Dive into the cutting-edge landscape of finance with a comprehensive exploration of the “Role of Artificial Intelligence in Financial Markets.” In today’s dynamic world, the integration of AI has revolutionized the way financial markets operate. From predictive analytics and algorithmic trading to risk management and fraud detection, AI has become a driving force behind informed decision-making and market efficiency.

This guide delves into the multifaceted applications of AI, highlighting its transformative impact on investment strategies and market trends. Join us on this enlightening journey as we unravel the intricate relationship between artificial intelligence and the ever-evolving financial landscape.

Key Takeaways

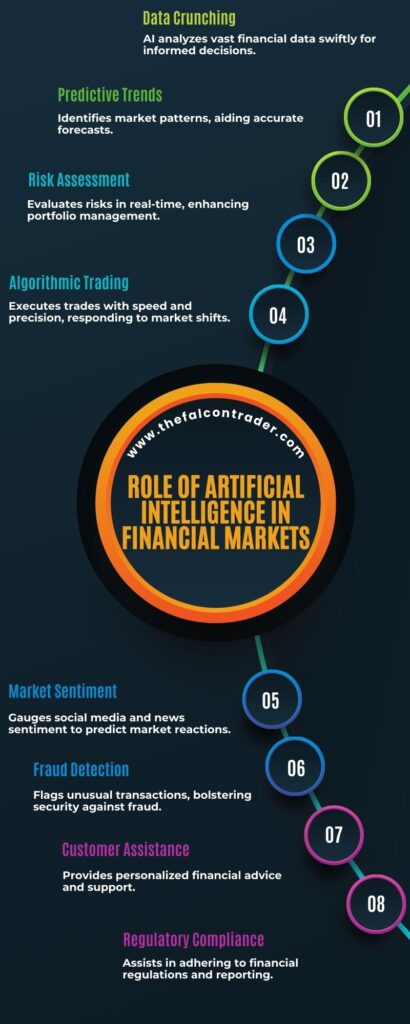

- AI is revolutionizing financial markets by integrating into various areas such as algorithmic trading, risk management, predictive analytics, portfolio management, fraud detection, customer service, regulatory compliance, and market research.

- AI-driven algorithmic trading removes human emotion and biases from decision-making, taking advantage of market inefficiencies, but also poses risks such as programming errors and flash crashes caused by interconnected algorithms.

- Risk management plays a crucial role in algorithmic trading by assessing and mitigating potential risks, minimizing losses through informed decision-making, and implementing risk management techniques to protect against excessive losses.

- AI in financial markets enables real-time monitoring and analysis of market conditions, identifies and manages potential risks by analyzing data, and enhances efficiency by improving analysis and decision-making processes, minimizing errors and biases, and optimizing resources and reducing costs.

Role Of Artificial Intelligence In Financial Markets

Artificial Intelligence (AI) has revolutionized the landscape of financial markets by bringing advanced analytical capabilities and automation. AI algorithms analyze vast amounts of data, spotting patterns, and making predictions with unprecedented accuracy. This technology empowers traders and investors with real-time insights, aiding in informed decision-making.

AI-driven trading systems execute orders swiftly and efficiently, responding to market fluctuations faster than human traders can. Additionally, AI can assess market sentiment from social media and news, providing a holistic view of market dynamics.

In conclusion, AI plays a pivotal role in financial markets by enhancing data analysis, automation, and predictive capabilities. It transforms the way trading is conducted, allowing for more efficient, data-driven, and informed decision-making.

Algorithmic Trading

Algorithmic trading, a prominent application of artificial intelligence in financial markets, has revolutionized the way trades are executed by using complex mathematical models and algorithms to make high-speed decisions. This automated trading strategy involves the use of pre-programmed instructions that analyze vast amounts of data and execute trades based on predetermined criteria.

One key aspect of algorithmic trading is its ability to conduct high frequency trading, where large volumes of trades are executed within milliseconds.

