Mastering the Mind: Why Is Trading Psychology So Important – Key Insights 2023

In the fast-paced and unpredictable world of trading, mastering the art of decision-making is not just about numbers and charts. “Why is trading psychology so important?” is a question that resonates with traders worldwide.

Beyond technical analysis, understanding and harnessing the power of trading psychology is critical for success in the financial markets. In this insightful guide, we delve into the intricacies of the human mind and emotions that can influence trading outcomes. Join us as we explore the significance of trading psychology and discover how emotional intelligence, discipline, and mindset play pivotal roles in achieving profitable trading results.

Key Takeaways

- Trading psychology plays a crucial role in determining the success or failure of traders in financial markets.

- Understanding and managing trading psychology is essential for consistent profitability and long-term success.

- Developing strong trading psychology involves discipline, emotional control, and adherence to a trading plan.

- Traders need to detach themselves emotionally from trades and make decisions based on logic.

Why Is Trading Psychology So Important?

Trading psychology plays a crucial role in determining the success or failure of traders in financial markets. It refers to the mental and emotional state of traders, which influences their decision-making process while buying or selling securities. The impact of emotions on trading decisions cannot be underestimated, as they can lead to impulsive actions that deviate from rationality and strategy.

Understanding and managing one’s trading psychology is essential for achieving consistent profitability and long-term success in the financial markets. Developing a strong trading psychology involves various aspects such as discipline, emotional control, and adherence to a well-defined trading plan. Traders must learn to detach themselves emotionally from their trades and make decisions based on logic rather than fear or greed.

They need to develop the ability to stick to their predetermined strategies even during periods of market volatility or unexpected events. Additionally, maintaining discipline is crucial for avoiding impulsive trades driven by short-term market fluctuations.

In summary, trading psychology is vital because it directly impacts traders’ decision-making process and ultimately determines their success in financial markets. By understanding the importance of emotions in trading decisions and developing strategies for controlling them, traders can achieve consistency and long-term profitability.

Understanding the Impact of Emotions on Trading Decisions

The examination of the influence of emotions on trading decisions provides valuable insights into the importance of understanding trading psychology.

Managing fear and controlling greed are two crucial aspects that traders need to master to make informed and rational decisions. Fear can often lead to hasty and impulsive actions, such as panic selling during market downturns, which can result in significant financial losses. On the other hand, unchecked greed may lead traders to take excessive risks and hold onto losing positions for too long, hoping for a miracle turnaround.

Research has shown that fear is one of the most powerful emotions that can negatively impact trading decisions. When faced with uncertainty or potential losses, fear can cloud judgment and cause traders to make irrational choices based on short-term emotional reactions rather than long-term strategies. For example, fear may prompt a trader to sell their investments at low prices out of panic instead of strategically analyzing market trends and making an informed decision based on objective data.

Similarly, controlling greed is essential for successful trading. Greed can drive traders to take unnecessary risks or become overly attached to profitable trades without considering potential downsides. This can lead to overtrading or holding onto positions for longer than necessary, resulting in missed opportunities or substantial losses when the market reverses.

By understanding and managing these emotions effectively, traders can develop a strong trading psychology that allows them to make rational decisions based on sound analysis rather than being swayed by emotional biases.

Understanding the impact of emotions on trading decisions is crucial for developing strong trading psychology. Managing fear and controlling greed are key components that enable traders to make rational choices based on objective analysis rather than emotional impulses. By recognizing how these emotions influence decision-making processes, traders can mitigate their negative effects and increase their chances of success in the volatile world of financial markets.

Developing strong trading psychology involves not only mastering these emotional aspects but also incorporating systematic risk management techniques and maintaining discipline throughout the trading journey.

Developing a Strong Trading Psychology

Developing a robust psychological framework is crucial for traders to navigate the complex and unpredictable nature of financial markets. Building resilience is an essential aspect of trading psychology as it allows traders to withstand the ups and downs of the market without being emotionally swayed by temporary fluctuations. Resilient traders can maintain a rational mindset, make objective decisions, and stick to their trading plan even in challenging times.

