Delve into the dynamic world of trading with a clear understanding of “What Is Leverage in Trading.” This fundamental concept revolutionizes how traders approach the market, amplifying both potential gains and risks. Leverage is akin to a double-edged sword, offering the ability to control larger positions with a fraction of the capital.

In this comprehensive guide, we unravel the intricacies of leverage, empowering you with the knowledge to wield it wisely. Join us on this enlightening journey as we explore how leverage influences trading strategies and discover the pivotal role it plays in maximizing potential returns.

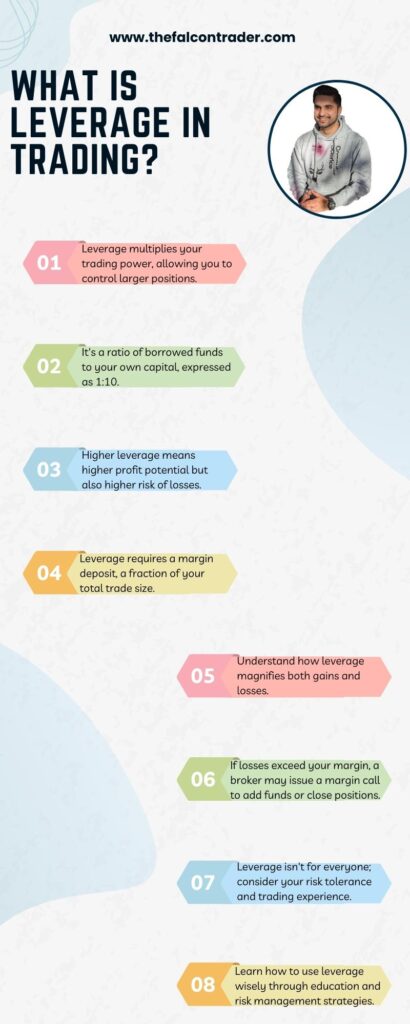

Key Takeaways

- Leverage in trading involves using borrowed funds to amplify potential returns or losses.

- It allows traders to control larger positions with a smaller amount of capital.

- Using leverage can lead to higher returns and diversification of portfolios.

- However, it also amplifies both gains and losses, so careful risk management is necessary.

What Is Leverage in Trading?

Leverage in trading refers to the ability to control a large position in the market with a relatively small amount of capital. It allows traders to amplify their exposure and potentially magnify profits, but it also increases the risk of significant losses.

For instance, with a leverage of 10:1, a trader can control a $10,000 position with just $1,000 of their own capital. While leverage can enhance gains, it’s crucial to exercise caution and have a robust risk management strategy in place, as it can also lead to substantial losses if the market moves against the trader.

The Basics of Leverage in Trading

The basics of leverage in trading involve the use of borrowed funds to amplify potential returns or losses from an investment. Leverage allows traders to control a larger position with a smaller amount of capital, which can lead to increased profits if the trade goes in their favor. However, it is important to understand the pros and cons of using leverage in trading.

One advantage of using leverage is the potential for higher returns. By utilizing borrowed funds, traders can increase their exposure to market movements and potentially generate larger profits. Additionally, leverage enables traders to diversify their portfolios and participate in multiple markets simultaneously.

On the other hand, there are several risks associated with using leverage. One major concern is that leveraging amplifies both gains and losses. While it can result in substantial profits during favorable market conditions, it can also lead to significant losses if the trade moves against expectations.

Understanding margin requirements is crucial when engaging in leveraged trading. Margin refers to the collateral that traders must maintain in their accounts to cover potential losses. Different brokers have varying margin requirements, which dictate how much capital needs to be deposited as collateral for a leveraged trade.

Understanding Leverage Ratios

Understanding leverage ratios involves analyzing the relationship between borrowed funds and equity in financial transactions. Leverage advantages include the potential for higher returns on investment, as a small amount of capital can control a larger position.

This allows traders to amplify their gains if the market moves in their favor. Additionally, leverage can provide access to markets that would otherwise be inaccessible due to high capital requirements.

However, leverage also carries certain disadvantages. It magnifies losses as well, meaning that even a small adverse movement in the market can result in significant losses for leveraged positions.

