AI can help in assessing risk exposure by continuously monitoring market conditions and providing real-time analysis. Such capabilities allow for prompt responses to changing circumstances, aiding in effective risk management strategies.

Transitioning into the next section about ‘real-time monitoring and analysis of market conditions’, it becomes evident that AI’s ability to provide timely insights facilitates proactive decision-making processes.

Real-time monitoring and analysis of market conditions

Utilizing advanced technology to continuously monitor and analyze real-time market conditions facilitates proactive decision-making processes, enabling investors to stay informed and adapt their strategies accordingly, ultimately contributing to a sense of confidence and assurance in the ever-evolving financial landscape.

To achieve this, artificial intelligence (AI) systems are designed to collect and process vast amounts of real-time data from various sources such as news articles, social media platforms, and financial statements. This data is then analyzed using complex algorithms that can detect patterns, trends, and anomalies in the market.

Three key benefits of real-time monitoring and analysis in financial markets include:

- Timely identification of emerging market trends or shifts helps investors make informed decisions promptly.

- Enhanced risk management by detecting potential threats or vulnerabilities in the market before they escalate.

- Improved portfolio performance through continuous evaluation of investment strategies based on up-to-date information.

By harnessing AI-powered tools for real-time data analysis and market surveillance, investors can gain valuable insights that guide their actions towards maximizing returns while minimizing risks. This capability sets the stage for the subsequent section on predictive analytics seamlessly.

Predictive Analytics

Predictive analytics plays a crucial role in financial markets. It provides insights into forecasting market trends and patterns. By analyzing historical data and using sophisticated algorithms, predictive models can identify potential market movements. This helps investors make data-driven investment decisions.

These models enable investors to assess risks accurately. They also help optimize their portfolios and enhance their overall investment strategies.

Forecasting market trends and patterns

By leveraging the power of artificial intelligence, market participants can gain valuable insights into potential trends and patterns within financial markets. This allows for more accurate market forecasting and trend analysis, enabling investors to make informed decisions.

Artificial intelligence algorithms can analyze large amounts of historical data to identify patterns and correlations that may not be apparent to human traders. Additionally, AI can continuously monitor real-time data and news feeds, allowing for quick identification of emerging trends or market shifts.

Furthermore, AI-based forecasting models are capable of adapting to changing market conditions and adjusting predictions accordingly. Overall, the use of artificial intelligence in forecasting market trends provides a powerful tool for investors seeking to stay ahead of the curve in an ever-changing financial landscape.

Moving forward into the subsequent section about making data-driven investment decisions, it is essential to understand how AI-generated forecasts can serve as a foundation for strategic investment choices.

Making data-driven investment decisions

The ability to forecast market trends and patterns is a key aspect of utilizing artificial intelligence (AI) in financial markets. By analyzing vast amounts of data, AI algorithms can identify potential market shifts and provide valuable insights for investors.

However, it is not enough to simply predict future trends; making informed investment decisions based on this information is equally crucial. This is where data-driven decision making comes into play. With the help of AI, investors can leverage quantitative analysis techniques to process large volumes of financial data and extract meaningful patterns and correlations.

If interested you can read about algo trading here.

By relying on objective data rather than subjective judgments, investors can minimize bias and make more accurate investment choices. This approach allows for a systematic and disciplined investment strategy that aligns with the goal of achieving optimal returns.

Transitioning into the subsequent section about ‘portfolio management,’ these data-driven decisions lay the foundation for effective portfolio construction and optimization.

Portfolio Management

Portfolio management is a crucial aspect of financial decision-making that involves optimizing asset allocation strategies.

This process aims to achieve the optimal balance between risk and return for an investment portfolio. By carefully diversifying investments across different asset classes, portfolio managers can reduce risk while maximizing potential returns.

Additionally, effective portfolio management also involves regularly monitoring and adjusting the portfolio based on market conditions and investment goals.

Optimizing asset allocation

Optimizing asset allocation in financial markets can be effectively achieved through the utilization of artificial intelligence technologies. Robo advisors, powered by AI algorithms, offer a systematic approach to portfolio management by taking into account factors such as risk profiling and investment goals. These technologies analyze vast amounts of data, including market trends and historical performance, to provide personalized recommendations for asset allocation.

To illustrate the benefits of AI in optimizing asset allocation, consider the following table:

| Asset Class | Weighting (%) | Expected Return (%) |

|---|---|---|

| Stocks | 60 | 8 |

| Bonds | 30 | 4 |

| Real Estate | 10 | 6 |

By using AI-driven robo advisors, investors can make informed decisions based on objective analysis rather than relying solely on human intuition or emotion. This not only improves the efficiency of portfolio management but also reduces biases that may arise from subjective decision-making.

In the subsequent section about ‘balancing risk and return,’ we will explore how AI can assist in finding an optimal balance between these two crucial aspects of investing.

Balancing risk and return

Achieving an optimal balance between risk and return is a crucial consideration for investors as it determines the potential rewards and exposure to potential losses in their portfolios. In the realm of financial markets, artificial intelligence (AI) plays a significant role in helping investors navigate this delicate balancing act. Here are four key aspects where AI aids in balancing risk and return:

- Risk assessment: AI algorithms analyze vast amounts of data to identify potential risks associated with different asset classes or investment strategies.

- Portfolio optimization: AI models optimize asset allocation by considering risk tolerance, time horizon, and desired returns to achieve an optimal balance.

- Predictive analytics: AI-powered tools employ advanced statistical techniques to forecast market movements and assess potential risks.

- Dynamic rebalancing: AI algorithms continuously monitor portfolio performance and automatically adjust allocations to maintain the desired risk-return trade-off.

By leveraging these capabilities, investors can make informed decisions that align with their risk appetite while maximizing returns.

Transitioning into the subsequent section about ‘fraud detection,’ we explore how AI enhances market integrity through its ability to detect fraudulent activities.

Fraud Detection

The application of artificial intelligence in financial markets has significantly contributed to the enhancement of fraud detection systems. By leveraging advanced algorithms and machine learning techniques, AI-powered systems can analyze vast amounts of data in real-time, enabling the identification of fraudulent activities with higher accuracy and efficiency. These systems employ sophisticated models that are trained to detect patterns and anomalies associated with fraudulent behavior, allowing for early intervention and prevention.

One key aspect of AI-enabled fraud detection is anomaly detection. This approach involves establishing baseline patterns of normal behavior within a given dataset and flagging any deviations from these patterns as potential fraudulent activities. Machine learning algorithms can continuously learn from new data, adapting their understanding of what constitutes normal behavior and identifying emerging fraud schemes.

