Trade Smarter: Top 3 Hacks for Better Trading – Expert Insights 2023

Elevate your trading game with the “Top 3 Hacks for Better Trading.” In the dynamic world of financial markets, success demands a blend of skill, strategy, and savvy. This guide unveils three potent hacks to enhance your trading prowess, from mastering technical analysis nuances to optimizing risk management strategies.

Each hack is tailored to empower traders with actionable insights, providing an edge in navigating the complexities of the market. Join us on this enlightening journey as we equip you with the tools to make informed decisions and maximize your potential for success.

Key Takeaways

- Develop strategies based on research and market analysis

- Utilize automated trading software to increase efficiency and accuracy while reducing human error

- Analyze the market carefully using fundamental and technical analysis

- Maximize profit potential by understanding currency reactions, analyzing market data, and managing risk with automated trading software

Top 3 Hacks For Better Trading

Here are the top 3 hacks for better trading:

- Leverage Your Knowledge: This is a fundamental principle in trading. Informed decisions are more likely to lead to profitable outcomes. By thoroughly understanding the assets you’re trading, the market conditions, and relevant economic factors, you’re better equipped to make strategic moves. This knowledge can help you identify potential opportunities and assess risks more accurately.

- Utilize Automated Trading Software: Automation can enhance trading efficiency and effectiveness. Automated trading software can execute trades on your behalf based on predetermined criteria. This reduces the chances of emotional trading, which can often lead to poor decisions. Additionally, these programs can monitor markets around the clock, ensuring you don’t miss out on important developments.

- Analyze the Market Carefully: Careful analysis is the bedrock of successful trading. This involves both technical and fundamental analysis. Technical analysis uses historical price data and chart patterns to predict future price movements, while fundamental analysis focuses on economic and financial factors that may affect an asset’s value. By combining these approaches, you gain a comprehensive understanding of market trends and potential entry or exit points.

Remember, while these hacks can significantly improve your trading, there is no one-size-fits-all approach. It’s crucial to adapt these strategies to your individual trading style, risk tolerance, and financial goals. Always stay updated on market trends and continuously refine your trading techniques for the best results.

Leverage Your Knowledge

Leveraging knowledge of the forex market can be a powerful tool for successful trading. Developing strategies based on research and market analysis, understanding trade psychology, and utilizing automated trading software are all essential components to gaining an advantage in forex trading.

As a trader, you must stay up-to-date with the latest news and trends in order to make informed decisions regarding entry and exit points. The ability to recognize patterns quickly within the volatile foreign exchange markets is paramount in determining whether or not a trade will be profitable. Additionally, having an understanding of how different currencies may react to certain events can provide invaluable insight into future market movements.

To remain competitive, traders should also take time to assess their own performance regularly in order to identify areas where improvement is needed. By doing so, they can develop more effective strategies that better fit their individual needs and goals.

With these steps taken into account, traders have the potential for greater success when it comes to forex trading. Utilizing automated trading software is an additional way to increase efficiency and accuracy while reducing human error during trades.

Utilize Automated Trading Software

Utilizing automated trading software can be advantageous for those engaged in international currency exchange. It is a helpful tool to effectively manage risk, set stop loss points, and practice discipline while trading. Automation can provide previously unavailable insights into the market which allow traders to make informed decisions quickly and accurately. This increased speed and accuracy of data analysis often leads to increased profits as well as decreased losses.

Additionally, automation eliminates the need for manual calculations which can take significant time and effort from traders. For these reasons, many experienced Forex traders utilize automated trading software to gain a competitive edge over other traders. Furthermore, automated systems are designed with scalability in mind so that they can scale along with increasingly complex requirements of trading strategies.

In conclusion, utilizing automated trading software is an important part of any Forex trader’s strategy; it allows them to analyze the market faster and more accurately while helping them manage risk and set stop loss points with greater ease. With this tool in their arsenal, Forex traders are better equipped to make successful trades on the international currency exchange market.

To further increase success rates within this field of investment, it is also important to analyze the market carefully before entering a trade.

Analyze the Market Carefully

Careful market analysis is an essential part of any successful currency exchange trade. Experienced forex traders understand that close monitoring and research of data are the keys to success. They use a variety of methods to analyze the market, including:

- Fundamental Analysis

- Technical Analysis

- Research Trends

- Monitor Data

Fundamental Analysis: Unearthing the True Value

Fundamental analysis is a cornerstone of financial market research. It revolves around scrutinizing a company’s financial health, its industry, and the broader economic conditions to determine its intrinsic value. This analysis helps investors make informed decisions about buying or selling stocks, bonds, or other financial assets.

At its core, fundamental analysis evaluates several key factors:

- Financial Statements: Reviewing a company’s income statement, balance sheet, and cash flow statement helps assess its profitability, debt levels, and cash management.

- Earnings and Revenue Growth: Examining a company’s historical and projected earnings and revenue growth provides insights into its potential for future success.

- Competitive Positioning: Analyzing a company’s competitive advantages, market share, and industry position can highlight its long-term prospects.

- Management and Governance: Evaluating the quality and effectiveness of a company’s leadership and corporate governance practices is crucial.

- Macroeconomic Factors: Assessing broader economic indicators, such as interest rates, inflation, and GDP growth, can help understand how external factors might impact the company.

Fundamental analysis isn’t just limited to stocks; it can be applied to any asset class. Investors often combine fundamental analysis with other approaches, such as technical analysis, to make well-rounded investment decisions.

Technical Analysis: Charting the Market’s Behavior

Technical analysis, in contrast to fundamental analysis, focuses on market data like price and volume to predict future price movements. It assumes that all relevant information is already reflected in an asset’s price. Here are some key aspects of technical analysis:

- Charts and Patterns: Technicians use price charts and patterns to identify trends, reversals, and potential entry or exit points. Common chart patterns include head and shoulders, flags, and triangles.

- Indicators and Oscillators: Technical analysts employ various indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) to gauge momentum, overbought or oversold conditions, and trend strength.

- Support and Resistance: Identifying price levels where assets tend to find support (bottom) or resistance (top) is crucial for making trading decisions.

- Volume Analysis: Monitoring trading volume helps confirm price trends and spot potential reversals.

- Timeframes: Technical analysis can be applied to various timeframes, from minutes in day trading to weeks or months in long-term investing.

- While some traders swear by technical analysis, it’s essential to remember that it’s not foolproof, and market sentiment can change suddenly.

Research Trends: Staying Ahead in a Dynamic Market

The financial markets are ever-evolving, driven by economic, technological, and geopolitical shifts. To stay ahead, investors need to stay informed about the latest research trends. Here are a few areas to keep an eye on:

- Artificial Intelligence (AI) and Machine Learning: AI-driven algorithms are increasingly being used for predictive analytics, portfolio optimization, and risk management.

- Environmental, Social, and Governance (ESG) Investing: Sustainable investing has gained significant traction. Investors are integrating ESG criteria into their decision-making to align their portfolios with ethical and environmental values.

- Cryptocurrency and Blockchain: The rise of cryptocurrencies and blockchain technology has created new investment opportunities and challenges. Understanding this emerging asset class is essential.

- Quantitative Finance: The use of mathematical models and quantitative techniques for trading and risk management continues to grow in importance.

- Regulatory Changes: Keeping abreast of regulatory changes and their potential impact on the financial markets is crucial for risk management.