Managing risk is another key component of developing a strong trading psychology. Traders need to have a clear understanding of their risk tolerance and implement effective risk management strategies. This involves setting appropriate stop-loss levels, diversifying their portfolios, and avoiding overexposure to any single trade or asset class. By effectively managing risk, traders can protect themselves from significant losses and ensure long-term sustainability in the market.

Incorporating psychological techniques such as mindfulness and self-awareness can also contribute to building a strong trading psychology. Mindfulness helps traders stay present at the moment, allowing them to focus on current market conditions rather than getting caught up in past mistakes or future uncertainties. Self-awareness enables traders to recognize their own biases, emotions, and patterns of behavior that may hinder their decision-making process. By cultivating these skills, traders can enhance their ability to make informed choices based on data-driven analysis rather than being influenced by impulsive or emotional reactions.

As important as developing strong trading psychology is sticking to your trading plan.

Sticking to Your Trading Plan

Implementing and adhering to a well-defined trading plan is crucial for traders to maintain consistency and discipline in their decision-making process. Emotional discipline plays a significant role in the success of any trader, as it helps them avoid impulsive and emotionally driven decisions that can lead to poor outcomes.

By following a trading plan, traders can remove emotions from their decision-making process and focus on executing trades based on predetermined criteria.

Consistent execution is another important aspect of sticking to a trading plan. Traders who consistently execute their trades according to their plan are more likely to achieve long-term success. Consistency allows traders to develop a track record of reliable performance, build confidence in their abilities, and develop trust with other market participants. It also helps traders avoid making unnecessary adjustments or second-guessing their decisions, which can be detrimental to achieving desired outcomes.

To effectively stick to a trading plan, traders should consider incorporating the following strategies:

- Setting clear goals: Having specific goals provides direction and clarity for traders when making decisions. This helps them stay focused and motivated.

- Utilizing risk management techniques: Implementing risk management techniques such as setting stop-loss orders or position-sizing rules can help protect against excessive losses and ensure disciplined decision-making.

- Maintaining detailed records: Keeping accurate records of past trades allows traders to review their performance objectively, identify areas for improvement, and make necessary adjustments.

By implementing these strategies and sticking to a well-defined trading plan, traders can overcome short-term market fluctuations without succumbing to emotional biases or impulsive actions. The next section will explore how having the right mindset is essential in overcoming these challenges while staying focused on long-term goals.

Overcoming Short-Term Market Fluctuations

Successfully navigating through the challenges of short-term market fluctuations requires a resilient mindset that remains steadfast in the face of uncertainty, enabling traders to maintain focus on their long-term goals.

Managing market volatility is crucial for traders as it can greatly impact their investment performance. Market turbulence can lead to emotional reactions such as fear and greed, which can cloud judgment and result in impulsive decision-making. By staying focused during these turbulent times, traders are better equipped to make rational decisions based on data and analysis rather than emotions.

To effectively manage market volatility, traders need to develop strategies that allow them to mitigate risks and protect their capital. This includes diversifying their portfolio by investing in different asset classes or sectors. Diversification helps spread risk, reducing the potential impact of any single event or fluctuation. Additionally, setting stop-loss orders can help limit losses by automatically selling a security when it reaches a predetermined price level.

Staying focused during market turbulence also requires disciplined trading habits. Traders should have a clear understanding of their risk tolerance and set realistic expectations for returns. It is important to stick to a well-defined trading plan and avoid making impulsive decisions based on short-term market movements. By maintaining discipline, traders can resist the urge to chase quick profits or panic sell during downturns.

The role of discipline in trading goes beyond managing short-term fluctuations; it encompasses the overall approach and mindset required for successful trading.

The Role of Discipline in Trading

Exercising discipline is crucial in the field of trading as it plays a pivotal role in shaping one’s overall approach and mindset for achieving success. Developing self-control is essential for traders to resist impulsive decisions driven by fear or greed.

By maintaining focus on their long-term goals, disciplined traders can make rational decisions based on data and analysis rather than being swayed by short-term market fluctuations.

To understand the importance of discipline in trading, consider the following:

- Consistent adherence to a trading plan: A disciplined trader follows a well-defined trading plan that outlines their entry and exit strategies, risk management techniques, and profit targets. They have the self-control to stick to this plan even when faced with tempting opportunities or unexpected market movements. This helps them avoid emotional decision-making and ensures consistency in their approach.