The main advantage of algorithmic trading is its ability to remove human emotion from the decision-making process. By relying on mathematical models and algorithms, this approach eliminates biases and makes objective decisions based solely on market data. Additionally, the speed at which these algorithms operate allows for quick execution of trades, taking advantage of even the smallest market inefficiencies.

However, algorithmic trading also comes with certain risks. The reliance on complex algorithms means that any errors in their programming can lead to significant losses. Moreover, as more participants engage in algorithmic trading strategies, there is an increased risk of flash crashes or other unexpected market events caused by interconnected algorithms.

In order to mitigate these risks, effective risk management techniques need to be implemented alongside algorithmic trading strategies. These techniques may include setting limits on trade sizes and frequencies or implementing stop-loss orders to protect against excessive losses.

By incorporating robust risk management practices into algorithmic trading strategies, investors can harness the power of artificial intelligence while minimizing potential downsides associated with this approach.

Risk Management

Risk management plays a crucial role in algorithmic trading. It involves assessing and mitigating potential risks that can arise from various factors such as market volatility, liquidity issues, or system failures.

Real-time monitoring and analysis of market conditions allow traders to make informed decisions. By constantly tracking market movements and adjusting their strategies accordingly, they can minimize potential losses.

Identifying and managing potential risks

One must recognize the significance of effectively identifying and mitigating potential risks when considering the role of artificial intelligence in financial markets, for doing so is paramount in ensuring stability and safeguarding against detrimental consequences.

AI can play a crucial role in managing market volatility by analyzing vast amounts of data and detecting patterns or correlations that human analysts might overlook. By utilizing advanced algorithms, AI systems can identify investment opportunities and make informed decisions based on historical data, market trends, and other relevant factors. This enables investors to capitalize on potential gains while minimizing losses.

Furthermore, AI can help in assessing risk exposure by continuously monitoring market conditions and providing real-time analysis. Such capabilities allow for prompt responses to changing circumstances, aiding in effective risk management strategies.

Transitioning into the next section about ‘real-time monitoring and analysis of market conditions’, it becomes evident that AI’s ability to provide timely insights facilitates proactive decision-making processes.

Real-time monitoring and analysis of market conditions

Utilizing advanced technology to continuously monitor and analyze real-time market conditions facilitates proactive decision-making processes, enabling investors to stay informed and adapt their strategies accordingly, ultimately contributing to a sense of confidence and assurance in the ever-evolving financial landscape.

To achieve this, artificial intelligence (AI) systems are designed to collect and process vast amounts of real-time data from various sources such as news articles, social media platforms, and financial statements. This data is then analyzed using complex algorithms that can detect patterns, trends, and anomalies in the market.

Three key benefits of real-time monitoring and analysis in financial markets include:

- Timely identification of emerging market trends or shifts helps investors make informed decisions promptly.

- Enhanced risk management by detecting potential threats or vulnerabilities in the market before they escalate.

- Improved portfolio performance through continuous evaluation of investment strategies based on up-to-date information.

By harnessing AI-powered tools for real-time data analysis and market surveillance, investors can gain valuable insights that guide their actions towards maximizing returns while minimizing risks. This capability sets the stage for the subsequent section on predictive analytics seamlessly.

Predictive Analytics

Predictive analytics plays a crucial role in financial markets. It provides insights into forecasting market trends and patterns. By analyzing historical data and using sophisticated algorithms, predictive models can identify potential market movements. This helps investors make data-driven investment decisions.

These models enable investors to assess risks accurately. They also help optimize their portfolios and enhance their overall investment strategies.

Forecasting market trends and patterns

By leveraging the power of artificial intelligence, market participants can gain valuable insights into potential trends and patterns within financial markets. This allows for more accurate market forecasting and trend analysis, enabling investors to make informed decisions.

Artificial intelligence algorithms can analyze large amounts of historical data to identify patterns and correlations that may not be apparent to human traders. Additionally, AI can continuously monitor real-time data and news feeds, allowing for quick identification of emerging trends or market shifts.