Monitor Data: Real-Time Decision Making

In today’s fast-paced markets, access to real-time data is invaluable. Traders and investors rely on data sources such as Bloomberg, Reuters, and financial news networks to make informed decisions. Additionally, trading platforms and software provide customizable dashboards to monitor asset prices, news feeds, and technical indicators.

Remember, while data is essential, it’s equally important to have a well-thought-out trading or investment strategy that aligns with your financial goals and risk tolerance.

In conclusion, a holistic approach to analyzing financial markets involves a blend of fundamental and technical analysis, keeping an eye on research trends, and monitoring real-time data. Mastering these elements can help you navigate the complex world of finance and make more informed investment decisions.

Conclusion

In conclusion, the “Top 3 Hacks for Better Trading” serve as invaluable assets in the arsenal of any aspiring trader. By integrating these hacks into your trading approach, you’re poised to navigate the markets with greater confidence and precision. Remember, continuous learning and disciplined execution are the cornerstones of trading success.

Let this guide be your companion in the pursuit of financial prosperity. With these hacks at your disposal, you’re better equipped to seize opportunities and mitigate risks, ultimately propelling your trading journey towards sustained success. Embrace these hacks and watch as they transform your trading experience.

References

- A Forex trading system based on a genetic algorithm

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

- Lessons from the evolution of foreign exchange trading strategies

- Application of neural network for forecasting of exchange rates and forex trading

Frequently Asked Questions

What Is the Best Forex Trading Platform?

The best forex trading platform is one that provides technical analysis tools and a comprehensive trading psychology guide. It should also include features such as charting capabilities, access to market data, and reliable customer support. Such a platform will help traders develop the necessary skills for success in the forex market.

What Time Frames Should I Use for Forex Trading?

When considering what time frames to use for forex trading, day trading can provide a more aggressive approach with higher risk. Risk management is essential to be successful in this type of trading. Utilizing multiple strategies and time frames may prove beneficial, as well as monitoring market trends and news.

How Much Capital Do I Need to Start Forex Trading?

A trader typically needs to have at least $250 in capital to start forex trading. Currency pairs, leverage and risks must be considered when making decisions. A case study of a successful trader using proper risk management shows how it is possible to make profits with even small amounts of capital. Forex trading can offer great opportunities if done correctly.

What Types of Strategies Should I Use for Forex Trading?

When trading Forex, a sound strategy is essential. Technical analysis and risk management are two key components to consider when developing a trading plan. Understanding the markets, along with one’s own risk tolerance, can lead to successful trading decisions and results.

What Are the Risks Associated With Forex Trading?

Forex trading carries a range of risks including loss of capital due to market volatility, poor money management and incorrect market analysis. It is important to understand these risks before engaging in forex trading and ensure appropriate strategies are put in place to mitigate them.

Unraveling Insights: Stochastic Indicator – In-Depth Analysis 2023

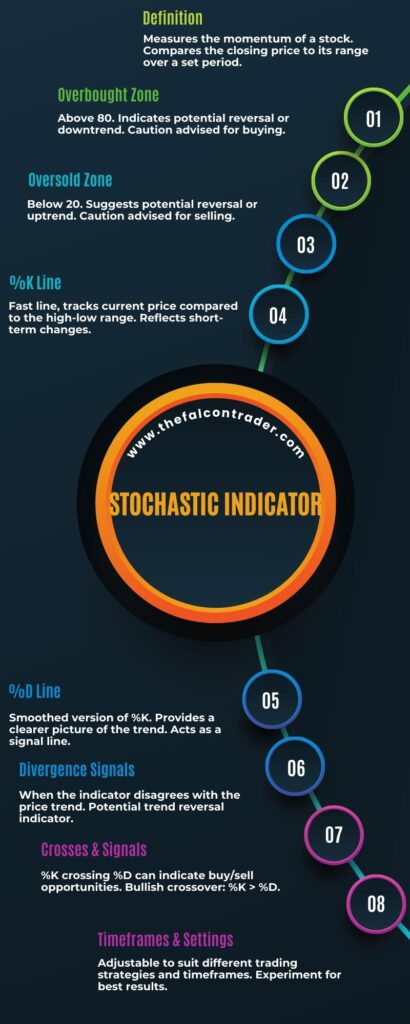

Step into the world of technical analysis with the “Stochastic Indicator.” This powerful tool has earned its place as a cornerstone of market analysis, providing traders with invaluable insights into price momentum and potential trend reversals. By assessing the relationship between a security’s closing price and its price range over a specified period, the stochastic indicator offers a window into market psychology.

In this comprehensive guide, we’ll dissect the nuances of this essential indicator, exploring its applications, interpretations, and strategic implementations. Join us on this illuminating journey as we unravel the secrets of the stochastic indicator and equip you with the tools to navigate the dynamic landscape of financial markets.

Key Takeaways

- Stochastic Indicator is a momentum indicator used in technical analysis

- It helps identify potential turning points in markets and predicts future price trends

- It determines if a financial asset is overbought or oversold

- It provides timely signals for trading decisions and helps manage risks

What Is a Stochastic Indicator?

A stochastic indicator is a type of momentum indicator used to identify potential turning points in markets. Developed by George C. Lane, it is part of the broader area of technical analysis and helps traders analyze price action. This indicator compares an asset’s closing price to its price range over a given period, typically 14 days or periods. By doing so, the stochastic oscillator attempts to gauge the momentum of an asset’s recent performance and predict future trends in prices.

The main benefit of using this indicator is that it can help traders make better decisions when entering or exiting a trade by signaling whether an asset’s current direction may continue into the near future or reverse. When combined with other indicators or forms of analysis, such as support and resistance levels in markets, traders can use the stochastic indicator to get a more accurate view of market conditions before deciding where to place their trades.

The most important thing for traders to remember about using this tool is that it does not predict future prices precisely but rather provides an indication as to whether there may be continued buying pressure (indicated by higher highs) or selling pressure (indicated by lower lows). This information can then be used in combination with other forms of analysis for making informed trading decisions.

How Does a Stochastic Indicator Work?

By examining the price trend of a financial asset, one can identify whether it is overbought or oversold in the market. A stochastic indicator is an analytical tool used to make this determination and signal potential buying and selling opportunities. This type of technical indicator works by comparing a security’s closing price to its range of prices throughout a certain period.

Stochastic indicators measure the momentum of price movements as well as their direction, making them invaluable for traders. They are easy to interpret and use. They provide insight into whether an asset is undervalued or overvalued. They generate timely signals that enable investors to respond quickly. They have increased reliability compared to other methods due to their ability to absorb price divergence.

Overall, stochastic indicators are effective tools for gauging momentum changes and predicting future trends in financial assets. Their simplicity, accuracy, and speed make them particularly attractive for trading purposes. Furthermore, they help investors gauge when conditions are right for entering or exiting markets with greater confidence and success.

Examples of Stochastic Indicators

Stochastic indicators are a type of technical analysis indicator which can be used to observe the momentum and trends in price movements.

Two common examples of stochastic indicators are the Moving Average Crossover and Momentum Oscillator.

The Moving Average Crossover calculates two moving averages and compares them, while the Momentum Oscillator displays overbought/oversold levels by comparing the closing price to its range over a specified period of time.

These stochastic indicators can provide useful information for traders when making decisions on market entry and exit points.