The benefits brought by AI in fraud detection extend beyond simply reducing financial losses. They also help to safeguard customer trust in financial institutions by enhancing security measures and protecting personal information. Moreover, these systems enable regulatory compliance by monitoring transactions for potential violations or suspicious activities.

Customer Service and Personalization

This discussion focuses on the role of artificial intelligence (AI) in customer service and personalization within the financial sector.

AI-powered chatbots and virtual assistants have emerged as valuable tools for enhancing customer interaction and resolving queries efficiently.

Additionally, AI enables customized financial recommendations and advice by analyzing vast amounts of data to provide tailored solutions based on individual needs and goals.

AI-powered chatbots and virtual assistants

AI-powered chatbots and virtual assistants have revolutionized the financial markets, providing efficient and personalized customer support without the need for human intervention.

These advanced technologies enable companies to offer round-the-clock assistance to customers by automating various tasks such as answering frequently asked questions, resolving common issues, and facilitating automated financial transactions.

The use of AI-powered chatbots ensures that customers receive instant responses, reducing waiting times and enhancing their overall experience. Moreover, these virtual assistants are capable of analyzing large amounts of data in real-time, allowing them to provide accurate and relevant information to customers.

By leveraging natural language processing and machine learning algorithms, AI-powered chatbots can understand customer queries and deliver tailored solutions. This level of personalized service not only improves customer satisfaction but also increases operational efficiency for financial institutions.

Transitioning into the subsequent section about customized financial recommendations and advice, these technological advancements further empower customers with valuable insights for making informed decisions regarding their finances.

Customized financial recommendations and advice

AI-powered chatbots and virtual assistants have revolutionized the way financial institutions interact with their customers by providing instant support and information. Building upon this technology, artificial intelligence has now ventured into the realm of customized financial recommendations and advice.

Automated wealth management platforms utilize AI algorithms to analyze vast amounts of data, including individual preferences, risk tolerance, and investment goals, to generate personalized financial plans for clients. These platforms offer tailored investment strategies and asset allocations that align with an individual’s unique circumstances.

By leveraging machine learning techniques, these systems continuously adapt and refine their recommendations based on changing market conditions and client feedback. The integration of AI in personalized financial planning provides individuals with greater control over their investments while benefiting from expert-level insights.

As we transition to the subsequent section on regulatory compliance, it is essential to explore how AI addresses legal frameworks governing financial markets.

Regulatory Compliance

Regulatory compliance in financial markets is an intricate web of rules and regulations that govern the behavior and operations of market participants. It ensures fair practices, protects investors, and maintains market integrity. However, complying with these regulations can be a daunting task for financial institutions due to the numerous challenges they face.

One major challenge is keeping up with the constantly evolving regulatory landscape. Regulations are regularly updated or new ones are introduced to address emerging risks. This makes it difficult for financial institutions to stay compliant without a robust system in place.

Automation in regulatory compliance has emerged as a solution to this challenge. Artificial intelligence (AI) technologies can analyze vast amounts of data quickly and accurately, helping firms identify any non-compliance issues more efficiently. AI algorithms can also learn from past cases, enabling them to make informed decisions when addressing new compliance challenges.

Additionally, automation can streamline reporting processes by automatically generating reports that meet regulatory requirements. This reduces the time and resources needed for manual reporting tasks, allowing employees to focus on higher-value activities.

In conclusion, automation in regulatory compliance offers significant benefits for financial institutions by providing efficient solutions to tackle evolving challenges. The integration of AI technology enables firms to navigate the complex regulatory environment effectively while ensuring adherence to guidelines. Transitioning into market research and data analysis further enhances decision-making capabilities within financial markets without compromising on compliance standards.

Market Research and Data Analysis

Market research and data analysis play a crucial role in understanding consumer behavior, market trends, and identifying potential investment opportunities. Market segmentation is an essential technique used to divide the market into distinct groups based on various factors such as demographics, psychographics, and buying behaviors. This allows financial institutions to target specific customer segments with tailored products and services that meet their unique needs.

Competitor analysis is another important aspect of market research. By analyzing competitors’ strategies, strengths, weaknesses, and market positions, financial institutions can gain valuable insights into their own competitive advantage and identify areas for improvement. This information helps them make informed decisions about product development, pricing strategies, and marketing campaigns.

To better understand the significance of market research and data analysis in financial markets, consider the following table:

| Market Segmentation | Competitor Analysis |

|---|---|

| Identifies target customer groups based on demographics, psychographics, and buying behaviors | Analyzes competitors’ strategies and market positions |

| Enables tailored marketing campaigns to specific customer segments | Helps identify competitive advantages |

| Guides product development by addressing unique customer needs | Identifies areas for improvement |

In conclusion, market research and data analysis are invaluable tools for financial institutions seeking to navigate the complex landscape of financial markets. By employing these techniques effectively, they can gain a competitive edge by understanding consumer behavior through market segmentation and staying ahead of their competitors through thorough competitor analysis.

Conclusion

In conclusion, the “Role of Artificial Intelligence in Financial Markets” underscores the pivotal role that AI plays in reshaping the financial industry. As technology continues to advance, AI’s potential to enhance data analysis, optimize trading strategies, and mitigate risks becomes increasingly evident. Embracing AI-driven insights empowers traders and investors to make informed decisions, maximize profitability, and navigate complex market dynamics. As you navigate the exciting world of finance, let this guide serve as a reminder of the indispensable role AI plays in shaping the future of financial markets. Embrace the power of artificial intelligence and position yourself at the forefront of the ever-evolving financial landscape.

References

- Uninformative feedback and risk taking: Evidence from retail forex trading

- Technical analysis of Forex by MACD Indicator

- Extended evidence on the use of technical analysis in foreign exchange

- Can deep learning improve technical analysis of forex data to predict future price movements?

Frequently Asked Questions

How does artificial intelligence impact the overall efficiency and speed of algorithmic trading strategies?

Artificial intelligence (AI) has significantly improved the efficiency of algorithmic trading strategies by enhancing speed and reducing human error. Through advanced data analysis and machine learning algorithms, AI enables faster decision-making and execution, leading to more profitable trades in financial markets.

What are the key challenges faced in implementing AI-based risk management systems in financial markets?