Risks and Rewards of Trading With Leverage

One important consideration when utilizing leverage is the potential for both risks and rewards. Trading with leverage offers several benefits, such as the ability to magnify profits and access to larger positions in the market. By using borrowed funds, traders can amplify their gains and potentially achieve higher returns on their investments. Leverage also allows traders with limited capital to participate in markets that would otherwise be inaccessible to them.

However, it is crucial to acknowledge the potential dangers of trading with leverage. The main risk associated with leveraging is the increased exposure to losses. Since leveraged positions require a smaller initial investment, even a small adverse price movement can result in significant losses. Traders must carefully manage their risk by setting stop-loss orders and closely monitoring their positions.

Another danger of trading with leverage is overtrading or taking on excessive risks due to greed or lack of experience. Leveraged trading requires discipline and a thorough understanding of market dynamics. Without proper risk management strategies in place, traders may find themselves exposed to substantial financial losses.

Common Misconceptions About Leverage

A common misconception about utilizing leverage is that it guarantees higher profits in trading. However, this is a misunderstanding of the impact of leverage on trading performance. While leverage can amplify potential gains, it also magnifies potential losses. The use of leverage involves borrowing funds to invest in an asset, with the aim of increasing returns through the use of borrowed capital. It allows traders to control larger positions with a smaller amount of capital.

The impact of leverage on trading performance depends on various factors such as market volatility, risk appetite, and trading strategies. High levels of leverage can lead to significant financial risks if not managed properly. Traders need to carefully assess their risk tolerance and set appropriate stop-loss orders to mitigate potential losses.

Moreover, it is crucial for traders to have a thorough understanding of how leverage works before using it in their trades. They should consider factors such as margin requirements, interest rates on borrowed funds, and potential margin calls.

Different Types of Leverage in Trading

Different types of leverage in financial markets include operational, financial, and market leverage.

Leverage refers to the use of borrowed funds or debt to increase the potential return on investment. In margin trading, investors can borrow money from a broker to purchase securities. This allows them to control a larger position than they could with their own capital.

Operational leverage involves using fixed costs, such as rent and salaries, to amplify profits when sales increase. It allows companies to generate higher returns on equity through economies of scale.

Financial leverage is the use of borrowed funds to finance investments or acquisitions. It magnifies both gains and losses but can enhance returns if the cost of borrowing is lower than the return on investment.

The benefits of leverage in trading are important for investors seeking increased profitability and potential returns. By utilizing borrowed funds, traders can take larger positions in the market and potentially earn higher profits compared to what they would have achieved with only their own capital. Additionally, leverage enables investors with limited capital to participate in markets that would otherwise be out of reach for them.

However, it is crucial for traders to exercise caution when using leverage as it also amplifies losses. Excessive leveraging can lead to significant financial risks and potential bankruptcy if trades do not go as planned. Therefore, proper risk management strategies should be implemented when utilizing leverage in trading activities.

How to Calculate Leverage in Trading

In the previous subtopic, we explored the different types of leverage in trading. Now, let us delve into how to calculate leverage in trading and understand its importance.

Leverage is a crucial concept for traders as it allows them to amplify their potential profits or losses by using borrowed funds. To calculate leverage, one needs to determine the ratio between the trader’s own capital and the total position size.

The most commonly used formula for calculating leverage is:

Leverage = Total Position Size / Trader’s Capital

For instance, if a trader has a capital of $10,000 and opens a position worth $50,000, the leverage can be calculated as follows:

Leverage = $50,000 / $10,000 = 5:1

This means that the trader has a leverage ratio of 5:1 or 5 times their capital invested.

Understanding how to calculate leverage is essential because it helps traders assess their risk exposure. Higher levels of leverage magnify both profits and losses. While it offers the potential for significant gains, excessive leveraging can also lead to substantial losses if trades go against expectations.

Therefore, traders must carefully consider their risk tolerance and use appropriate leveraging strategies when engaging in trading activities. By calculating leverage accurately and managing it effectively, traders can optimize their chances for success while minimizing potential risks.

Tips for Using Leverage Responsibly in Trading

Risk management strategies are essential for traders to mitigate potential losses and protect their capital.

Calculating leverage ratios helps traders understand the amount of borrowed funds they are using relative to their own capital, allowing them to assess the level of risk involved.

Setting leverage limits is crucial in maintaining control over one’s trading activities and preventing excessive exposure to potential financial risks.