- Emotion regulation: Trading can evoke strong emotions such as fear and greed, which can cloud judgment and lead to poor decision-making. Disciplined traders develop strategies for controlling emotions by practicing mindfulness techniques, setting realistic expectations, and focusing on long-term goals rather than short-term gains or losses. This allows them to make objective decisions based on data-driven analysis rather than being influenced by momentary market sentiments.

- Risk management: Discipline is crucial for effective risk management in trading. Disciplined traders set strict limits on the amount of capital they are willing to risk per trade, ensuring that no single trade has the potential to significantly impact their overall portfolio. They also use stop-loss orders and other risk mitigation techniques to protect themselves from excessive losses. By strictly adhering to these risk management rules, disciplined traders can minimize the impact of market volatility on their trading outcomes.

Developing self-control and maintaining focus are key components of successful trading psychology. Discipline enables traders to adhere to their trading plans consistently, regulate their emotions effectively, and manage risks prudently.

The next section will discuss strategies for controlling emotions in trading, highlighting the importance of emotional intelligence and practical techniques for maintaining a disciplined mindset.

Strategies for Controlling Emotions

Strategies for managing emotions in the context of trading involve employing techniques that allow traders to maintain a composed and rational mindset amidst the inherent volatility of financial markets. Emotional management is crucial because trading decisions influenced by strong emotions can often lead to impulsive actions and irrational behavior, which can result in significant financial losses. Psychological resilience plays a vital role in controlling emotions, as it enables traders to adapt and recover from stressful situations more effectively.

One effective strategy for emotional management is developing self-awareness. Traders must be able to recognize their emotional state at any given moment and understand how it may impact their decision-making process. By being aware of their emotions, traders can take steps to prevent them from clouding their judgment. For example, if a trader detects feelings of fear or greed arising during a trade, they can consciously remind themselves of the importance of sticking to their predetermined trading plan.

Another strategy is practicing mindfulness. Mindfulness involves staying fully present in the current moment without getting caught up in past regrets or future worries. It allows traders to focus on objective market data rather than being swayed by subjective emotions. Techniques such as meditation or deep breathing exercises can help traders cultivate mindfulness and enhance their ability to make rational decisions based on facts rather than emotional impulses.

To further illustrate these strategies, consider the following table:

| Strategy | Description |

|---|---|

| Self-awareness | Involves recognizing one’s emotional state during trading and understanding its potential impact on decision-making |

| Mindfulness | Practicing staying fully focused on the present moment, enabling objective analysis based on factual market information |

| Developing resilience | Enhancing psychological strength and adaptability to overcome stressors encountered while making trading decisions |

By incorporating these strategies into their trading routine, individuals can better manage their emotions and maintain a composed mindset essential for successful trading. Achieving long-term success in trading requires not only mastering emotional management but also adopting effective risk management techniques and continuously learning from past experiences.

Achieving Long-Term Success in Trading

Developing a comprehensive understanding of risk management techniques, continuously expanding knowledge through ongoing learning, and effectively adapting to market changes are crucial factors in achieving long-term success in the field of trading.

Emotional intelligence plays a significant role in this process as it allows traders to control their emotions and make rational decisions even in high-pressure situations. By being aware of their emotional state and understanding how it can impact their decision-making, traders can minimize impulsive actions and stick to their predefined strategies.

One key aspect of achieving long-term success in trading is effective risk management. Traders need to have a clear understanding of the risks associated with each trade and implement appropriate measures to mitigate them. This involves setting stop-loss orders, diversifying investments, and closely monitoring market trends.

Emotional intelligence plays a vital role in risk management as it helps traders stay calm and rational when faced with potential losses or unexpected market fluctuations. By keeping their emotions in check, traders are more likely to make well-informed decisions based on data-driven analysis rather than succumbing to fear or greed.

Continuous learning is another essential element for long-term success in trading. Markets are dynamic and constantly evolving, so traders must stay updated with the latest trends, strategies, and technological advancements. This requires a commitment to ongoing education through reading books, attending seminars or webinars, participating in trading communities, and analyzing past trades for lessons learned.

Having a growth mindset allows traders to adapt quickly to changing market conditions and refine their strategies accordingly.