Implementing AI-based risk management systems in financial markets faces challenges such as data quality, model interpretability, and regulatory compliance. These obstacles hinder the seamless implementation of AI technology and require careful consideration to ensure effective and reliable risk management processes.

Can predictive analytics accurately forecast market trends and potential risks in real-time?

Predictive analytics has limitations in accurately forecasting real-time market trends and potential risks. These limitations arise due to the complexity of financial markets, the dynamic nature of data, and the inherent uncertainty associated with future outcomes.

How does AI technology assist in optimizing portfolio management strategies and achieving higher returns?

Optimizing investment strategies and achieving higher profitability are facilitated by AI technology. It provides objective and analytical insights, enabling informed decision-making. By leveraging advanced algorithms, AI can analyze vast amounts of data, identify patterns, and generate personalized portfolio recommendations for investors.

What role does AI play in enhancing fraud detection capabilities and preventing financial crimes in the market?

AI plays a crucial role in enhancing fraud detection capabilities and preventing financial crimes in the market. It revolutionizes credit scoring and loan underwriting, while also improving customer experience and personalization in financial markets.

Understanding Pledging | What Is Pledging and Its Benefits 2023

Explore the world of financial flexibility with “What Is Pledging and Its Benefits.” Pledging is a dynamic financial practice that opens doors to new opportunities for businesses and individuals alike. Uncover the power of leveraging assets to access funds while retaining ownership. In this comprehensive guide, we delve into the benefits of pledging, from unlocking liquidity to obtaining loans at lower interest rates. Join us as we demystify the concept of pledging, empowering you to make informed decisions that can enhance your financial standing and propel you towards your goals.

Key Takeaways

- Pledging involves transferring assets as collateral for loans, and there are different types of pledging such as asset-based lending, stock pledging, and real estate pledging.

- The benefits of pledging include access to capital for business expansion or personal needs, security and assurance for lenders, and lower interest rates and increased financing options.

- Pledging fosters unity and solidarity by creating a sense of belonging and connection, building strong relationships and networks, and promoting teamwork and collaboration.

- Accountability and commitment are important aspects of pledging, as they build trust within the group, demonstrate reliability and instill confidence, and encourage personal growth and unity.

What is Pledging and its Benefits?

Pledging is a financial practice that involves the transfer of assets from one party to another as collateral, providing security for a loan or other obligations.

The benefits of pledging are manifold. First and foremost, it enables borrowers to access much-needed capital, which can be used for business expansion or personal needs. Pledging also provides a sense of security and assurance to lenders since they have a legal claim on the pledged assets in case of default by the borrower. This reduces the risk associated with lending and allows lenders to offer more favorable loan terms.

Furthermore, pledging can facilitate lower interest rates on loans due to the reduced risk for lenders.

It also enables businesses and individuals with limited credit history or poor credit scores to obtain financing that might otherwise be unavailable.

Types of Pledging

There are various types of pledging, including:

- Asset-based lending: Companies use their assets such as inventory or accounts receivable as collateral to secure loans.

- Stock pledging: Involves using stocks or shares as collateral for borrowing funds.

- Real estate pledging: Allows individuals to use their property as security for obtaining loans.

Fostering Unity and Solidarity

Creating a sense of belonging is crucial as it helps individuals feel connected and invested in the community, leading to increased motivation and productivity.

Building strong relationships and networks not only promotes personal growth but also enhances collaboration and knowledge sharing among members.

Lastly, promoting teamwork and collaboration encourages individuals to work together towards common goals, fostering a supportive environment that can lead to higher success rates for projects and initiatives.

Creating a sense of belonging

Fostering a sense of belonging within a group can be achieved through the implementation of rituals and traditions, which not only strengthen social bonds but also evoke a profound emotional connection among members. These practices create a sense of community and belongingness by:

- Establishing shared experiences: Rituals and traditions provide a common ground for individuals to connect with one another. By participating in these activities together, members develop a shared history and identity.

- Promoting inclusivity: Inclusive rituals ensure that every member feels valued and accepted within the group. This fosters an environment where individuals feel safe to express themselves without fear of judgment or exclusion.

By creating this sense of belonging, groups can build strong relationships and networks that extend beyond their immediate circle. These connections allow for collaboration, support, and personal growth within the group dynamic.

Building strong relationships and networks

Establishing strong relationships and networks is crucial for individuals to thrive within a group. These connections provide opportunities for collaboration, support, and personal growth.

Building trust is an essential component of cultivating strong relationships. Trust allows individuals to rely on each other, share ideas openly, and work towards common goals. Research has shown that high levels of trust within a group lead to increased satisfaction, productivity, and loyalty among its members.

In addition to building trust, strong relationships and networks also expand opportunities for individuals. By connecting with others who have different skills, experiences, and perspectives, individuals gain access to new resources and knowledge. This can lead to professional development opportunities such as mentorship programs or job referrals. Moreover, strong relationships provide emotional support during challenging times and create a sense of belonging within the group.

In the subsequent section about ‘promoting teamwork and collaboration,’ these established relationships will serve as a foundation for effective collaboration and cooperation among group members without explicitly stating ‘step.’

Promoting teamwork and collaboration

Promoting teamwork and collaboration is crucial for achieving success in group settings. Studies have shown that teams who collaborate effectively are 5 times more likely to achieve their goals compared to those who do not.

Team building activities play a significant role in fostering cooperation and collaboration among team members. These activities can range from ice-breaking exercises to problem-solving challenges that require collective effort. By engaging in team building exercises, individuals develop a sense of trust and understanding, which enhances communication and promotes effective collaboration.

Furthermore, when team members work together towards a common goal, they can pool their strengths and expertise to overcome challenges more efficiently. This fosters creativity, innovation, and productivity within the group.

Transitioning into the subsequent section about ‘accountability and commitment,’ it is important to recognize how teamwork lays the foundation for individual accountability and commitment within a group dynamic.

Accountability and Commitment

Encouraging accountability and commitment is crucial in the practice of pledging, as it fosters a sense of responsibility and dedication among individuals. Accountability ensures that each member takes ownership of their actions and honors their commitments. Commitment, on the other hand, establishes a strong bond within the group, promoting teamwork and collaboration.

To evoke emotion in the audience, consider these benefits of accountability and commitment:

- Trust: When members are accountable for their actions, trust is built within the group. Trust allows for open communication and cooperation, creating a supportive environment where everyone feels valued.

- Reliability: By being committed to their tasks and obligations, individuals demonstrate reliability. This reliability not only contributes to the success of the group but also instills confidence in fellow members.