Moving Average Crossover

Moving Average Crossover is a technical analysis tool which involves the comparison of two different moving averages, in order to identify potential trading opportunities. It is used by traders as a trend following strategy and can help them to set trailing stops. This technique looks at price data over specific periods of time and uses this data to calculate the average closing price.

Some key items for using Moving Average Crossover are:

- Identifying buying and selling signals

- Determining momentum shifts

- Noting when a security is overbought or oversold

- Calculating support and resistance levels.

Overall, Moving Average Crossover is an effective way of tracking a stock’s performance and making educated decisions regarding entry and exit points in the market.

The next section discusses Momentum Oscillators, which can be used in conjunction with this technique for further accuracy.

Momentum Oscillator

Momentum Oscillators are technical analysis tools used to measure the speed and strength of a price trend. They can be used to identify overbought/oversold levels, as well as generate buy/sell signals when combined with other indicators.

The oscillator is calculated by subtracting a longer-term moving average from a shorter-term moving average and plotting the difference between them on a chart. By analyzing the movement of this line, traders can determine whether momentum is increasing or decreasing in relation to the underlying price action and trend lines.

When momentum is positive, it indicates that recent prices have been higher than earlier prices, while negative momentum indicates that recent prices have been lower than earlier prices. This information can provide valuable insight into potential areas of support and resistance which could result in profitable trading opportunities.

With this knowledge, traders can make informed decisions about buying or selling securities at advantageous times.

Overbought/Oversold Levels

The use of Momentum Oscillators can provide insight into potential overbought/oversold levels. Using time frames, the oscillator signals can help traders identify market turning points and divergence trading opportunities.

Traders should be aware of these indicators when monitoring prices:

- Moving averages to determine trend strength;

- Maximums and minimums that indicate price exhaustion;

- Divergence between the oscillator and price action;

- Support/resistance levels that signal a reversal in sentiment.

Analyzing these conditions within the context of different time frames allows traders to more accurately assess market momentum, aiming for optimal entry/exit points with higher confidence.

Benefits of Using a Stochastic Indicator

Utilizing a stochastic indicator can provide numerous benefits to traders. Risk management and trading strategies are improved when using a stochastic indicator, as it tracks the momentum of asset prices in order to identify potential turning points. A trader can then use this data to their advantage by making more informed decisions that could lead to better returns on investment.

| Benefit | Description | Example |

|---|---|---|

| Improved Risk Management | Stochastic indicators help identify overbought/oversold levels, allowing traders to control risk better and set stop-loss orders accordingly. | Setting stop-losses at overbought or oversold levels ensures that significant losses are minimized if the market suddenly reverses directions. |

| Trading Strategies Optimization | By recognizing potential turning points in an asset’s price, traders can create more effective trading strategies based on these insights. | Using a stochastic indicator, traders could watch for areas where an asset is oversold and then buy into it at the right time before its price rises again. |

| Greater Returns on Investment (ROI) | When used properly, a stochastic indicator can be beneficial in helping traders earn higher ROI from their trades. | By entering positions at certain points based on the signals provided by the indicator, investors may be able to obtain better returns than they would have without using one at all. |

Setting Up a Stochastic Indicator

Setting up a Stochastic Indicator requires consideration of two key parameters: Parameters Setup and System Optimization.

Parameters Setup refers to the selection of the appropriate settings for the indicator, such as time frames, signal levels and other relevant technical indicators.

System Optimization involves adjusting variables in order to maximize profits while minimizing risk.

It is important to understand these components thoroughly in order to develop an effective trading strategy using a Stochastic Indicator.

Parameters Setup

Parameters of a stochastic indicator must be properly configured for accurate results. There are four key components to consider when setting up the parameters:

- Technical Analysis: understanding how indicators move in relation to price movements, as well as analyzing historical data.

- Risk Management: determining an appropriate level of risk and determining stop-loss levels.

- System Optimization: ensuring that all settings are optimized for trading objectives.

- Data Collection: collecting and analyzing data from different sources.

Properly configuring the parameters of a stochastic indicator can help traders make informed decisions and mitigate risks.

Transitioning into system optimization is essential to ensure successful trades.

System Optimization

Optimizing system parameters is an essential step for successful trading. Machine learning and genetic algorithms can be used to optimize a stochastic indicator system for maximum performance. By creating a mathematical model of the data, machine learning can detect patterns in the markets that could not be found by manual analysis.

Additionally, genetic algorithms provide an efficient way to search through possible solutions from a large set of parameters and find optimal settings. The use of these tools helps traders gain insight into their strategies and fine tune them for better results.

Through this process, traders can increase their chances of success while minimizing risk exposure.

Interpreting a Stochastic Indicator

Interpreting a stochastic indicator requires an understanding of the underlying market conditions. An effective strategy includes risk management, signal accuracy, data analysis, and an understanding of how these indicators are used. It is important to understand the different types of stochastic indicators available in order to make informed decisions when trading.

Risk management should be at the forefront of any trader’s strategy as it can help mitigate losses while maximizing gains. Signal accuracy is also important as traders need to ensure they are accurately interpreting signals from the stochastic indicator and making sound trading decisions based on that information. Data analysis is essential for a trader to understand trends in the market and how their trades will impact those trends.

In addition, it is important for traders to understand how different types of stochastic indicators work and what they signify in terms of market movements. By learning about various types of stochastics, traders can use this knowledge to create more accurate strategies for trading with them.

Lastly, understanding how these indicators fit into an overall trading plan can help guide traders as they navigate markets and determine when it might be best to enter or exit positions.

Challenges of Using a Stochastic Indicator

Using a stochastic indicator can present certain challenges for traders, including data analysis and signal accuracy. One of the most important difficulties in using a stochastic indicator is noise filtering; without proper noise filtering, it can be difficult to identify meaningful trends or signals. Additionally, traders must ensure that the signals generated by their stochastic indicator are accurate and reliable.

| Challenge | Description | Solution |

|---|---|---|

| Noise Filtering | Identifying meaningful trends from random market movements | Use indicators such as moving averages to filter out noise and identify true trends from random market movements |

| Signal Accuracy | Ensuring that the signals generated by the stochastic indicator are reliable and accurate | Use multiple technical indicators together to increase the reliability of signals generated by the stochastic indicator |

Alternatives to Stochastic Indicators

Analyzing market data can be done through alternative methods to stochastic indicators. Examples of such alternatives include:

- The Relative Strength Index (RSI) which is a momentum indicator used to compare the magnitude of recent gains and losses over a specific period.

- The Commodity Channel Index (CCI), which is a technical indicator that helps traders identify cyclical trends in the market.

- MACD, or Moving Average Convergence Divergence, which is an oscillator used to measure momentum.

- And Bollinger Bands, a volatility indicator composed of three lines.

Each of these indicators offer their own advantages and drawbacks for trading purposes and should be carefully studied before making decisions on how to best analyze market data.

By understanding these various alternatives, investors can make more informed economic decisions based on their individual needs.

Conclusion

In conclusion, the “Stochastic Indicator” stands as a beacon for traders seeking to decipher market dynamics and identify potential turning points. Its ability to gauge the relative strength of a trend is a priceless asset in the arsenal of any technical analyst. However, it’s crucial to combine the stochastic indicator with other indicators and employ effective risk management strategies.

As you delve into the world of technical analysis, let this guide be your steadfast companion, offering valuable insights and empowering you to make informed trading decisions. With a firm grasp of the stochastic indicator, you’ll be well-positioned to navigate the complexities of financial markets and seize opportunities with confidence.

