Embark on a journey into the fascinating realm of technical analysis with an exploration of “How Do Double Top and Double Bottom Chart Patterns Work.” These patterns serve as crucial indicators in deciphering market trends, offering invaluable insights to traders and investors. A ‘Double Top’ signifies a potential trend reversal, where an uptrend may transition into a downtrend.

Conversely, a ‘Double Bottom’ marks a shift from a downtrend to an uptrend. In this comprehensive guide, we unravel the intricacies of these patterns, providing actionable strategies to enhance your trading prowess. Join us as we delve into the world of chart analysis and empower you with the knowledge to make informed investment decisions.

Key Takeaways

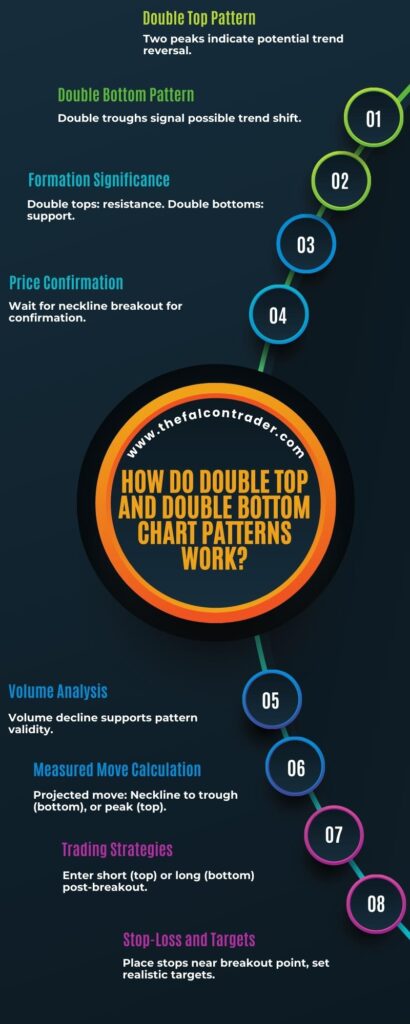

- Double top and double bottom patterns are widely used chart patterns in technical analysis to identify potential price trends.

- These patterns are formed due to resistance or support levels at specific price points, influenced by traders’ emotions and reactions to market news or events.

- Double top pattern occurs when the price increases, decreases, and then increases again without surpassing the initial high level, indicating a potential reversal from an uptrend to a downtrend.

- Double bottom pattern occurs when the price decreases, increases, and then decreases again without going below the initial low level, suggesting a potential reversal from a downtrend to an uptrend.

What Is a Double Top/Double Bottom Chart Pattern

A double top/double bottom chart pattern is a chart formation that occurs when there is resistance or support at a particular price point. Technical indicators and money management strategies are used to identify these patterns.

The double top pattern appears after a security’s price has increased, then decreased, and then increased again, but not beyond the initial high level before decreasing.

Similarly, the double bottom pattern appears after the security’s price has decreased, then increased, and then decreased again but not beyond the initial low level before increasing.

The formation of this type of chart pattern can be attributed to traders’ emotions as they react to market news or events. Buyers tend to become more cautious once prices have reached certain levels during an uptrend or downtrend which results in less buying pressure causing prices to reverse direction.

Therefore, traders should be able to recognize this type of chart pattern in order to take advantage of potential opportunities or avoid potential losses from trading breakouts that may not occur.

How Do Double Top and Double Bottom Chart Patterns Work?

Double top and double bottom chart patterns are technical analysis patterns used in financial markets, particularly in stock trading, to identify potential trend reversals. Here’s how they work:

Double Top Pattern:

Formation: The double top pattern occurs after a prolonged uptrend in a security’s price. It consists of two peaks at approximately the same price level, separated by a valley (trough) in between. This formation resembles the letter “M.”

Significance: The double top pattern suggests that the previous uptrend may be losing momentum, and a trend reversal to the downside could be imminent. It indicates that buyers have failed to push the price higher twice, and selling pressure may be increasing.

Trading Strategy: Traders often look for a confirmed breakdown below the trough (valley) that separates the two peaks to confirm the pattern. This breakdown can be seen as a signal to sell or short the asset, anticipating a downtrend.

Double Bottom Pattern:

Formation: The double bottom pattern is the opposite of the double top. It occurs after an extended downtrend and consists of two troughs at approximately the same price level, separated by a peak in between. This formation resembles the letter “W.”