Risk Management Strategies

One effective approach to risk management in trading is the implementation of appropriate strategies. Portfolio diversification is a commonly used strategy that involves spreading investments across various assets, sectors, or regions to reduce exposure to any single investment. By diversifying their portfolios, traders can mitigate the potential losses from individual investments and achieve a more balanced risk-return profile.

Another important risk management strategy is the use of stop loss orders. These orders are set at predetermined price levels, and when triggered, they automatically execute trades to limit potential losses. Stop loss orders help traders control risks by ensuring that they exit positions before losses become excessive.

Both portfolio diversification and stop loss orders are essential components of a comprehensive risk management plan in trading. By incorporating these strategies into their trading activities, traders can minimize the impact of adverse market movements and protect their capital from significant losses.

Calculating Leverage Ratios

To calculate leverage ratios, financial analysts use a formula that compares an organization’s total debt to its equity. This calculation provides insights into the financial risk associated with an organization’s capital structure.

Leverage ratios are commonly used in financial analysis to assess the extent to which a company relies on borrowed funds for its operations. A higher leverage ratio indicates a greater proportion of debt relative to equity, which can increase both potential returns and risks.

Setting Leverage Limits

In leveraged trading strategies, the impact of leverage on trading profits is a crucial aspect to consider. Setting appropriate leverage limits is imperative to protect traders from excessive risk and potential losses. By limiting the amount of leverage used, traders can mitigate the potential negative effects that high leverage can have on their trading profits.

To illustrate this concept further, let’s consider a hypothetical scenario in which a trader uses different levels of leverage while executing trades. The table below showcases the impact of varying leverage ratios on trading profits:

| Leverage Ratio | Trading Profits |

|---|---|

| 1:1 | $100 |

| 5:1 | $500 |

| 10:1 | $1000 |

| 20:1 | $2000 |

As seen in the table, higher leverage ratios amplify both gains and losses. While using higher leverage may result in larger profits when successful trades are executed, it also exposes traders to greater risks if market conditions turn unfavorable. Therefore, setting appropriate leverage limits is essential for achieving sustainable and consistent trading profitability.

Conclusion

In conclusion, understanding “What Is Leverage in Trading” is pivotal for any trader looking to optimize their investment strategies. It grants the power to magnify gains, but also requires prudent risk management. By comprehending how leverage functions and incorporating it judiciously into your trading approach, you can unlock new dimensions of potential in the financial markets.

Let this guide serve as your compass, providing you with the knowledge and insights needed to navigate the complexities of trading with leverage. With knowledge comes power, and with power comes the potential for more informed, strategic, and ultimately successful trading endeavors.

References

- Opening an Account: How to Select a Forex Broker, and Set Up and Fund a Trading Account

- Forex Analysis: An Introduction and Comparison of Fundamental and Technical Analysis

- What Makes Currencies Move? An Exploration of the Key Forces That Cause Currencies to Fluctuate

- Pitfalls and Risks: Understanding the Risks of Forex and the Mistakes that New Traders Make

Frequently Asked Questions

What Are Some Common Mistakes Traders Make When Using Leverage?

Common misconceptions about leverage in trading can lead to mistakes such as inadequate risk management. Traders may underestimate the potential losses magnified by leverage, resulting in significant financial setbacks and potentially even account liquidation.

Is Leverage Available for All Financial Instruments?

Leverage is not available for all financial instruments. It has both pros and cons, such as the potential for increased profits but also higher risks. Understanding these risks is crucial in leveraged trading.

Can Leverage Be Adjusted During a Trade?

Adjusting leverage in real time can have a significant impact on risk management in trading. It allows traders to modify their exposure and potentially increase or decrease the level of risk depending on market conditions and their risk tolerance.

How Does Leverage Affect the Cost of Borrowing in Trading?

The impact of leverage on trading profits is a subject of interest to many investors. It is important to understand that while high leverage can potentially lead to higher profits, it also carries significant risks.

Are There Any Restrictions on the Amount of Leverage a Trader Can Use?

Restrictions on leverage in trading exist to mitigate potential risks. While leverage can amplify profits, it also magnifies losses. Traders must consider the pros and cons of using leverage, including the potential for significant financial gains or losses.