References

- A Forex trading system based on a genetic algorithm

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

- Lessons from the evolution of foreign exchange trading strategies

- Application of neural network for forecasting of exchange rates and forex trading

Frequently Asked Questions

What Is the Difference Between a Stochastic Indicator and a Regular Indicator?

Regular indicators are based on price data and do not take into account the probability of a trade outcome. Stochastic indicators, on the other hand, incorporate probability to analyze market movements and predict future trends in order to enable more effective risk management and trading strategies.

How Often Should I Use a Stochastic Indicator to Receive the Most Accurate Results?

Analyzing market trends through technical analysis can help determine the best frequency of using a stochastic indicator. Data-driven decisions can reveal the most accurate results, allowing for informed decision-making to ensure success in the long term.

Is a Stochastic Indicator Better for Short-Term or Long-Term Analysis?

Price movements and market trends can be analyzed over short-term or long-term periods. A stochastic indicator is often used to measure these changes in data, providing insight into the direction of the markets. Such analysis can help traders make informed decisions about their investments.

Is It Possible to Combine a Stochastic Indicator With Other Indicators?

It is possible to combine a stochastic indicator with other indicators, such as those that generate overbought/oversold signals or measure momentum swings. By doing so, investors can gain more insight into market behavior and make more informed decisions. Data-driven analysis of these combined indicators should help traders better anticipate shifts in the market and potentially identify profitable trading opportunities.

Do I Need to Be an Experienced Trader to Understand the Results of a Stochastic Indicator?

Navigating trading strategies and risk management can be a daunting task, even for experienced traders. Understanding the results of a stochastic indicator requires an in-depth analysis of market trends – something that may prove difficult to grasp without proper knowledge. However, with dedication and effort, anyone can gain the skills necessary to make informed decisions.

Optimize Performance: Trade According to Your Trading System – Expert Advice 2023

Embark on a journey of precision and success with the mantra, “Trade According to Your Trading System.” In the dynamic world of financial markets, having a well-defined trading system is akin to having a reliable compass in uncharted territory. This guide empowers you to align your trading decisions with the proven strategies and methodologies that underpin your system.

By emphasizing discipline and adherence to your unique trading blueprint, you unlock the potential for consistent profits. Join us as we unravel the art of trading in harmony with your system, providing you with the confidence and clarity needed to navigate the complexities of the market.

Key Takeaways

- Trading according to a trading system provides a consistent approach to managing investments.

- Following a trading system helps avoid emotionally-driven decisions and improves understanding of market trends.

- Automated trading saves time, reduces mistakes, and allows for faster execution and higher profits.

- Risk tolerance is crucial in trading, and aligning goals with risk tolerance helps in setting realistic expectations and making rational trading decisions.

Why You Should Trade According To Your Trading System

Adhering to a trading system provides traders with a consistent approach to managing their investments. It allows them to take emotions out of the equation and avoid emotionally-driven decisions, which can be disastrous when trading.

Automated trading also offers advantages in that it is easier for traders to enter orders without having to execute each trade manually. This saves time and helps reduce mistakes due to human error.

Additionally, following a predetermined system helps build confidence in one’s ability as it gives traders an understanding of how they are performing and what improvements need to be made.

Trading systems also help manage risk appetite while allocating capital appropriately. By adhering strictly to predetermined rules, it prevents overtrading or taking on too much risk while limiting losses if the market moves against them.

This ensures that the trader is always within their preset parameters for acceptable returns and risks taken. Ultimately, this helps protect capital and ensure profitable trades in the long term.

Benefits of Trading According to Your Trading System

Trading according to a system can provide numerous benefits.

- One of these benefits is consistency. Consistency is key in trading because it helps traders maintain a profitable approach by following the same strategy over time.

- Another benefit of trading according to a system is objective decision making. This is important because it allows traders to remain impartial when evaluating markets and taking positions.

- Efficiency is also a benefit of trading with a system. Automated processes can be used to reduce human error and ensure timely executions of trades, making the trading process more efficient.

- Risk management is another benefit of trading with a system. By using risk management techniques, traders can minimize losses while providing an opportunity for potential profits.

- Lastly, adaptability is a benefit of trading with a system. Traders can adjust their systems over time to changing market conditions, allowing them to stay ahead of the game.

Consistency

Following a trading system consistently allows for traders to make informed decisions based on predetermined rules. This type of consistency helps traders control their emotions, journaling techniques, and understand market trends better.

In addition, it provides the opportunity to use stop loss orders and position sizing techniques that align with one’s goals. By staying consistent with a trading system, traders are able to accurately predict price movements and act accordingly, resulting in higher profitability rates.

Furthermore, consistency helps create discipline over time as well as instill confidence when making trades. Ultimately, following a trading system consistently is beneficial for any trader who wants to maximize efficiency and success in their trades.

Objective Decision Making

Objectively making decisions based on predetermined rules can help maximize efficiency and success in trading. Quantitative analysis, emotional control, market research, and money management are all key components of a successful trading system.

Additionally, controlling one’s psychology while trading is essential to achieve desired results. By setting up clear objectives and goals that are measurable, one can objectively assess the effectiveness of their strategy and make adjustments as needed.

Furthermore, market research can provide traders with valuable insight for informed decision-making when entering trades. Through this objective approach to decision-making coupled with an understanding of the markets, a trader can ensure they remain profitable over time.

This allows for increased efficiency in the trading process by preventing mistakes due to emotional attachment or lack of knowledge about the markets. Thus, objective decision making is a crucial aspect of successful trading.

Efficiency

Efficiency in trading can be improved by objectively making decisions based on predetermined rules. Systematic investing, backtesting strategies, and trade automation are key components to achieving this goal.

By understanding the risk-reward ratio of a particular trade, as well as market psychology, traders can make better decisions with less stress and more confidence.

Additionally, automated trading systems allow trades to be executed much faster than manual ones. This efficiency leads to higher profits in shorter amounts of time. Automated systems also ensure consistent execution of the same strategy every time without any human emotions getting involved in the decision-making process.

All of these elements combined create an efficient environment for traders that helps them achieve their goals without taking unnecessary risks or wasting resources.

Risk Management

Risk management is essential in order to maximize profits and minimize losses when trading. Stop losses, position sizing, diversification, and money management are all important components of risk management that should be incorporated into any trading system.

By setting stop losses for each trade, traders can limit their downside risk on each trade. Position sizing ensures that the size of the trades will remain consistent with the portfolio’s goals and objectives.

Diversification helps to spread out risk throughout multiple assets and markets rather than having concentrated exposure in a single asset or market. Money management helps to ensure that an appropriate amount of capital is allocated for each trade so as not to over leverage oneself.

All together, these elements allow traders to effectively manage their risk while trading according to their system.

Adaptability

Adaptability is an important factor for traders to consider when developing a trading system in order to remain competitive in changing markets. With limitless possibilities, developing the right strategy can help traders achieve financial freedom and overcome psychological barriers.

Adapting one’s trading system allows for:

- Emotional control

- Time management

- Greater potential for success

By doing so, traders are able to create a powerful tool that will help them reach their goals with ease and confidence while maintaining emotional stability and creating new opportunities.

Through adaptability, traders have the chance to unlock new pathways towards financial independence and experience greater levels of satisfaction.