Significance: The double bottom pattern suggests that the previous downtrend may be losing steam, and a trend reversal to the upside could be on the horizon. It indicates that sellers have failed to push the price lower twice, and buying pressure may be increasing.

Trading Strategy: Traders often look for a confirmed breakout above the peak that separates the two troughs to confirm the pattern. This breakout can be seen as a signal to buy or go long on the asset, anticipating an uptrend.

It’s important to note that while double top and double bottom patterns can be useful tools for technical analysis, they are not foolproof. Traders often use them in conjunction with other indicators and analysis techniques to make informed trading decisions. Additionally, the success of these patterns relies on proper risk management and timing, as false signals can occur.

What Causes the Formation of a Double Top/Double Bottom Pattern

The formation of a Double Top/Double Bottom pattern is typically caused by resistance or support levels that are reached at specific price points. Market sentiment and technical indicators play an integral role in creating the chart pattern.

As prices reach certain levels, traders will often have differing opinions on whether to buy or sell. If the sentiment is divided, then the price can struggle to break through either the resistance or support level, creating a double top/bottom pattern.

Additionally, technical indicators such as moving averages and oscillators can also be used to identify when these patterns may occur. When combined with market sentiment, they can provide valuable insights into potential breakout points that could lead to further price movements.

Ultimately, double top/bottom patterns are essential for traders interested in understanding how prices move within certain ranges and identifying opportunities for profit.

What Is the Difference Between a Double Top and Double Bottom Pattern

Double top and double bottom chart patterns are price formations identifiable on a financial chart that are used by traders to spot reversals in the market. Both of these patterns signify trend exhaustion and can potentially indicate a change in direction for the security being charted.

Identifying these patterns requires an analysis of historical data, with investors closely monitoring price movements to determine when one of these formations is present. The difference between a double top and double bottom pattern lies primarily in their visual formation, with the former representing two consecutive peaks and the latter representing two consecutive troughs.

Identifying Patterns

Identifying chart patterns, such as double top and double bottom formations, requires careful observation. Technical analysis involves studying price action over time to recognize certain patterns that may indicate an impending trend change.

In the case of a double top pattern, two consecutive peaks appear in price action with a moderate trough between them. The peak signals often indicate a potential reversal from an uptrend to a downtrend.

Conversely, in the case of the double bottom formation, two consecutive troughs are present with moderate peaks between them; these signals can suggest that prices may reverse from a downtrend to an uptrend.

Analysts must carefully observe price movements and identify any repeating patterns before making investment decisions based on observed trends.

Spotting Reversals

Spotting potential reversals in price action requires careful observation of the market. This is especially true for short-term swing trading, where a trader needs to stay alert and react quickly.

Price patterns can help traders identify the possibility of a reversal, such as double tops and double bottoms. These patterns are useful for traders seeking to take advantage of small movements in prices over a short period of time.

Double top chart patterns occur when an asset’s price reaches its previous high twice before reversing direction. Similarly, double bottom chart patterns occur when an asset’s price reaches its previous low twice before reversing direction.

With careful observation and understanding of these chart patterns, traders can spot potential reversals and utilize them to their advantage.

How to Trade the Double Top/Double Bottom Pattern

Trading the double top/double bottom pattern involves analyzing price action at the key points of reversal. When a double top or double bottom appears, it signals that a potential trend reversal is occurring. Technical analysis can be used to identify when these patterns form, as well as when traders should enter and exit trades. It’s important to set stop losses in order to protect yourself from potential losses if the trade doesn’t go in your favor.

| Entry Setup | Stop Loss | Take Profit |

|---|---|---|

| Double Top/Double Bottom Pattern Forms | Initial Risk Below Reversal Point | Target Price at Swing High/Low Level |

| Wait for Price Action Pullback After Breakout | Adjust Stop Loss According to Market Movement & Risk Management Rules | Move Stop Loss to Break Even After Price Reaches Halfway Point of Targeted Profit Level |

| Enter Trade Once Momentum is Established Again (Breakout) | Protect Profits by Taking Partial Closure Before Reach Target Profit Level | Close Out Position Once Target Profit Level Reached or Momentum Weakens |

When trading this pattern, it’s important to take into account various factors such as volume, volatility, and market conditions before entering the trade. Additionally, traders should also consider using additional indicators such as support and resistance levels in order to confirm that the pattern has formed correctly and that a reversal may occur soon. By understanding how this pattern works and incorporating risk management rules into their trading strategy, traders will have an increased chance of success when trading this chart pattern.