Achieving long-term success in trading necessitates emotional intelligence and effective risk management practices. Traders who can control their emotions during high-pressure situations are more likely to make rational decisions based on data-driven analysis rather than acting impulsively.

Additionally, continuous learning is crucial for staying abreast of market trends and refining trading strategies over time. By incorporating these key elements into one’s approach towards trading psychology, individuals can increase their chances of attaining sustainable success throughout their trading careers.

If you are new to the world of Forex, we highly recommend you read our beginner’s guide to Forex trading.

Conclusion

In conclusion, the importance of trading psychology cannot be overstated. Mastering the mental and emotional aspects of trading is a key factor in achieving success in the financial markets. Emotional intelligence enables traders to manage fear, greed, and impulsiveness, allowing for more rational decision-making. Discipline is essential in adhering to trading plans and strategies, preventing impulsive actions that can lead to losses.

A positive mindset fosters resilience, enabling traders to bounce back from setbacks and stay focused on their long-term goals. By recognizing the influence of emotions on trading outcomes and developing strong psychological skills, traders can navigate the markets with confidence and increase their chances of achieving consistent profitability.

References

- Technical analysis of Forex by MACD Indicator

- Extended evidence on the use of technical analysis in foreign exchange

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

Frequently Asked Questions

How can traders manage their emotions during a market downturn?

Traders can manage their emotions during a market downturn by implementing strategies such as setting realistic expectations, maintaining discipline, and employing risk management techniques. These practices help in mitigating emotional responses and making rational decisions amidst volatile market conditions.

What are some common mistakes traders make when it comes to sticking to their trading plan?

Common mistakes traders make when sticking to their trading plan include emotional decision-making, lack of discipline, and failure to adapt. Strategies for success involve setting clear goals, maintaining discipline, using risk management techniques, and regularly reviewing and adjusting the trading plan.

How can traders overcome the fear of missing out (FOMO) and avoid impulsive trading decisions?

Traders can overcome FOMO by setting clear trading goals and sticking to a well-defined trading plan. They should focus on objective data, practice disciplined risk management, and employ strategies like taking breaks or using stop-loss orders to control impulsive trading decisions.

Are there any specific techniques or exercises that can help traders develop discipline in their trading approach?

Traders can develop discipline in their trading approach by employing various techniques. These include setting clear goals, creating a structured trading plan, practicing self-control, utilizing risk management strategies, and maintaining a focused mindset for consistent performance.

How can traders remain motivated and resilient during periods of prolonged losses in the market?

To build resilience in trading psychology, traders can employ strategies for maintaining motivation during periods of prolonged market losses. These may include setting realistic goals, practicing self-care, seeking social support, and adapting trading strategies based on data-driven analysis.

Unveiling Investment Options: What Are Options and How Do They Work 2023

Embark on a captivating journey into the world of finance with the question, “What Are Options and How Do They Work?” Unravel the secrets of these versatile financial instruments that add an element of excitement to the world of investing. Options provide investors with the opportunity to trade contracts that grant the right to buy or sell underlying assets at a predetermined price within a specified timeframe. In this enlightening guide, we demystify the mechanics of options, exploring call and put options, strike prices, and expiration dates. Join us as we delve into the intricacies of options trading, empowering you to make informed investment decisions and embrace the possibilities that these contracts offer.

Key Takeaways

- Options provide financial leverage and limit downside risk

- Options allow investors to profit from market movements without owning the underlying asset

- Options can be used for risk management purposes

- Options offer flexibility in different market conditions

What Are Options and How Do They Work?

Options are financial derivatives that provide investors with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. These versatile instruments are commonly used in the financial markets to hedge against risk, speculate on price movements, and generate potential profits.

Options work by granting the holder two primary choices: a call option, which allows the purchase of the underlying asset at the strike price, and a put option, which permits the sale of the asset at the strike price. Traders can choose between buying options to benefit from price appreciation or selling options to collect premiums and earn income.

The value of an option is determined by several factors, including the underlying asset’s price, the option’s strike price, the time left until expiration, and market volatility. As the market conditions change, so does the option’s price, making them dynamic tools for strategic trading.