Developing a Trading System

Developing a trading system requires careful consideration of factors such as market conditions and strategies. It is important to select the right strategy for the given situation, and use technical analysis to determine the best timing for entering and exiting trades.

While money management and position sizing are also critical components, traders must not forget about discipline and patience when it comes to their investments. This means that they should stick with their chosen trading system even if it does not result in immediate profits.

With ongoing practice, traders can master their system, refine its parameters, and better manage risk over time. The importance of discipline and patience cannot be overlooked: without these qualities, any trader is likely to falter in achieving long-term success.

The Importance of Discipline and Patience

Adhering to a disciplined and patient approach is essential for any trader hoping to achieve long-term success. A successful trading system must factor in psychology as well as practical trading techniques. Traders need to be mindful of their risk tolerance, understand the psychology of trading, and maintain control over their emotions while trading.

Here are three important steps traders should take when engaging in mindful trading:

- Understand your risk tolerance: Every trader has different levels of risk they are comfortable taking. It is important to set reasonable goals and expectations that align with your personal risk tolerance before making trades.

- Get familiar with the psychology of trading: Emotions can have a huge impact on how you make decisions when trading, so it is important to build up mental resilience and stay grounded during volatile market conditions.

- Maintain emotional control: Self-control and discipline are key components of successful trading systems; allowing emotions to take over can cause costly mistakes that will derail any progress made towards achieving long-term success.

Conclusion

In conclusion, “Trade According to Your Trading System” is the cornerstone of a prosperous trading journey. It ensures that every move is rooted in a systematic approach, bolstering your confidence and minimizing impulsive decisions. By staying true to your established strategies, you not only navigate the market with precision but also foster a sense of discipline crucial for long-term success.

As you apply this principle to your trading endeavors, let it serve as a guiding light, reminding you of the power of a well-defined system. With each trade, you reinforce your commitment to a method that aligns with your goals and aspirations in the financial realm.

References

- Forex Trading using MetaTrader 4 with the Fractal Market Hypothesis

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

Frequently Asked Questions

How Long Does It Take to Develop a Trading System?

Developing a trading system can be likened to a complex jigsaw puzzle; it requires emotional detachment, market analysis, backtesting strategies and risk management. Algorithmic trading adds further complexity. It takes vast knowledge and experience to piece together a successful system that fits the needs of traders who wish to belong in the market.

What Is the Best Way to Stay Disciplined and Patient When Trading?

Staying disciplined and patient while trading requires emotional control, risk management, technical analysis, market research and system optimization. Successful traders must remain focused on their goals, analyze the markets objectively, and adjust to changes in the markets with confidence.

What Are the Risks Associated With Trading According to a System?

Taking calculated risks is essential for successful trading, but mismanaging risk can lead to devastating losses. Understanding risk management, developing robust trading strategies, back testing and analysing market conditions are key elements of successful trading. Additionally, understanding psychological aspects of trading is equally important in mitigating risk.

Are There Any Costs Associated With Creating and Using a Trading System?

Creating and using a trading system can involve backtesting costs, algorithmic trading, risk management, psychology aspects, and trading automation. These factors require an experienced approach that weighs the associated risks and benefits of systemized trading.

How Do I Know if My Trading System Is Profitable?

Tracking performance, data analysis, risk management, market trends and money management are all important components in determining if a trading system is profitable. Examining past data and assessing potential risks can help assess future profitability of the system.

Top 7 Lessons You Must Take From The Book “Trading In The Zone” – Expert Insights 2023

Dive into the transformative insights of the book “Trading in the Zone” with our guide. This seminal work by Mark Douglas illuminates the often-overlooked psychological dimensions of trading. Through vivid anecdotes and practical wisdom, the book imparts invaluable lessons on mastering the mental game of trading.

Explore with us as we distill the essence of Douglas’s teachings, shedding light on strategies to achieve a disciplined, focused, and ultimately successful trading mindset. These lessons serve as a compass, guiding traders through the unpredictable terrain of financial markets with confidence and clarity.

Key Takeaways

- Importance of self-discipline in adhering to trading plans

- Role of emotional intelligence in managing emotions effectively

- Continuous improvement through self-reflection and practice

- Acknowledging fear without letting it dictate actions

Top 7 Lessons You Must Take From The Book “Trading In The Zone”

The book ‘Trading In The Zone’ offers invaluable insights into this complex world, providing readers with three essential lessons that can reshape their approach to trading.

- Quantitative Approach: “Trading in the Zone” emphasizes the importance of viewing investing and trading as a numbers game. This underscores the need for a systematic, data-driven approach rather than relying on gut feelings or intuition.

- Absence of Prediction: The book highlights that successful trading doesn’t require predicting the future. Instead, it encourages traders to accept uncertainty and focus on concrete strategies like setting effective stop-loss and take-profit levels.

- Risk Management through Uncertainty: By accepting uncertainty, traders can implement robust risk management strategies, particularly through well-placed stop-loss and take-profit levels. This ensures that losses are controlled, and profits are secured.

- Probabilistic Thinking: “Trading in the Zone” advocates for a probabilistic mindset. It stresses that not every trade needs to be a win, but a series of well-managed trades, each with a positive expectancy, can lead to consistent profitability.

- Market Independence: The book emphasizes that past trades have no bearing on future market movements. Each trade is an independent event, and the outcome of one trade doesn’t influence the probability of success in the next.

- Psychological Mastery: Overcoming the fear of being wrong is crucial. The book underscores the significance of separating one’s ego from trading decisions. This allows for rational, unemotional decision-making, even in the face of potential losses.

- Open-mindedness towards Market Behavior: “Trading in the Zone” encourages traders to maintain an open-minded perspective, believing that markets are capable of unexpected moves. This mentality prevents traders from becoming overly attached to specific outcomes and enables them to adapt to changing conditions.

Lesson 1: Quantitative Approach

“It’s a number game in investing and trading systems.”

In the realm of trading, emotions can often run high, clouding judgment and leading to impulsive decisions. “Trading in the Zone” underscores the significance of adopting a quantitative approach. This means relying on concrete data, statistical analysis, and proven trading systems rather than intuition or emotional reactions.

A quantitative approach requires traders to develop a systematic, well-researched trading strategy grounded in quantifiable metrics. This could involve technical indicators, historical price patterns, and other objective criteria. By basing decisions on tangible evidence, traders can mitigate the impact of emotional biases and make more objective, rational choices.

Furthermore, a quantitative approach facilitates the establishment of clear entry and exit points, allowing traders to effectively manage risk. It enables the use of backtesting to evaluate the historical performance of a trading strategy and refine it for future application. Ultimately, this lesson emphasizes that successful trading is rooted in a disciplined, data-driven methodology.

Lesson 2: Absence of Prediction

“No need for a crystal ball.”

Contrary to popular belief, successful trading doesn’t hinge on the ability to predict future market movements. “Trading in the Zone” emphasizes that attempting to forecast market direction with certainty is not only futile but also detrimental to a trader’s success.

Instead, it encourages traders to focus on strategies that thrive on current market conditions. This could involve techniques like trend following or mean reversion, which exploit existing patterns and tendencies. Additionally, traders are advised to implement techniques to manage risk effectively, such as setting stop-loss and take-profit levels.

By relinquishing the need for clairvoyance, traders can approach the markets with a more pragmatic and level-headed mindset. This allows for greater adaptability to the dynamic nature of financial markets and reduces the emotional stress associated with trying to predict the unpredictable.