Benefits and Risks of Trading Double Top/Double Bottom Patterns

Analyzing double top/double bottom patterns offers both potential benefits and risks for traders.

One benefit is the ability to use a short-selling strategy, which involves selling an asset that has not been owned by the seller before. This allows traders to profit from downward price movements while also minimizing risk through careful risk management strategies.

Double tops/bottoms can also be used as a signal of reversal, allowing traders to capitalize on changes in market sentiment if they spot them quickly and accurately enough.

On the other hand, there are some possible risks associated with trading these chart patterns. As with any technical analysis tool, double tops/bottoms may not always provide accurate signals or produce consistent results over time.

Additionally, short-term price movements may invalidate any signals generated by these chart patterns and thus lead to losses rather than profits.

Therefore, it is important for traders to take into account all available information when making decisions based on double top/bottom chart patterns and use risk management strategies when trading them.

Analyzing the Performance of Double Top/Double Bottom Patterns

Assessing the performance of double top/double bottom patterns can provide an indication of their effectiveness as a trading tool. When analyzing these patterns, it is important to consider four key factors:

- The degree of accuracy when predicting short selling opportunities;

- The likelihood of experiencing large losses;

- Analyzing market trends and indicators for confirmation;

- Establishing stop losses to limit potential risks.

A properly implemented double top/double bottom pattern can offer traders a great opportunity to make profits by accurately predicting price movements within a defined range. However, it is also essential to consider the risk associated with short selling, which could result in substantial losses if not managed correctly.

Additionally, it is important to use technical analysis and take into account market trends and indicators before making any decisions regarding trades based on these chart patterns. Moreover, stop losses should be established to ensure that potential losses are limited if the trade does not go according to plan.

Ultimately, traders should assess the performance of double top/double bottom patterns in order to determine whether they are effective tools for their trading strategies or not.

Conclusion

In conclusion, understanding the mechanics of ‘Double Top’ and ‘Double Bottom’ chart patterns is a pivotal skill for traders seeking to navigate the dynamic landscape of financial markets. These patterns offer valuable cues about potential trend reversals, enabling traders to make timely and informed decisions.

By recognizing the subtle nuances within these formations, you gain a strategic advantage in identifying optimal entry and exit points. As you incorporate these insights into your trading arsenal, let this guide be your beacon of knowledge, illuminating the path to more confident and successful trading endeavors. Embrace the power of chart analysis and harness the potential for greater returns in your investment journey.

References

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

- Technical indicators for forex forecasting: a preliminary study

Frequently Asked Questions

What Time Frame Is Best for Trading a Double Top/Double Bottom Pattern?

When trading a double top/double bottom pattern, swing trading is generally recommended as it allows for more time to assess risk management. This longer timeframe also provides ample opportunity to identify signals and patterns. Analyzing multiple timeframes can be beneficial in order to properly assess the potential of the trade.

How Do I Determine the Entry Level for a Double Top/Double Bottom Pattern?

To determine entry level for a double top/bottom pattern, one must use trendlines analysis and support/resistance. Like pieces of an intricate puzzle, these two techniques combined can unlock the door to successful trades. With precision and finesse, traders can analyze price movements to identify key levels that act as boundaries for their positions. By examining past data with an analytical eye, traders can confidently enter their desired market position.

What Are the Key Differences Between a Double Top/Double Bottom Pattern and Other Chart Patterns?

Double top/bottom patterns are chart formations that indicate support and resistance levels in a trend reversal, providing key insights for traders. They differ from other patterns by their distinct shape and the clear signals they provide to enter or exit trades.

Is There a Way to Increase the Success Rate of a Double Top/Double Bottom Pattern?

To increase the success rate of a double top/bottom pattern, one must employ savvy stop losses and position sizing. With an eye to the markets, by taking a measured approach, traders can strive for optimal returns. A well-honed strategy is essential for navigating these tricky waters; employing careful analysis and precision trading will ensure a better outcome.

How Can I Use a Double Top/Double Bottom Pattern to Anticipate Future Price Movements?

Double top/bottom patterns can be used to anticipate future price movements in swing trading by carefully examining the risk management strategies associated with them. Understanding these patterns and their risks can provide traders with a greater ability to make informed decisions.