In essence, options allow investors to control large positions of an asset with a smaller upfront investment, offering both potential rewards and risks. Understanding how options work empowers investors to implement various strategies and navigate the financial markets with greater confidence.

Understanding the Basics of Options Trading

Call options give traders the right, but not the obligation, to buy an underlying asset at a specific price within a specified timeframe.

On the other hand, put options grant traders the right, but not the obligation, to sell an underlying asset at a predetermined price within a set period.

Understanding these fundamental concepts is crucial for individuals looking to engage in options trading as it allows them to make informed investment decisions based on market conditions and their own risk appetite.

Call Options

Call options, known as contracts that grant the right but not the obligation to buy an underlying asset at a predetermined price within a specific timeframe, provide investors with a potential profit opportunity based on the future movement of the asset’s price.

Call option pricing is determined by various factors such as the current price of the underlying asset, its expected volatility, time until expiration, and interest rates.

The advantages of call options include leverage, limited risk exposure (as investors can only lose what they paid for the option), and the ability to participate in the potential upside of an asset without actually owning it.

By understanding how call options work and analyzing market trends and indicators, investors can make informed decisions about when to exercise their right to buy or sell assets.

Now let’s move on to discussing put options.

Put Options

Put options provide investors with the right but not the obligation to sell an underlying asset at a predetermined price within a specific timeframe, offering potential profit opportunities based on the future movement of the asset’s price. These options are commonly used for short selling and risk management purposes.

Short selling involves borrowing assets and selling them in anticipation of a decline in their price, allowing investors to profit from falling markets. Put options can be utilized as an alternative strategy for those who do not want to engage in short selling directly. They offer protection against downside risk by allowing investors to sell an asset at a predetermined price, even if its market value decreases.

Understanding how put options work is crucial for effective risk management strategies in financial markets. The mechanics of options contracts will be explored further in the subsequent section.

The Mechanics of Options Contracts

The strike price refers to the predetermined price at which an option can be exercised.

The expiration date is the deadline by which the option must be exercised or it becomes worthless.

Lastly, the premium is the cost of purchasing an option and represents the potential profit or loss for the buyer.

These three components are essential in understanding how options contracts work and play a crucial role in determining their value.

Strike Price

The strike price acts as a threshold, separating potential gains and losses in the options market, like a fork in the road guiding investors towards different outcomes. It is the predetermined price at which an option can be exercised or traded.

Here are four key points to understand about strike prices:

- Strike prices determine the intrinsic value of an option.

- The relationship between the strike price and the market price of the underlying asset determines whether an option is in-the-money, at-the-money, or out-of-the-money.

- Strike prices can be set at various levels depending on market expectations and investor preferences.

- Different strike prices offer different risk-reward profiles to traders.

Understanding strike prices is crucial for option pricing and making informed investment decisions.

The next section will explore another important aspect of options contracts: the expiration date, which further influences their value and trading strategies.

Expiration Date

The expiration date of an options contract marks the point at which the contract ceases to be valid and no longer conveys any rights or obligations. It is a predetermined date set by the options exchange on which the contract expires.

The expiration date is significant because it determines when the option holder must decide whether to exercise their rights or let the contract expire worthless. Additionally, it affects the time value of an option, which is influenced by factors such as market conditions and volatility. As the expiration date approaches, the time value decreases, as there is less time for potential price movements to occur.

This can impact both buyers and sellers of options, as they need to consider how much time they have left before making any decisions regarding exercising or closing out their positions. Understanding the expiration date is crucial in effectively trading options and managing risk.

Transitioning into discussing the next section about ‘premium,’ it is important to note that along with considering factors such as strike price and expiration date, traders also need to evaluate another key aspect known as ‘premium’.

Premium

One important consideration when trading options is the evaluation of the premium, which represents the cost associated with purchasing or selling an option contract. Premium analysis involves assessing various factors to determine the fair value of an option. These factors include the underlying asset’s price, strike price, time until expiration, volatility, and interest rates. The premium pricing can be influenced by supply and demand dynamics in the options market.

To better understand this concept, let’s consider a hypothetical scenario where we have two call options on Company X stock. Option A has a premium of $2.00 and expires in one month, while Option B has a premium of $3.00 and expires in three months.