Lesson 3: Risk Management through Uncertainty

“Accept uncertainty for good ‘stop-losses’ and ‘take profits’.”

One of the cornerstones of successful trading is acknowledging the inherent uncertainty in financial markets. This lesson from “Trading in the Zone” highlights the importance of setting clear stop-loss and take-profit levels.

Accepting uncertainty means understanding that not every trade will be a winner. It requires traders to establish predefined levels at which they will exit a position, whether to limit losses or secure profits. This practice forms the basis of sound risk management.

By setting these parameters based on solid risk management principles, traders protect their capital from significant losses and ensure that profits are realized when opportunities arise. This acceptance of uncertainty forms the bedrock of a resilient and sustainable trading strategy.

Lesson 4: Probabilistic Thinking

“Probabilities: no need to win every trade.”

“Trading in the Zone” introduces traders to the crucial concept of probabilistic thinking. Instead of fixating on winning every individual trade, this approach emphasizes the importance of creating a series of trades with positive expected values.

This shift in perspective is monumental. It acknowledges that losses are an integral part of trading and that what truly matters is the net outcome over a series of trades. By focusing on the long-term, traders can maintain discipline and avoid succumbing to the emotional rollercoaster that can come with individual wins or losses.

Probabilistic thinking also encourages traders to stick to their well-researched strategies, even in the face of short-term losses. It provides a rational framework that helps traders avoid impulsive decisions based on emotions like fear or greed. This approach ultimately leads to a more sustainable and profitable trading journey.

Lesson 5: Market Independence

“Past trades have no affect on market risk.”

“Trading in the Zone” shatters the misconception that previous trades have any bearing on future market behavior. Each trade exists as an independent event, unaffected by prior successes or failures.

Understanding this principle is crucial in cultivating a rational and disciplined trading mindset. It means that a winning streak does not guarantee future success, just as a losing streak does not condemn future trades to failure. This recognition of market independence liberates traders from the psychological baggage of past performance.

Traders who internalize this lesson are better equipped to approach each trade objectively, without being swayed by the ghosts of previous outcomes. They avoid overconfidence that can arise from a string of wins and prevent undue hesitancy due to past losses. This clear-headed approach is vital for making rational, well-informed decisions in the fast-paced world of trading.

Lesson 6: Psychological Mastery

“Overcome fear of being wrong.”

The fear of being wrong is a potent force that can paralyze even the most seasoned trader. “Trading in the Zone” delves deep into the psychological aspect of trading, emphasizing the critical need to separate one’s ego from trading decisions. It underscores that a trader’s self-worth is distinct from the outcomes of individual trades. By making this crucial distinction, traders can approach the markets with a calm and rational mindset.

This shift in mindset is transformative. It liberates traders from the paralyzing fear of making mistakes, which often leads to impulsive and ill-advised decisions. Instead, traders are encouraged to make decisions based on a thorough analysis of the market, devoid of the emotional baggage that comes with the fear of being wrong. This psychological mastery is a cornerstone of successful trading.

Lesson 7: Open-mindedness towards Market Behavior

“Really believe markets can do anything.”

“Trading in the Zone” advocates for a fundamental shift in how traders perceive market behavior. It urges traders to maintain a broad and open-minded perspective, acknowledging that markets have an uncanny ability to defy expectations. This means being receptive to the possibility of unexpected and unconventional movements.

This lesson is invaluable. It prompts traders to avoid falling into the trap of rigid, preconceived notions about how markets should behave. Instead, they are encouraged to adapt swiftly and effectively to changing conditions. By embracing the reality that markets can exhibit a wide range of behaviors, traders position themselves to make more informed and adaptable decisions. This open-mindedness is a powerful tool in navigating the ever-evolving landscape of the financial markets.

Each of these lessons from “Trading in the Zone” provides invaluable insights into the mindset and strategies required for successful trading. By internalizing these principles, traders can cultivate a disciplined, rational approach that is less susceptible to emotional biases and more likely to lead to consistent profitability.

Conclusion

In conclusion, the lessons gleaned from “Trading in the Zone” are invaluable pillars for any aspiring or seasoned trader. Mark Douglas’s profound insights into the psychological intricacies of trading resonate through every page, offering a roadmap to navigate the complexities of the financial landscape.

By embracing discipline, cultivating self-awareness, and developing a robust trading mindset, one can transcend the realm of uncertainty and become a more confident and profitable trader. These enduring lessons serve as a beacon, not only in trading but in various facets of life where a disciplined mind and focused approach are paramount. Embrace these principles, and let them be the cornerstone of your trading success.

References

- Forex Trading using MetaTrader 4 with the Fractal Market Hypothesis

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

Frequently Asked Questions

What Are the Key Psychological Barriers That Traders Often Face When Trying to Master Their Mindset?

Traders often face psychological barriers when trying to master their mindset. Overcoming these barriers requires mental discipline and a keen understanding of one’s emotions, biases, and cognitive processes. Developing self-awareness and implementing effective strategies can help traders navigate these challenges successfully.

How Can Traders Effectively Manage and Control Their Emotions While Trading?

Effective management and control of emotions while trading requires emotional discipline and a deep understanding of trading psychology. Traders must develop strategies to regulate emotions, such as mindfulness techniques, risk management practices, and maintaining a disciplined mindset.

What Are Some Common Misconceptions About Risk and Uncertainty in Trading?

Common misconceptions about risk and uncertainty in trading include equating them, underestimating the impact of emotions on decision-making, and neglecting the importance of a well-defined risk management strategy. Understanding these distinctions is crucial for successful trading.

How Do Successful Traders Approach Risk Management in Their Trading Strategies?

Successful traders approach risk management in their trading strategies by employing various techniques such as diversification, setting stop-loss orders, and conducting thorough research. These strategies help mitigate potential losses and increase the likelihood of profitable trades.

What Are the Essential Components of a Winning Trading Plan That Traders Should Focus on Developing?

When developing a winning trading plan, traders should focus on essential components such as defining clear goals, identifying risk management strategies, and establishing a disciplined approach to decision-making.

Reality Check: Unrealistic Expectations Harm Trading Account – Vital Insights 2023

In the dynamic world of trading, the allure of quick riches often lures traders into a perilous trap—unrealistic expectations. “Unrealistic Expectations Harm Trading Accounts” is more than a cautionary tale; it’s a pivotal lesson for every trader.

As we delve into the intricacies of the market, we uncover how overambitious outlooks can lead to significant losses. Join us in this insightful exploration as we dissect the consequences of setting the bar too high and provide practical strategies to safeguard your trading account from the detrimental effects of unrealistic expectations.

Key Takeaways

- Unrealistic expectations can be detrimental to the profitability and success of a trading account.

- Emotional decision-making and impulsive behavior are common consequences of unrealistic expectations in trading.

- Unrealistic expectations can lead to excessive risk-taking and failure to adhere to sound trading strategies.

- It is important to set realistic goals, evaluate performance objectively, and rely on objective data and analysis rather than emotions in trading.

The Impact of Unrealistic Expectations on Trading Performance

The impact of unrealistic expectations on trading performance can be detrimental to the overall profitability and success of a trading account. The psychology of trading plays a crucial role in managing emotions and making rational decisions. When traders set unrealistic expectations, they often fall into the trap of chasing high returns or quick profits without considering the inherent risks involved in trading. This mindset can lead to impulsive decision-making, excessive risk-taking, and failure to adhere to sound trading strategies.