Furthermore, AI-based forecasting models are capable of adapting to changing market conditions and adjusting predictions accordingly. Overall, the use of artificial intelligence in forecasting market trends provides a powerful tool for investors seeking to stay ahead of the curve in an ever-changing financial landscape.

Moving forward into the subsequent section about making data-driven investment decisions, it is essential to understand how AI-generated forecasts can serve as a foundation for strategic investment choices.

Making data-driven investment decisions

The ability to forecast market trends and patterns is a key aspect of utilizing artificial intelligence (AI) in financial markets. By analyzing vast amounts of data, AI algorithms can identify potential market shifts and provide valuable insights for investors.

However, it is not enough to simply predict future trends; making informed investment decisions based on this information is equally crucial. This is where data-driven decision making comes into play. With the help of AI, investors can leverage quantitative analysis techniques to process large volumes of financial data and extract meaningful patterns and correlations.

If interested you can read about algo trading here.

By relying on objective data rather than subjective judgments, investors can minimize bias and make more accurate investment choices. This approach allows for a systematic and disciplined investment strategy that aligns with the goal of achieving optimal returns.

Transitioning into the subsequent section about ‘portfolio management,’ these data-driven decisions lay the foundation for effective portfolio construction and optimization.

Portfolio Management

Portfolio management is a crucial aspect of financial decision-making that involves optimizing asset allocation strategies.

This process aims to achieve the optimal balance between risk and return for an investment portfolio. By carefully diversifying investments across different asset classes, portfolio managers can reduce risk while maximizing potential returns.

Additionally, effective portfolio management also involves regularly monitoring and adjusting the portfolio based on market conditions and investment goals.

Optimizing asset allocation

Optimizing asset allocation in financial markets can be effectively achieved through the utilization of artificial intelligence technologies. Robo advisors, powered by AI algorithms, offer a systematic approach to portfolio management by taking into account factors such as risk profiling and investment goals. These technologies analyze vast amounts of data, including market trends and historical performance, to provide personalized recommendations for asset allocation.

To illustrate the benefits of AI in optimizing asset allocation, consider the following table:

| Asset Class | Weighting (%) | Expected Return (%) |

|---|---|---|

| Stocks | 60 | 8 |

| Bonds | 30 | 4 |

| Real Estate | 10 | 6 |

By using AI-driven robo advisors, investors can make informed decisions based on objective analysis rather than relying solely on human intuition or emotion. This not only improves the efficiency of portfolio management but also reduces biases that may arise from subjective decision-making.

In the subsequent section about ‘balancing risk and return,’ we will explore how AI can assist in finding an optimal balance between these two crucial aspects of investing.

Balancing risk and return

Achieving an optimal balance between risk and return is a crucial consideration for investors as it determines the potential rewards and exposure to potential losses in their portfolios. In the realm of financial markets, artificial intelligence (AI) plays a significant role in helping investors navigate this delicate balancing act. Here are four key aspects where AI aids in balancing risk and return:

- Risk assessment: AI algorithms analyze vast amounts of data to identify potential risks associated with different asset classes or investment strategies.

- Portfolio optimization: AI models optimize asset allocation by considering risk tolerance, time horizon, and desired returns to achieve an optimal balance.

- Predictive analytics: AI-powered tools employ advanced statistical techniques to forecast market movements and assess potential risks.

- Dynamic rebalancing: AI algorithms continuously monitor portfolio performance and automatically adjust allocations to maintain the desired risk-return trade-off.

By leveraging these capabilities, investors can make informed decisions that align with their risk appetite while maximizing returns.

Transitioning into the subsequent section about ‘fraud detection,’ we explore how AI enhances market integrity through its ability to detect fraudulent activities.

Fraud Detection

The application of artificial intelligence in financial markets has significantly contributed to the enhancement of fraud detection systems. By leveraging advanced algorithms and machine learning techniques, AI-powered systems can analyze vast amounts of data in real-time, enabling the identification of fraudulent activities with higher accuracy and efficiency. These systems employ sophisticated models that are trained to detect patterns and anomalies associated with fraudulent behavior, allowing for early intervention and prevention.