As shown in the table below:

| Option | Premium | Expiration |

|---|---|---|

| A | $2.00 | 1 month |

| B | $3.00 | 3 months |

We can observe that Option B has a higher premium compared to Option A due to its longer expiration period.

Understanding premium analysis and pricing is crucial for making informed decisions when trading options.

The Role of Options in Speculation and Hedging

Contrary to popular belief, options play a pivotal role in both speculation and hedging strategies due to their inherent ability to provide financial leverage and limit downside risk. When it comes to investing, options offer investors the opportunity to profit from market movements without actually owning the underlying asset. This flexibility allows individuals to speculate on the future direction of a stock or index, amplifying potential gains through leverage.

On the other hand, options are also used for risk management purposes. They allow investors to protect their existing positions against adverse price movements by hedging with options contracts.

To further understand the role of options in speculation and hedging, consider the following points:

- Options in investment: By purchasing call options, investors can potentially benefit from rising prices of underlying assets. Conversely, buying put options allows them to profit from declining prices.

- Options in risk management: Investors can use put options as insurance policies against downturns in their portfolios. By doing so, they mitigate potential losses if the market moves against their positions.

- Flexibility: Options provide various strategies such as spreads and straddles that cater to different market conditions and investor preferences.

- Limited risk: Unlike trading stocks directly, when buying an option contract, investors’ maximum loss is limited to the premium paid for that contract.

- Diversification: Including options within a portfolio can help diversify risk and enhance overall returns.

Understanding these aspects of options lays a foundation for exploring different types of option strategies that traders employ.

Types of Options Strategies

Different types of option strategies provide traders with a range of approaches to capitalize on market conditions and optimize their investment portfolios. These strategies can be classified into two main categories: bullish strategies and bearish strategies.

Bullish strategies are employed when traders anticipate an increase in the price of the underlying asset. One common strategy is buying call options, which gives the trader the right to purchase the asset at a predetermined price within a specific time frame. Another bullish strategy is selling cash-secured puts, where traders sell put options and receive premium income while committing to buy the asset at a specified price if it falls below a certain level.

On the other hand, bearish strategies are implemented when traders expect a decline in the value of the underlying asset. One popular bearish strategy involves buying put options, which grants traders the right to sell the asset at a predetermined price within a given time period. Alternatively, selling covered calls allows traders to generate income by selling call options against an existing long position.

The advantages of options trading include leverage, limited risk exposure, and flexibility in market conditions. Traders can use these different types of option strategies to profit from both upward and downward market movements or even generate income in stagnant markets.

In considering factors when trading options…

Factors to Consider When Trading Options

When engaging in options trading, it is essential to carefully evaluate various factors that can significantly impact the outcome of trades. Factors to consider include market conditions, volatility, and risk management.

Market Conditions

- Understanding the overall market trends and direction is crucial for successful options trading. This involves analyzing economic indicators, news events, and technical analysis.

- Identifying whether the market is bullish, bearish or range-bound can help determine which options strategies are most appropriate.

Volatility

- Options pricing is influenced by volatility levels in the underlying asset. High volatility increases option premiums while low volatility decreases them.

- Traders should assess historical and implied volatility to make informed decisions about strike prices and expiration dates.

Risk Management

- Implementing effective risk management strategies is paramount when trading options.

- Setting stop-loss orders or using protective puts can limit potential losses.

- Diversification across different assets or strategies can help manage risk exposure.

Considering these factors will contribute to making well-informed options trading decisions. By understanding market conditions, assessing volatility levels, and implementing sound risk management techniques, traders can increase their chances of success in this complex financial arena.

Transitioning into the subsequent section on ‘risks and rewards of options trading,’ it is important to recognize that despite careful consideration of these factors, there are inherent risks associated with options trading that need to be addressed.

Risks and Rewards of Options Trading

One must acknowledge the potential for both substantial gains and considerable losses when engaging in options trading, as the risks associated with this financial practice can be significant. Options trading involves the buying and selling of contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time period. It provides traders with various strategies and tactics to capitalize on market movements.

The risks of options trading include the possibility of losing the entire investment if the option expires worthless or if the trader makes incorrect predictions about market movements. Additionally, options are subject to time decay, meaning their value decreases as they approach their expiration date. This can result in significant losses if traders do not accurately predict short-term price movements.