- Growth: Accountability encourages personal growth by holding individuals responsible for their own progress. It pushes them to strive for improvement, leading to individual development within the community.

- Unity: Commitment promotes unity among members by fostering a shared purpose and common goals. This sense of unity strengthens relationships and enhances overall team performance.

- Resilience: Being accountable and committed helps develop resilience in individuals. They learn to overcome challenges together as a team, bouncing back stronger from setbacks.

Encouraging accountability and commitment in pledging cultivates an environment where individuals can thrive through increased motivation and focus on achieving shared objectives.

Increased Motivation and Focus

This discussion will explore the impact of increased motivation and focus on individuals.

One way to enhance motivation and focus is through setting clear goals and objectives. Research has shown that having specific, measurable, achievable, relevant, and time-bound (SMART) goals can increase motivation by providing clarity and direction.

Additionally, a sense of purpose and direction can be fostered through activities that align with one’s values and beliefs, which in turn can contribute to greater motivation and focus.

Finally, boosting determination and drive is crucial for maintaining long-term motivation. This can be achieved through strategies such as rewarding progress or breaking down big goals into smaller manageable tasks.

Setting clear goals and objectives

Setting clear goals and objectives is essential for effective pledging. It provides a structured framework for individuals or groups to work towards specific outcomes. Clear targets help define the desired result, while measurable outcomes allow progress to be tracked and evaluated.

By setting clear goals and objectives, individuals or groups can focus their efforts and resources on achieving these targets. This ensures that energy is not wasted on activities that do not contribute directly to the desired outcome.

Moreover, having clear goals and objectives enables individuals or groups to prioritize tasks and allocate resources efficiently. In this way, pledging becomes more organized and purposeful, leading to increased productivity and effectiveness in achieving the desired results.

Furthermore, setting clear goals and objectives provides a sense of purpose and direction for individuals or groups involved in pledging activities. This will be discussed in the subsequent section about providing a sense of purpose and direction.

Providing a sense of purpose and direction

The provision of a clear sense of purpose and direction is crucial in ensuring the effectiveness and productivity of pledging activities. When individuals have a clear understanding of why they are engaging in a particular activity or goal, they are more likely to feel a sense of fulfillment and personal fulfillment when they achieve it. This sense of purpose provides them with motivation and drive to work towards their goals, even when faced with challenges or setbacks.

To further understand the importance of providing a sense of purpose and direction, consider the following:

- Increased focus: Having a clear objective helps individuals concentrate on what needs to be done.

- Enhanced commitment: A strong sense of purpose encourages dedication and perseverance.

- Improved decision-making: Clarity enables individuals to make informed choices aligned with their goals.

- Greater satisfaction: Achieving goals that align with one’s values leads to increased overall happiness.

By establishing a clear sense of purpose and direction, pledging activities can boost determination and drive towards achieving desired outcomes without losing sight of individual aspirations.

Boosting determination and drive

Boosting determination and drive can be compared to a well-oiled engine, as it requires consistent fuel and maintenance to keep running smoothly towards achieving desired outcomes. When individuals have a strong sense of determination, they are more likely to persevere through challenges and setbacks without losing motivation.

Enhancing drive involves cultivating a deep desire and passion for success, which fuels the individual’s efforts in achieving their goals. Research suggests that boosting determination and enhancing drive can lead to increased productivity and effectiveness in various aspects of life, such as academics, career, or personal relationships.

By maintaining a high level of determination and drive, individuals are better equipped to overcome obstacles and achieve success in their endeavors. Strengthening personal growth and development is the next step towards realizing one’s full potential.

Strengthening Personal Growth and Development

Enhancing personal growth and development involves actively engaging in a transformative process that fosters self-reflection and encourages the acquisition of new knowledge and skills. This journey towards personal transformation and self-improvement can lead to various benefits, both on an individual level and in relation to society as a whole.

- Self-awareness: Pledging oneself to personal growth requires deep introspection, allowing individuals to identify their strengths, weaknesses, values, and goals. This heightened self-awareness enables them to make informed decisions that align with their authentic selves.

- Skill development: Through the commitment to personal growth, individuals engage in continuous learning experiences that expand their skill sets. Whether it be through formal education or informal means such as reading books or attending workshops, these new skills contribute to personal development while also enhancing employability.

- Emotional intelligence: Personal growth often involves developing emotional intelligence – the ability to understand and manage one’s own emotions as well as empathize with others’. Strengthening emotional intelligence leads to better interpersonal relationships, effective communication, and increased empathy.

By actively pursuing personal growth and development, individuals not only benefit themselves but also inspire change and make a difference in the world around them.

Inspiring Change and Making a Difference

Inspiring change and making a difference involves actively engaging in personal growth and development, which can result in transformative experiences that lead to positive impacts on both individuals and society as a whole. When individuals commit themselves to a cause or pledge to make a difference, they contribute to the betterment of society by addressing various social issues or advocating for positive change. Research has shown that engaging in activities aimed at inspiring change not only benefits the community but also enhances personal well-being.

One way individuals can inspire change is by volunteering their time and skills to charitable organizations or community projects. This involvement allows them to directly contribute towards solving problems and improving the lives of others. Additionally, when people witness others making a difference, it serves as an inspiration for them to get involved as well. This ripple effect amplifies the impact of individual efforts and encourages collective action.

To further illustrate this concept, consider the following table:

| Individual Actions | Societal Impacts |

|---|---|

| Volunteering at local shelters | Addressing homelessness |

| Advocating for environmental sustainability | Promoting conservation practices |

| Supporting educational initiatives | Reducing illiteracy rates |

By engaging in activities that inspire change, individuals not only fulfill their desire for belonging but also leave behind a legacy of positive contributions.

Long-lasting Effects and Legacy

Leaving a lasting impact on future generations is an important aspect of creating a legacy, as it ensures that positive changes continue to benefit society in the years to come.

Additionally, establishing a tradition of commitment and loyalty towards causes or movements helps to foster a sense of collective responsibility among individuals, leading to sustained efforts for social progress.

Lastly, contributing to the greater good and collective progress not only benefits current generations but also lays the foundation for future advancements by addressing societal issues and promoting positive change.

Leaving a lasting impact on future generations

Leaving a lasting impact on future generations can be achieved through the act of pledging, which ensures the perpetuation of positive values and principles for years to come.

By making a pledge, individuals commit themselves to a cause or organization, creating a ripple effect that extends beyond their own lifetime. This commitment serves as an example for future generations, inspiring them to follow suit and continue the legacy of positive change.