Managing emotions in trading is essential for maintaining discipline and avoiding irrational behavior that can negatively affect performance. Unrealistic expectations can create a sense of urgency and pressure, causing traders to deviate from their plans and make hasty decisions. Additionally, when these expectations are not met, traders may experience feelings of frustration, disappointment, or even self-doubt.

Furthermore, unrealistic expectations can impair traders’ ability to objectively analyze market conditions and make informed decisions based on reliable data and analysis. Instead of focusing on long-term goals and realistic outcomes, they become fixated on short-term gains or losses.

To mitigate the impact of unrealistic expectations on trading performance, it is important for traders to cultivate a realistic mindset. This involves setting achievable goals based on thorough research and analysis while recognizing that losses are an inherent part of trading. By managing emotions effectively and maintaining a disciplined approach grounded in reality rather than wishful thinking, traders can improve their chances of long-term profitability and success in the markets.

Common Unrealistic Expectations in Trading

Commonly held misconceptions regarding the profitability of trading often lead to unfavorable outcomes for individuals’ financial investments. These misconceptions arise from unrealistic expectations that traders may have, which can hinder their ability to make informed decisions and effectively manage risk. Emotional control and risk management are key factors in successful trading, but many traders underestimate their importance or fail to develop these skills adequately.

- One common misconception is the belief that trading is a quick and easy way to make money. This expectation leads individuals to take unnecessary risks and engage in impulsive decision-making, often resulting in significant losses. Another misconception is the idea that all successful traders possess some innate talent or special insight into the market. This belief overlooks the importance of education, practice, and continuous learning in developing profitable trading strategies.

- Furthermore, some traders hold unrealistic expectations about the consistency of profits they can achieve. They may believe every trade should be profitable or expect high returns on every investment. However, trading involves inherent risks, and losses are an inevitable part of the process. By not acknowledging this reality and failing to implement proper risk management strategies, traders put themselves at a significant disadvantage.

- To overcome these misconceptions, it is crucial for traders to cultivate emotional control and develop effective risk management techniques. Emotionally driven decisions often lead to impulsive actions based on fear or greed rather than rational analysis. By mastering emotional control techniques such as mindfulness exercises or maintaining a disciplined approach to trading, individuals can mitigate potential biases caused by emotions.

- Additionally, implementing sound risk management practices helps ensure long-term success in trading endeavors. This includes setting realistic profit targets and stop-loss levels based on thorough analysis of market conditions and individual risk tolerance levels. Traders should also diversify their portfolios across different asset classes and avoid putting all their eggs in one basket.

How Unrealistic Expectations Lead to Emotional Decision Making?

This discussion will examine the emotional trading pitfalls that can arise from having unrealistic expectations in the financial markets.

Unrealistic expectations often lead to emotional decision-making, which can have detrimental effects on a trader’s performance and overall profitability.

Emotional Trading Pitfalls

Emotional trading pitfalls can lead to detrimental outcomes for traders’ accounts. Traders who let their emotions drive their decision-making process often find themselves making impulsive and irrational trades, which can result in significant financial losses. It is crucial for traders to effectively manage their emotions and expectations in order to make informed and rational trading decisions.

Some common emotional trading pitfalls include:

- Overconfidence: When traders become overly confident in their abilities, they may take on more risk than they should or hold onto losing positions longer than necessary.

- Fear of missing out (FOMO): This occurs when traders feel the need to enter a trade simply because others are doing so, regardless of whether it aligns with their strategy or analysis.

- Revenge trading: After experiencing a loss, some traders may seek revenge by taking excessive risks in an attempt to recover their losses quickly.

Impact of Unrealistic Expectations

One potential consequence of having unrealistic expectations in the context of trading is the increased likelihood of making impulsive and irrational decisions that can negatively impact financial outcomes. Trading psychology plays a crucial role in determining an individual’s ability to make rational decisions while managing their trading account.

Unrealistic expectations often stem from a lack of understanding or experience in the market, leading traders to overestimate their abilities and underestimate market volatility. This can result in excessive risk-taking, chasing unrealistic profit targets, or holding losing positions for longer than necessary.

Performance evaluation becomes challenging when traders have unrealistic expectations, as they may perceive losses as failures rather than learning opportunities. It is important for traders to set realistic goals based on thorough analysis and to continually evaluate their performance objectively, considering both gains and losses as part of the trading journey.

Rational Decision-Making Strategies

Rational decision-making strategies are crucial for traders to effectively navigate the complexities of financial markets and optimize their trading outcomes. These strategies help traders overcome cognitive biases that can hinder their decision-making process.

Here are three important rational decision-making strategies:

- Analyzing data: Traders should rely on objective data and analysis rather than emotional or impulsive reactions. This involves gathering and evaluating market information, financial reports, trends, and technical indicators to make informed decisions.

- Setting realistic goals: Traders need to set achievable goals based on their knowledge, experience, and risk tolerance. Unrealistic expectations can lead to impulsive actions and poor trading decisions.

- Implementing risk management techniques: It is essential for traders to establish risk management techniques such as setting stop-loss orders or using position sizing methods. These techniques mitigate potential losses and protect the trading account.

The Dangers of Overleveraging Due to Unrealistic Expectations

Unrealistic expectations regarding potential profits can lead to the dangers of overleveraging, which in turn poses risks to trading accounts. Overleveraging occurs when traders borrow more money than they can afford to repay in order to increase their potential profits. This strategy can be tempting, especially when fueled by unrealistic expectations of quick and substantial gains. However, it is important for traders to recognize the importance of risk management and exercise patience in their trading activities.

One key aspect of risk management is setting realistic profit targets and adhering to them. Rather than chasing after unattainable profits, traders should focus on consistent, achievable goals that align with their trading strategies. Additionally, employing proper position sizing techniques can help mitigate the risks associated with overleveraging. By carefully determining the appropriate amount of capital to allocate per trade based on factors such as account size and risk tolerance, traders can avoid exposing themselves to excessive losses.

Patience also plays a crucial role in successful trading. It allows traders to wait for favorable market conditions before entering or exiting positions, rather than succumbing to impulsive decisions driven by unrealistic expectations or emotions. Patient traders understand that markets operate cyclically and that not every opportunity will yield immediate results.

In conclusion, unrealistic expectations regarding potential profits can lead individuals to overleverage their trading accounts, which poses significant risks. However, by adopting effective risk management practices and exercising patience in their trades, individuals can enhance their chances of long-term success while minimizing unnecessary exposure to financial harm.

| Importance of Risk Management | Role of Patience in Trading |

|---|---|

| – Sets realistic profit targets | – Allows waiting for favorable market conditions |

| – Manages risks associated with overleveraging | – Avoids impulsive decisions driven by emotions |

| – Determines proper position sizing | – Recognizes cyclic nature of markets |

Strategies to Manage and Realign Expectations in Trading

This discussion will explore strategies to manage and realign expectations in trading, focusing on three key points:

- Setting achievable goals: Setting achievable goals is crucial as it allows traders to have a clear direction and helps them avoid unrealistic expectations that can lead to overleveraging and potential losses.

- Embracing market unpredictability: Embracing market unpredictability acknowledges the inherent nature of financial markets and encourages traders to adapt their strategies accordingly, rather than trying to predict or control every outcome.