On the other hand, options trading also offers attractive rewards for those who employ effective strategies. Traders can use options to leverage their positions and potentially generate higher returns compared to simply buying or selling stocks outright. By employing advanced strategies such as spreads or straddles, traders can mitigate risk while maintaining profit potential.

To further understand these risks and rewards of options trading, let’s take a look at this table:

| Risks | Rewards | Strategies and Tactics |

|---|---|---|

| Potential loss | Possibility of gain | Leverage |

| Time decay | Higher returns | Spreads |

| Incorrect predictions | Mitigated risk | Straddles |

In conclusion, while there are risks involved in options trading, it also presents opportunities for substantial gains when approached strategically. Traders must carefully consider their risk tolerance and employ appropriate strategies to maximize potential rewards while minimizing potential losses.

Conclusion

In conclusion, “What Are Options and How Do They Work?” introduces you to the fascinating world of financial opportunities through options trading. Understanding the mechanics of call and put options, along with strike prices and expiration dates, equips you with the knowledge to navigate the complexities of the options market confidently. These versatile financial instruments add an element of excitement and potential for profits to your investment endeavors. Embrace the world of options trading, harnessing the power of informed decision-making, and unlock the potential for financial success through the dynamic realm of options contracts.

References

- Technical analysis of Forex by MACD Indicator

- Extended evidence on the use of technical analysis in foreign exchange

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

Frequently Asked Questions

Are options only available for stocks, or can they be used for other types of assets as well?

Options are not limited to stocks; they can also be used for real estate and commodities. Real estate options provide the right, but not the obligation, to buy or sell a property at a predetermined price. Similarly, commodity options allow individuals to trade contracts based on the future price of commodities.

Can options be exercised before their expiration date?

Yes, options can be exercised before their expiration date through a process known as early exercise. However, this decision depends on various factors such as option premiums and the underlying asset’s market conditions.

What happens if the price of the underlying asset doesn’t reach the strike price before the option expires?

If the option is in the money but the holder chooses not to exercise it, they forfeit their right to buy or sell the underlying asset at the strike price. Options can be traded on the secondary market before expiration.

Are there any restrictions or requirements for trading options?

There are restrictions and requirements for trading options. These may include minimum age, financial suitability, and approval from a brokerage firm. Additionally, some options strategies may require higher levels of experience or account size.

How are options priced, and what factors influence their value?

Options pricing models are used to determine the value of options, taking into account factors such as volatility and time decay. These models help investors assess the fair price of an option before making trading decisions, ensuring informed and calculated investment strategies.

Unveiling Algorithmic Trading: What Is Algo Trading 2023

Unleash the power of automation in the financial world with our guide on “What Is Algo Trading?” Algo trading, short for algorithmic trading, is revolutionizing the way investors approach the market. This cutting-edge strategy employs advanced mathematical models and computer algorithms to execute trades at lightning speed and with precision.

Dive into the dynamic world of algorithmic trading as we explore its key components, benefits, and potential risks. Discover how this innovative approach to trading empowers investors to capitalize on market opportunities and navigate complexities seamlessly. Join us on this thrilling journey as we demystify algo trading and its transformative impact on the financial landscape.

Key Takeaways

- Algo trading uses computer algorithms to execute trades based on predefined rules and strategies.

- Algo trading eliminates human emotions and biases from decision-making.

- Algo trading enables speed optimization and automation.

- Algo trading provides liquidity and efficiency to the markets.

What Is Algo Trading?

Algo trading, short for algorithmic trading, is a cutting-edge and technology-driven approach to trading financial assets. It involves the use of advanced mathematical models and computer algorithms to execute trades with speed, precision, and efficiency. Algo trading eliminates the need for manual intervention and relies on predefined rules and parameters to make trading decisions.

In algo trading, algorithms analyze vast amounts of historical data, market trends, and real-time information to identify trading opportunities and execute orders at optimal prices. These algorithms can be designed to execute various strategies, such as arbitrage, trend following, and market making.