Moreover, pledging fosters a sense of responsibility towards the collective well-being and encourages individuals to actively contribute to society. Research has shown that when people feel connected and have a sense of belonging, they are more likely to engage in activities that benefit both themselves and others.

Therefore, pledging not only leaves a lasting impact on future generations but also establishes a tradition of commitment and loyalty towards shared goals.

Establishing a tradition of commitment and loyalty

Leaving a lasting impact on future generations involves more than just passing down material wealth or knowledge. It requires establishing traditions that foster loyalty and commitment among individuals.

By creating rituals, customs, and practices that are deeply ingrained in the fabric of society, communities can instill a sense of belonging and purpose in their members. These traditions serve as a reminder of shared values, ideals, and goals, inspiring individuals to remain loyal to their community even in times of hardship or change.

Moreover, they provide a sense of continuity and stability across generations, allowing individuals to feel connected to those who came before them and those who will come after.

This establishment of tradition is an essential component in contributing to the greater good and collective progress towards a better future for all.

Contributing to the greater good and collective progress

Contributing to the greater good and collective progress involves actively participating in initiatives that aim to improve society as a whole, fostering collaboration and cooperation among individuals towards common goals. By pledging support to such initiatives, individuals become part of a larger movement that seeks to address pressing issues and bring about positive change. This not only benefits society as a whole but also creates a sense of belonging and purpose for the individuals involved.

Research has shown that contributing to collective progress can have numerous benefits, both for the individual and the community. It fosters social connections and strengthens relationships, as people come together with a shared purpose. It also enhances personal well-being by promoting feelings of fulfillment, satisfaction, and meaning in life.

By actively participating in initiatives that contribute to collective progress, individuals become agents of change and play an important role in shaping their communities. The following table highlights some key ways through which contributing can lead to collective progress:

| Ways of Contributing | Benefits |

|---|---|

| Volunteering | Enhanced sense of purpose |

| Advocacy | Increased awareness and influence |

| Donating | Tangible impact on causes |

In conclusion, contributing to the greater good and collective progress is essential for building thriving communities. By actively engaging in initiatives aimed at improving society, individuals not only benefit themselves but also foster collaboration and create lasting positive change.

Conclusion

In conclusion, “What Is Pledging and Its Benefits” showcases the immense potential of this financial practice in providing liquidity and financial leverage. By pledging assets, individuals and businesses can access funds and make strategic investments while maintaining ownership. The benefits of pledging include lower interest rates on loans and the ability to optimize resources. Embrace the power of pledging, as it propels you towards financial freedom and unlocks a world of opportunities. Armed with the knowledge of pledging and its advantages, you can confidently navigate the financial landscape and achieve your aspirations with greater ease and efficiency.

References

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

- Longer time frame concept for foreign exchange trading indicator using matrix correlation technique

- Forex for beginners

- What is forex trading?

Frequently Asked Questions

How can pledging enhance personal growth and development?

Pledging can enhance personal growth and development by fostering a sense of belonging, promoting self-discipline, and providing opportunities for leadership and teamwork. These experiences contribute to the acquisition of valuable skills and personal growth.

What are some examples of long-lasting effects and legacies that can result from pledging?

Examples of long-lasting effects and legacies resulting from pledging include increased social networks, enhanced leadership skills, improved self-confidence, lifelong friendships, and a sense of belonging to a supportive community.

How does pledging inspire change and make a difference in communities?

Pledging inspires change and makes a difference in communities by inspiring action and creating a lasting community impact. It fosters a sense of belonging, encourages collective efforts, and empowers individuals to work towards common goals for the betterment of their community.

Can you provide some specific ways in which pledging fosters unity and solidarity among individuals?

Pledging fosters unity and solidarity by building strong relationships and encouraging teamwork. It provides individuals with a sense of belonging, as they work together towards a common goal, strengthening their bond and creating a cohesive community.

What are some strategies for maintaining accountability and commitment throughout the pledging process?

Maintaining accountability and commitment throughout the pledging process can be achieved through various strategies. These include regular check-ins, goal setting, mentorship programs, team-building exercises, and clear expectations. By implementing these strategies, individuals are more likely to stay committed and accountable to their pledges.

Expert Insights: Top 5 Option Buying Basics – Your Essential Guide 2023

Are you ready to explore the thrilling world of options trading? Mastering the Top 5 option buying basics is your gateway to success in this dynamic market. Whether you’re an aspiring trader or a seasoned investor, understanding the essentials of options buying is crucial for maximizing profits and managing risks.

From comprehending call and put options to unraveling the mysteries of option premiums and strike prices, this guide will equip you with the knowledge and confidence to navigate the options market like a pro. Join us on this exciting journey as we unlock the secrets behind these top five basics and empower you to seize opportunities and thrive in the world of options trading.

Top 5 Option Buying Basics

Option buying basics are essential for investors looking to venture into the world of options trading. Here are the top five basics to keep in mind:

- Understanding Call and Put Options: The first step is grasping the difference between call and put options. Call options provide the right to buy an underlying asset at a specific price (strike price) within a predetermined time frame, while put options grant the right to sell an underlying asset at a specified price within a given period.

- Option Premium and Strike Price: The option premium is the price one pays to purchase an option. The strike price is the agreed-upon price at which the underlying asset can be bought or sold. Understanding the relationship between the strike price and the current market price of the asset is crucial for making informed decisions.

- Time Decay and Expiration Dates: Options have expiration dates, after which they become worthless. Time decay is the gradual reduction in an option’s value as it approaches expiration. Traders must consider time decay when buying options and plan their trades accordingly.

- Risk Management: Buying options involves a limited loss potential and unlimited profit potential. However, it is essential to manage risk by avoiding excessive exposure and using stop-loss orders to protect against adverse market movements.

- Market Research and Analysis: Before buying options, conducting thorough market research and analysis is vital. Consider factors such as market trends, volatility, and underlying asset fundamentals to make informed decisions.

By mastering these option buying basics, investors can navigate the complexities of the options market and potentially capitalize on various trading opportunities with greater confidence and understanding.

Understanding Options and Their Differences from Stocks

Options differ from stocks in that they grant the holder the right, but not the obligation, to buy or sell shares at a specific price within a set time frame, providing investors with potential leverage and downside protection.

Unlike stocks, which represent ownership in a company, options are derivative contracts that derive their value from an underlying asset such as stocks. This key difference allows options to offer unique advantages and trading strategies that can be attractive to investors.