- Focusing on long-term success: Focusing on long-term success emphasizes the importance of patience, discipline, and consistency in trading practices for sustainable profitability.

Setting Achievable Goals

Setting achievable goals is crucial for minimizing the harm to a trading account caused by unrealistic expectations. Achieving consistency in trading requires the establishment of realistic and attainable goals that align with one’s trading strategy.

Adapting to market conditions is another important aspect of setting achievable goals. Traders need to recognize that markets are dynamic, and their strategies may need to be adjusted accordingly. This means being flexible and open to making changes as necessary in response to changing market conditions.

Additionally, setting achievable goals involves understanding one’s risk tolerance and capital limitations. It is essential for traders to set goals that are within their means and align with their risk appetite. By doing so, they can reduce the likelihood of taking on excessive risks that could potentially harm their trading account.

Transitioning into embracing market unpredictability, it is important for traders to acknowledge the inherent uncertainty present in financial markets.

Embracing Market Unpredictability

In order to navigate the complexities of trading, it is essential for traders to embrace the inherent uncertainty and unpredictability of the market. The ability to adapt to changing market conditions is crucial for success in this dynamic environment.

Embracing uncertainty requires a mindset that acknowledges the constant fluctuations and risks associated with trading, rather than seeking absolute certainty. It involves recognizing that markets are influenced by various factors such as economic indicators, geopolitical events, and investor sentiment, which can lead to unexpected outcomes.

By accepting this reality and being open to adjusting strategies accordingly, traders can position themselves better for potential opportunities and mitigate potential losses. This approach also fosters a proactive mindset that encourages continuous learning and staying up-to-date with relevant market information.

Ultimately, embracing uncertainty enables traders to become more resilient and adaptable in their decision-making process.

Focusing on Long-Term Success

To achieve long-term success, traders must prioritize the development of robust strategies that can withstand market fluctuations and uncertainties. Setting realistic targets and managing risk effectively are key components in achieving this goal. Traders should consider the following:

- Understanding Market Dynamics: A deep understanding of market dynamics is crucial for setting realistic targets. Traders need to analyze historical data, identify patterns, and assess market trends to make informed decisions.

- Implementing Risk Management Techniques: Effective risk management is essential for protecting trading accounts from excessive losses. Traders should employ techniques such as stop-loss orders, diversification, and position sizing to mitigate risks.

- Continual Evaluation and Adaptation: Markets are dynamic, so traders must continually evaluate their strategies’ performance and adapt them accordingly. Regular analysis allows traders to identify what works and what doesn’t, enabling them to refine their approach over time.

The Role of Education and Skill Development in Setting Realistic Goals

Education and skill development play a vital role in ensuring traders are able to establish realistic goals for their trading accounts. The impact of education on traders’ ability to set realistic goals cannot be overstated. Through education, traders gain knowledge about the financial markets, trading strategies, risk management techniques, and other relevant factors that influence trading outcomes. This knowledge equips them with the necessary skills to analyze market trends, make informed decisions, and effectively manage their trading accounts.

Skill development is equally essential in setting realistic goals for traders. By continuously honing their skills through practice and experience, traders become more proficient in executing trades and managing risks. They develop an understanding of their own strengths and weaknesses as well as the limitations of their chosen trading strategies. This self-awareness allows them to set achievable goals that align with their capabilities.

Setting realistic goals based on education and skill development helps traders avoid unrealistic expectations that can harm their trading accounts. Unrealistic expectations often lead to impulsive decision-making, excessive risk-taking, and emotional reactions to market fluctuations. These behaviors can result in significant losses and undermine long-term success.

Building a Healthy Mindset for Long-Term Trading Success

The cultivation of a healthy mindset is crucial for traders aiming to achieve long-term success in their trading endeavors. A healthy mindset provides the foundation for rational decision making and effective market analysis.

Here are three key components of building a healthy mindset for trading success:

- Emotional resilience: Traders need to develop the ability to manage their emotions and remain calm in high-pressure situations. This allows them to make rational decisions based on objective analysis, rather than being swayed by fear or greed.

- Discipline and patience: Successful traders understand that trading is not about quick profits, but rather about consistent, disciplined execution of proven strategies. They have the patience to wait for optimal entry and exit points, avoiding impulsive decisions driven by short-term market fluctuations.

- Positive self-talk: Maintaining a positive inner dialogue is essential for building confidence and resilience in the face of setbacks. Traders who engage in negative self-talk may become discouraged easily and make irrational decisions based on self-doubt.

Conclusion

In conclusion, “Unrealistic Expectations Harm Trading Accounts” serves as a vital reminder in the world of trading. By tempering expectations and embracing a more realistic approach, traders can protect their accounts from undue risks and preserve their capital.

Let this guide be your trusted companion, steering you away from the pitfalls of overzealous aspirations. Ultimately, a balanced perspective, prudent risk management, and a commitment to continuous learning are the keys to long-term trading success. Embrace the wisdom of realistic expectations, and watch your trading journey flourish with resilience and profitability.

References

- Forex Trading using MetaTrader 4 with the Fractal Market Hypothesis

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

Frequently Asked Questions

What Are Some Common Unrealistic Expectations That Traders Have?

Common unrealistic expectations in trading include consistently high profits, quick success, and minimal losses. These expectations can negatively impact performance by leading to impulsive decisions, overtrading, and failure to manage risk effectively.

How Do Unrealistic Expectations Impact Trading Performance?

Psychological impact of unrealistic expectations on trading performance can lead to impaired decision making. Traders with unrealistic expectations may be more prone to taking excessive risks or holding onto losing positions, ultimately harming their trading account.

How Do Unrealistic Expectations Lead to Emotional Decision Making?

The interplay between fear and greed in emotional decision making is influenced by unrealistic expectations. A realistic risk reward ratio is crucial in trading to prevent the harmful impact on one’s trading account.

What Are the Dangers of Overleveraging in Trading?

The dangers of overleveraging in trading are significant. It can lead to substantial financial losses, increased risk exposure, and the potential for margin calls. Therefore, emphasizing the importance of risk management is crucial to maintaining a healthy trading account.

What Strategies Can Be Used to Manage and Realign Expectations in Trading?

Strategies for managing and realigning expectations in trading involve a mindset shift towards realistic goals. By adopting a detail-oriented and analytical approach, traders can mitigate the harm caused by unrealistic expectations to their trading account.

Unlock Forex Opportunities: How to Start Forex Trading With $1 – 2023

Embark on your forex trading journey with a budget-friendly approach – “Start Forex Trading With $1.” Contrary to popular belief, you don’t need a substantial capital to dive into the world of foreign exchange. This guide unveils the strategies and platforms that allow you to kickstart your trading adventure with as little as $1.

We’ll explore the tools, techniques, and risk management practices essential for success in this dynamic market. Join us as we break down the barriers to entry and empower you to take your first steps towards potentially lucrative forex trading, even with a modest initial investment.

Key Takeaways

- Starting with a small investment of $1 allows traders to minimize risk and test out different strategies without risking too much.

- By starting small, traders have the opportunity to explore and experiment, developing new skills and optimizing their strategies.

- Starting with a small investment allows traders to focus on refining their approach before committing larger amounts of capital.

- Starting small in forex trading provides the ability to test out different strategies and gain experience before investing larger amounts of money.

What Is Forex Trading