One key aspect of AI-enabled fraud detection is anomaly detection. This approach involves establishing baseline patterns of normal behavior within a given dataset and flagging any deviations from these patterns as potential fraudulent activities. Machine learning algorithms can continuously learn from new data, adapting their understanding of what constitutes normal behavior and identifying emerging fraud schemes.

The benefits brought by AI in fraud detection extend beyond simply reducing financial losses. They also help to safeguard customer trust in financial institutions by enhancing security measures and protecting personal information. Moreover, these systems enable regulatory compliance by monitoring transactions for potential violations or suspicious activities.

Customer Service and Personalization

This discussion focuses on the role of artificial intelligence (AI) in customer service and personalization within the financial sector.

AI-powered chatbots and virtual assistants have emerged as valuable tools for enhancing customer interaction and resolving queries efficiently.

Additionally, AI enables customized financial recommendations and advice by analyzing vast amounts of data to provide tailored solutions based on individual needs and goals.

AI-powered chatbots and virtual assistants

AI-powered chatbots and virtual assistants have revolutionized the financial markets, providing efficient and personalized customer support without the need for human intervention.

These advanced technologies enable companies to offer round-the-clock assistance to customers by automating various tasks such as answering frequently asked questions, resolving common issues, and facilitating automated financial transactions.

The use of AI-powered chatbots ensures that customers receive instant responses, reducing waiting times and enhancing their overall experience. Moreover, these virtual assistants are capable of analyzing large amounts of data in real-time, allowing them to provide accurate and relevant information to customers.

By leveraging natural language processing and machine learning algorithms, AI-powered chatbots can understand customer queries and deliver tailored solutions. This level of personalized service not only improves customer satisfaction but also increases operational efficiency for financial institutions.

Transitioning into the subsequent section about customized financial recommendations and advice, these technological advancements further empower customers with valuable insights for making informed decisions regarding their finances.

Customized financial recommendations and advice

AI-powered chatbots and virtual assistants have revolutionized the way financial institutions interact with their customers by providing instant support and information. Building upon this technology, artificial intelligence has now ventured into the realm of customized financial recommendations and advice.

Automated wealth management platforms utilize AI algorithms to analyze vast amounts of data, including individual preferences, risk tolerance, and investment goals, to generate personalized financial plans for clients. These platforms offer tailored investment strategies and asset allocations that align with an individual’s unique circumstances.

By leveraging machine learning techniques, these systems continuously adapt and refine their recommendations based on changing market conditions and client feedback. The integration of AI in personalized financial planning provides individuals with greater control over their investments while benefiting from expert-level insights.

As we transition to the subsequent section on regulatory compliance, it is essential to explore how AI addresses legal frameworks governing financial markets.

Regulatory Compliance

Regulatory compliance in financial markets is an intricate web of rules and regulations that govern the behavior and operations of market participants. It ensures fair practices, protects investors, and maintains market integrity. However, complying with these regulations can be a daunting task for financial institutions due to the numerous challenges they face.

One major challenge is keeping up with the constantly evolving regulatory landscape. Regulations are regularly updated or new ones are introduced to address emerging risks. This makes it difficult for financial institutions to stay compliant without a robust system in place.

Automation in regulatory compliance has emerged as a solution to this challenge. Artificial intelligence (AI) technologies can analyze vast amounts of data quickly and accurately, helping firms identify any non-compliance issues more efficiently. AI algorithms can also learn from past cases, enabling them to make informed decisions when addressing new compliance challenges.

Additionally, automation can streamline reporting processes by automatically generating reports that meet regulatory requirements. This reduces the time and resources needed for manual reporting tasks, allowing employees to focus on higher-value activities.