One important distinction between options and stocks is the concept of leverage. With options, investors have the opportunity to control a larger number of shares for a fraction of the cost compared to buying the actual stock. This leverage amplifies both potential gains and losses.

For example, if an investor purchases an option contract on 100 shares of a stock when it is trading at $50 per share with a strike price of $55, they can potentially profit if the stock price increases above $55 by expiration. However, if the stock price falls below $55 by expiration, they may lose their entire investment.

Furthermore, options provide downside protection through their limited risk nature. When buying options contracts outright (also known as long positions), investors can only lose what they initially paid for the contract. This limits potential losses compared to owning stocks outright where losses could be unlimited if the stock price drops significantly.

Options also allow for more sophisticated trading strategies such as hedging against existing positions or generating income through selling options contracts.

Types of Options

This discussion will focus on the different types of options commonly used in trading: call options and put options.

Call options give the holder the right to buy an underlying asset at a specified price, while put options give the holder the right to sell an underlying asset at a specified price.

Additionally, we will explore three key terms related to options: in-the-money, at-the-money, and out-of-the-money.

These terms describe the relationship between the strike price of an option and the current market price of the underlying asset.

Call Options

Call options provide investors with the right, but not the obligation, to buy an underlying asset at a predetermined price within a specific time frame. This type of option is commonly used in financial markets as part of various investment strategies. Investors who believe that the price of an asset will increase can purchase call options to potentially profit from this upward movement. Call option strategies involve analyzing market trends and making predictions about future price movements. Traders can choose different strike prices and expiration dates based on their expectations for the underlying asset’s performance.

To understand call options better, let’s consider the following table:

| Option Contract | Strike Price | Expiration Date | Premium |

|---|---|---|---|

| XYZ Call 1 | $50 | 30 days | $2 |

| XYZ Call 2 | $55 | 60 days | $5 |

| XYZ Call 3 | $60 | 90 days | $8 |

| XYZ Call 4 | $65 | 120 days | $12 |

In this example, we have four call options contracts for XYZ stock with varying strike prices, expiration dates, and premiums. The strike price is the predetermined price at which investors can buy the underlying asset. The expiration date indicates when the option contract expires and becomes invalid if not exercised before then. The premium represents the cost of purchasing the call option.

Transitioning into the subsequent section about ‘put options’, it is important to note that while call options give investors the right to buy an asset, put options provide them with the right to sell an underlying asset at a predetermined price within a specific time frame without any obligation.

Put Options

Put options, the polar opposite of call options, grant investors the right to sell an underlying asset at a predetermined price within a specified time period, allowing them to potentially profit from downward movements in the market. Unlike call options that benefit from price increases, put options are used by investors who anticipate a decline in the value of an asset.

Here are five important points to understand about put options:

- Protection against downside risk: Buying put options can act as insurance for an investor’s portfolio. If the value of their assets decreases, they can exercise their put option and sell at a higher predetermined price.

- Speculative trading: Traders can also use put options as a way to speculate on declining prices. By purchasing puts on an asset they believe will decrease in value, they have the potential to profit if their prediction is correct.

- Limited loss potential: When buying a put option, the maximum loss is limited to the premium paid for the option contract. This makes it an attractive strategy for risk management since losses are capped.

- Put option strategies: There are various strategies that can be employed using put options such as long puts (buying puts outright), protective puts (combining long stock positions with long puts), and bear spreads (selling high-strike puts while buying lower-strike puts).

- Put option pricing: Put option prices depend on factors such as the strike price, expiration date, underlying asset’s volatility, interest rates, and dividends. Understanding these factors is crucial when evaluating whether purchasing a put option is favorable.

Transitioning into the subsequent section about ‘in-the-money’, ‘at-the-money’, and ‘out-of-the-money’ options allows us to explore how different price levels impact an option’s profitability and its likelihood of being exercised.

In-the-Money, At-the-Money, and Out-of-the-Money Options

In financial markets, options can be classified into three categories based on their strike price in relation to the current market price of the underlying asset: in-the-money, at-the-money, and out-of-the-money options.

An in-the-money option is one where the strike price is lower than the current market price for call options or higher for put options. This means that if the option were exercised immediately, it would result in a profit for the holder. Intrinsic value is an important concept when discussing in-the-money options. It represents the amount by which an option is already profitable due to its immediate exercise potential.

For example, if a stock is trading at $50 and a call option with a strike price of $45 has an asking price of $8, then it has an intrinsic value of $5 ($50 – $45). The remaining portion of the option’s value is known as time value and represents its potential for further profitability until expiration.

At-the-money options have strike prices that are equal to or very close to the current market price of the underlying asset. They do not possess any intrinsic value because exercising them would neither result in a profit nor a loss for the holder at that particular moment. However, they still hold time value due to their potential to become profitable before expiration.

Out-of-the-money options have strike prices that are higher than the current market price for call options or lower for put options. These options do not have any intrinsic value and their entire worth comes from their time value.

If interested you can read the role of artificial intelligence in financial markets here. Moreover you can read about algo trading here.

Moving forward into the subsequent section about ‘option premiums and pricing,’ we will explore how these different factors influence option prices and how traders evaluate whether an option is overpriced or underpriced relative to its intrinsic value and time value components.

Option Premiums and Pricing

Option premiums and pricing are key factors to consider when engaging in options trading. Option pricing refers to the cost or premium that an investor pays to purchase an option contract. The price of an option is influenced by various factors, including the underlying asset’s price, time until expiration, volatility, interest rates, and market demand for the option. These factors collectively determine the value of an option and can cause its premium to fluctuate.

The underlying asset’s price is one of the primary influences on option pricing. For call options, which give the holder the right to buy the underlying asset at a specified price (the strike price), as the asset’s price increases, so does the call option’s value and premium. Conversely, for put options, which give the holder the right to sell an underlying asset at a specified price, as the asset’s price decreases, their value and premium increase.

Time until expiration also plays a crucial role in determining option premiums. Generally speaking, longer-term options have higher premiums compared to shorter-term ones because they provide more time for potential profit opportunities. Moreover, volatility affects both call and put options’ prices since higher levels of market volatility can increase their potential profitability. Lastly, interest rates impact option pricing due to their influence on borrowing costs and opportunity costs associated with holding an option.

Understanding these factors influencing premiums is essential for traders looking to engage in options trading effectively. By analyzing these variables thoroughly before making investment decisions, traders can better evaluate whether paying a particular premium aligns with their risk appetite and desired returns.

With this understanding in mind regarding option premiums and pricing considerations established from this section onwards about ‘option strategies’, traders can develop effective strategies tailored to their specific objectives.

Option Strategies

One effective approach to maximize potential profits and minimize risks in options trading is to implement various strategic techniques. Option strategies are specific combinations of option contracts that traders can utilize to achieve their desired outcomes. These strategies involve buying and selling options with different strike prices, expiration dates, and underlying assets. By employing these option buying strategies, traders can take advantage of market conditions and position themselves for potential gains.

| Strategy | Description | Potential Outcome |

|---|---|---|

| Long Call | Buying a call option gives the trader the right to purchase the underlying asset at a specified price within a certain timeframe. This strategy is used when the trader expects the price of the underlying asset to rise significantly. | The potential outcome of this strategy is unlimited profits if the price of the underlying asset increases significantly. However, there is limited risk as the maximum loss is limited to the premium paid for purchasing the call option. |

| Short Put | Selling a put option obligates the trader to buy the underlying asset at a predetermined price if it falls below that level by expiration. This strategy is employed when the trader anticipates minimal or no downside movement in an asset’s price. | The potential outcome of this strategy is limited profit equal to the premium received from selling the put option. However, there is significant risk as losses can be substantial if the price of the underlying asset declines substantially below its strike price by expiration. |

| Covered Call | This strategy involves owning shares of an underlying asset while simultaneously selling call options on those same shares. It allows traders to generate income from their existing stock holdings by collecting premiums from selling call options against them. | The potential outcome of this strategy is limited profit equal to both premiums received and any increase in stock value up until its strike price. However, there are limitations on upside gains as well since any increase beyond its strike price would result in the stock being called away from the trader. |

Implementing these option trading techniques opens up a wide range of possibilities for traders. Each strategy has its own unique risk-reward profile, allowing traders to tailor their approach based on their individual preferences and market expectations. By understanding and utilizing these strategies effectively, traders can increase their chances of achieving favorable outcomes in options trading.

Transition: Understanding different option strategies is crucial for maximizing profits, but it’s equally important to manage risks effectively. In the subsequent section, we will explore risk management in options trading without compromising potential gains.

Risk Management in Options Trading

Effective risk management is a critical aspect of options trading that enables traders to safeguard their investments and optimize their potential gains.

One important component of risk management in options trading is position sizing. Traders need to carefully determine the appropriate size of each position they take in order to minimize the impact of potential losses. By allocating a certain percentage of their overall portfolio to each option trade, traders can limit their exposure and prevent any single trade from having a significant negative impact on their overall account balance.

Another key element of risk management in options trading is the use of stop-loss orders. A stop-loss order is an instruction given by a trader to sell a specific option if it reaches a predetermined price level. This serves as a protective measure against excessive losses in case the market moves against the trader’s position. By setting an appropriate stop loss for each trade, traders can limit their downside risk and protect themselves from substantial losses.

Effective risk management techniques such as position sizing and the use of stop-loss orders are essential for successful options trading. Traders must carefully consider the size of each position they take and set appropriate stop-loss levels to protect themselves from excessive losses. By implementing these strategies, traders can mitigate risks while maximizing their potential gains in options trading.

Transitioning into the subsequent section about ‘market analysis for options,’ it is important for traders to conduct thorough market analysis before entering into any trades in order to make informed decisions based on market trends and indicators. This analysis involves studying various factors such as the overall market conditions, the performance of specific sectors or industries, the behavior of individual stocks, and the impact of economic and political events.

By analyzing these factors, traders can identify potential opportunities and risks, determine the optimal timing for entering or exiting trades, and develop effective strategies to maximize their potential gains in options trading.

Market Analysis for Options

Technical analysis involves studying past price movements and patterns to predict future price movements.

Fundamental analysis, on the other hand, focuses on analyzing factors such as company financials and industry trends to determine the intrinsic value of an option.

Implied volatility is a measure of the market’s expectation for future price fluctuations, which directly impacts option prices.

Lastly, option pricing models take into account various factors such as underlying asset price, strike price, time to expiration, risk-free interest rate, and volatility to estimate an option’s fair value.

Technical Analysis

Technical Analysis involves the use of various tools and indicators to analyze price movements and patterns in order to make informed decisions about options trading. Traders who rely on technical analysis believe that historical price data can provide insights into future price movements. They use a variety of technical indicators and chart patterns to identify trends, reversals, and other patterns that can help them predict market behavior.

Technical indicators are mathematical calculations based on historical price data. These indicators can be plotted on a chart alongside the price data to provide additional information about the market. Some common technical indicators include moving averages, relative strength index (RSI), and stochastic oscillator. Moving averages are used to smooth out price fluctuations and identify trends. The RSI is a momentum indicator that measures the speed and change of price movements, while the stochastic oscillator helps traders identify overbought or oversold conditions.

Chart patterns are another important aspect of technical analysis. These patterns are formed by the repeated behavior of prices over time and can indicate potential future price movements. Some common chart patterns include head and shoulders, double tops/bottoms, triangles, and flags. Traders study these patterns to determine when to enter or exit trades based on their predictive power.

By using technical analysis techniques such as technical indicators and chart patterns, traders aim to gain an edge in their options trading strategies. However, it’s important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis, such as fundamental analysis. In the next section, we will explore fundamental analysis techniques for options trading.

Fundamental Analysis

Fundamental analysis involves the evaluation of various factors, such as company financials, industry trends, and economic conditions, to assess the intrinsic value of an asset and make informed decisions about options trading.

It is based on the belief that the price of a financial instrument, like an option, should ultimately reflect its underlying value. By examining a company’s financial statements, investors can gain insights into its profitability, growth potential, and overall health.

Additionally, analyzing industry trends helps identify opportunities and risks specific to a particular sector. Economic conditions play a crucial role in assessing how external factors might impact an investment’s performance.

Option valuation is an essential aspect of fundamental analysis. It involves determining the fair value or worth of an option contract based on various factors such as the underlying asset’s price volatility, time remaining until expiration, interest rates, dividends (if applicable), and market sentiment.

Fundamental analysis provides a framework for understanding these variables and their influence on option pricing. By carefully evaluating these factors, traders can gauge whether an option is overvalued or undervalued relative to its expected return.

Transitioning into the subsequent section about ‘implied volatility and option pricing,’ it is important to explore how implied volatility affects the valuation process further.