In conclusion, automation in regulatory compliance offers significant benefits for financial institutions by providing efficient solutions to tackle evolving challenges. The integration of AI technology enables firms to navigate the complex regulatory environment effectively while ensuring adherence to guidelines. Transitioning into market research and data analysis further enhances decision-making capabilities within financial markets without compromising on compliance standards.

Market Research and Data Analysis

Market research and data analysis play a crucial role in understanding consumer behavior, market trends, and identifying potential investment opportunities. Market segmentation is an essential technique used to divide the market into distinct groups based on various factors such as demographics, psychographics, and buying behaviors. This allows financial institutions to target specific customer segments with tailored products and services that meet their unique needs.

Competitor analysis is another important aspect of market research. By analyzing competitors’ strategies, strengths, weaknesses, and market positions, financial institutions can gain valuable insights into their own competitive advantage and identify areas for improvement. This information helps them make informed decisions about product development, pricing strategies, and marketing campaigns.

To better understand the significance of market research and data analysis in financial markets, consider the following table:

| Market Segmentation | Competitor Analysis |

|---|---|

| Identifies target customer groups based on demographics, psychographics, and buying behaviors | Analyzes competitors’ strategies and market positions |

| Enables tailored marketing campaigns to specific customer segments | Helps identify competitive advantages |

| Guides product development by addressing unique customer needs | Identifies areas for improvement |

In conclusion, market research and data analysis are invaluable tools for financial institutions seeking to navigate the complex landscape of financial markets. By employing these techniques effectively, they can gain a competitive edge by understanding consumer behavior through market segmentation and staying ahead of their competitors through thorough competitor analysis.

Conclusion

In conclusion, the “Role of Artificial Intelligence in Financial Markets” underscores the pivotal role that AI plays in reshaping the financial industry. As technology continues to advance, AI’s potential to enhance data analysis, optimize trading strategies, and mitigate risks becomes increasingly evident. Embracing AI-driven insights empowers traders and investors to make informed decisions, maximize profitability, and navigate complex market dynamics. As you navigate the exciting world of finance, let this guide serve as a reminder of the indispensable role AI plays in shaping the future of financial markets. Embrace the power of artificial intelligence and position yourself at the forefront of the ever-evolving financial landscape.

References

- Uninformative feedback and risk taking: Evidence from retail forex trading

- Technical analysis of Forex by MACD Indicator

- Extended evidence on the use of technical analysis in foreign exchange

- Can deep learning improve technical analysis of forex data to predict future price movements?

Frequently Asked Questions

How does artificial intelligence impact the overall efficiency and speed of algorithmic trading strategies?

Artificial intelligence (AI) has significantly improved the efficiency of algorithmic trading strategies by enhancing speed and reducing human error. Through advanced data analysis and machine learning algorithms, AI enables faster decision-making and execution, leading to more profitable trades in financial markets.

What are the key challenges faced in implementing AI-based risk management systems in financial markets?

Implementing AI-based risk management systems in financial markets faces challenges such as data quality, model interpretability, and regulatory compliance. These obstacles hinder the seamless implementation of AI technology and require careful consideration to ensure effective and reliable risk management processes.

Can predictive analytics accurately forecast market trends and potential risks in real-time?

Predictive analytics has limitations in accurately forecasting real-time market trends and potential risks. These limitations arise due to the complexity of financial markets, the dynamic nature of data, and the inherent uncertainty associated with future outcomes.

How does AI technology assist in optimizing portfolio management strategies and achieving higher returns?

Optimizing investment strategies and achieving higher profitability are facilitated by AI technology. It provides objective and analytical insights, enabling informed decision-making. By leveraging advanced algorithms, AI can analyze vast amounts of data, identify patterns, and generate personalized portfolio recommendations for investors.

What role does AI play in enhancing fraud detection capabilities and preventing financial crimes in the market?

AI plays a crucial role in enhancing fraud detection capabilities and preventing financial crimes in the market. It revolutionizes credit scoring and loan underwriting, while also improving customer experience and personalization in financial markets.