Implied Volatility and Option Pricing

Implied volatility, a key factor in option pricing, is derived from the market’s expectations of future price fluctuations and reflects the uncertainty surrounding the underlying asset’s value. It represents the level of anticipated price movement in an options contract over a specific period.

Implied volatility is calculated using option pricing models such as Black-Scholes, which take into account various factors like time to expiration, strike price, risk-free interest rate, and underlying asset’s price. Traders use implied volatility to assess the potential profitability and risk associated with different option strategies.

When it comes to option pricing and Greeks, implied volatility plays a crucial role. The Greeks are measures that quantify how sensitive an option’s price is to changes in certain variables. One Greek called vega specifically captures the impact of changes in implied volatility on an option’s value.

Generally, when implied volatility increases or decreases significantly, options become more expensive or cheaper respectively due to higher expected future price swings. Traders can use this knowledge strategically by employing appropriate option strategies depending on their anticipation of future market conditions.

For example, during periods when they expect high levels of implied volatility (such as ahead of major news announcements), traders may purchase options to potentially profit from large movements in the underlying asset’s price.

Understanding implied volatility is essential for effectively trading options. By considering how changes in implied volatility affect option prices and incorporating this information into their decision-making process, traders can enhance their ability to select appropriate strategies based on market expectations.

Next we will explore resources for learning and practicing options trading without assuming any prior knowledge for beginners entering this field.

Resources for Learning and Practicing Options Trading

Investors seeking to enhance their knowledge and skills in options trading can explore a plethora of educational resources and simulated platforms available online, akin to a vast library of financial wisdom and virtual trading arenas.

These learning resources provide valuable information about options trading strategies, risk management techniques, and market analysis tools. Online courses, webinars, and tutorials are readily accessible to anyone interested in delving deeper into the world of options trading. Additionally, there are numerous books written by renowned experts that offer comprehensive insights into various aspects of options trading.

One effective way for investors to practice their options trading skills without risking real money is through paper trading. Paper trading involves making hypothetical trades using virtual money in a simulated environment that mimics real market conditions. It allows investors to test different strategies, understand the impact of market fluctuations on option prices, and gain confidence in their decision-making abilities. Many online brokerage firms offer paper trading platforms where users can execute trades with virtual funds based on real-time market data.

Moreover, some websites provide interactive tools and calculators specifically designed for options traders. These tools enable investors to analyze option pricing models, calculate potential profits or losses based on different scenarios, and even simulate entire portfolios to assess risk exposure. Such resources not only facilitate learning but also empower investors with the practical skills necessary for successful options trading.

Overall, the availability of learning resources and simulated platforms has revolutionized the way individuals can learn about and practice options trading. By utilizing these tools effectively, investors can enhance their understanding of options markets while honing their analytical abilities and decision-making skills.

Our online course and resources offer a valuable opportunity for aspiring options traders to develop expertise in this complex financial domain. Moreover, if you are new to the world of Forex, we highly recommend you read our beginner’s guide to Forex trading.

Conclusion

In conclusion, delving into the top 5 option buying basics provides you with a solid foundation for excelling in the exhilarating realm of options trading. Armed with a clear understanding of call and put options, option premiums, strike prices, and time decay, you can make informed decisions and strategize effectively.

Embrace risk management and continuous learning as you venture into the options market with confidence, maximizing potential gains while safeguarding against potential losses. Whether you’re aiming to hedge against market volatility or capitalize on market trends, these basics will serve as your compass on the exciting path to options trading success.

References

- Technical analysis of Forex by MACD Indicator

- Extended evidence on the use of technical analysis in foreign exchange

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

Frequently Asked Questions

Can options be exercised before the expiration date?

Options can be exercised before the expiration date through early exercise. However, it is important to consider factors such as the option’s time value and potential dividends. Option expiration refers to the date when an option contract becomes invalid and cannot be exercised anymore.

How can I determine the fair value of an option?

The fair value of an option can be determined using option pricing models, such as the Black-Scholes model. Factors affecting option value include the underlying asset price, strike price, time to expiration, volatility, interest rates, and dividend yield.

What is the difference between a call option and a put option?

A call option is a financial contract that gives the holder the right, but not the obligation, to buy an underlying asset at a specified price within a specific period. In contrast, a put option gives the holder the right to sell an underlying asset at a predetermined price during a set time frame.

Are there any risks associated with options trading?

Risk analysis and risk management are essential in options trading. Potential risks include loss of investment, volatility, and unpredictable market conditions. Traders must employ strategies to mitigate these risks and protect their capital.

Where can I find reliable resources to learn more about options trading?

To expand your knowledge on options trading, reliable resources provide valuable insights. These sources discuss option trading strategies and highlight the benefits it offers. Exploring these materials can enhance your understanding and contribute to your success in the field.

Trading Loss Management: How to Handle Losses in Trading – Expert Tips 2023

Embarking on the thrilling journey of trading comes with its share of ups and downs, and knowing “How to Handle Losses in Trading” is essential for any trader’s success. Losses are an inevitable part of the trading landscape, but how you respond to them can make all the difference. In this empowering guide, we delve into the art of managing emotions, developing a robust risk management strategy, and learning from setbacks. Join us as we navigate through the highs and lows of trading, equipping you with the tools to bounce back from losses and turn them into valuable learning experiences, propelling you towards greater trading prowess.

Key Takeaways

- Adjust trading strategy by implementing risk management techniques, stricter stop-loss orders, reducing position sizes, seeking professional advice, and learning from previous losses.

- Seek support and guidance from counseling services and online support groups, which offer professional guidance, strategies for managing stress, a sense of belonging, and accessible resources.

- Avoid revenge trading by taking a break after a loss, analyzing trades for mistakes and improvement, sticking to a risk management plan, seeking support from peers, and avoiding impulsive actions.

- Stick to trading rules by following predetermined guidelines, maintaining discipline to prevent emotional decisions, understanding and accepting potential risks, viewing losses as learning opportunities, and focusing on long-term goals.

How To Handle Losses In Trading?

To begin with, it is crucial for traders to understand the nature of losses in trading. By recognizing that losses are a normal occurrence and an inevitable aspect of the market dynamics, traders can develop a more objective perspective towards their trades.

Additionally, managing emotions plays a vital role in effectively handling losses. Emotion-driven decision-making often leads to impulsive actions that exacerbate losses. Therefore, implementing strategies to regulate emotions and maintain rationality is essential.