The key advantages of algo trading include reduced human error, improved execution speed, increased liquidity, and the ability to backtest strategies before implementation. It is widely used by institutional investors, hedge funds, and large financial institutions, as well as individual traders seeking to capitalize on market movements with precision and efficiency.

As technology continues to advance, algo trading is becoming more prevalent in the financial markets, transforming the way trading is conducted and revolutionizing the landscape of investing. However, it is essential to note that while algo trading offers numerous benefits, it also carries risks, such as technological failures and unforeseen market events. Understanding the intricacies of algo trading and its implications is crucial for traders and investors alike as they navigate the ever-evolving financial world.

The Advantages of Algo Trading

Algo trading offers several advantages, including:

- Speed and efficiency: By utilizing computer algorithms, trades can be executed at lightning-fast speeds, reducing the time it takes to enter or exit positions.

- Elimination of human bias: Algo trading eliminates human emotions and biases from decision-making processes, resulting in more objective and rational trading strategies.

- Ability to process large amounts of data: Algorithms have the capability to analyze vast quantities of data quickly and accurately, allowing for more informed trading decisions based on a comprehensive analysis of market conditions.

Speed and Efficiency

By harnessing the speed and efficiency of algorithms, market participants can swiftly navigate the complex web of financial markets like a skilled conductor guiding an orchestra through a meticulously choreographed symphony.

Algo trading enables speed optimization by utilizing computerized systems that can process vast amounts of data in fractions of a second. This allows for rapid decision making and execution, giving traders a competitive edge in capturing profitable opportunities.

The efficiency of algo trading is further enhanced through automation, eliminating manual errors and ensuring consistent execution based on predetermined rules. Moreover, the use of algorithms allows for simultaneous monitoring and analysis of multiple markets, enabling traders to exploit correlations and identify potential arbitrage opportunities across different exchanges.

By leveraging these advantages, algo trading eliminates human bias and paves the way for unbiased decision making in financial markets.

Elimination of Human Bias

Utilizing algorithms in financial decision-making processes allows for the removal of human bias, ultimately leading to more objective and unbiased outcomes.

By eliminating human emotions from the equation, algo trading ensures that trading decisions are based solely on data-driven analysis and predefined rules. This automation of trading decisions reduces the impact of irrational behavior caused by fear, greed, or other emotional factors that can cloud judgment.

As a result, algo trading provides a more consistent and disciplined approach to investing, which can lead to improved risk management and potentially higher returns.

Furthermore, algorithms have the ability to process large amounts of data quickly and accurately, allowing for faster execution of trades and identification of profitable opportunities.

This seamless transition into the subsequent section highlights the efficiency aspect of algo trading without explicitly stating it.

Ability to Process Large Amounts of Data

Algorithms have the capacity to rapidly and accurately analyze vast quantities of data, with the capability to process millions of data points in milliseconds. This processing speed is a key advantage of algo trading, as it allows for quick decision-making based on real-time market information.

The ability to process large amounts of data also enables algorithms to identify patterns and trends that may not be apparent to human traders. By analyzing historical and current market data, algorithms can generate signals for buying or selling securities.

Additionally, algorithms can automatically execute trades based on predefined rules and parameters. This eliminates the need for manual intervention and reduces the risk of human error or bias.

With this understanding of the processing capabilities of algorithms, we can now delve into how algo trading works without losing sight of its potential benefits.

How Algo Trading Works?

Algorithm development and testing is a key component of how algo trading works. This involves creating mathematical models that analyze market data to identify potential trading opportunities. These algorithms are then tested using historical data to evaluate their performance before being implemented in real-time trading.

Once the algorithms are developed and tested, they are deployed in the trading system. Trades are executed automatically based on predefined conditions, eliminating the need for human interference. This allows for faster and more efficient trade execution.

However, it is important to actively monitor the strategies to ensure their effectiveness. Market conditions can change rapidly, and adjustments may need to be made to the algorithms to adapt to these changes. Monitoring also helps to identify any issues or anomalies in the trading system.

Overall, algo trading works by developing and testing algorithms, executing trades automatically, and actively monitoring and adjusting strategies to optimize performance.

You can read whether or not Forex trading is passive income here. Moreover, you can read how profitable Forex trading is here.

Algorithm Development and Testing

Developing and assessing algorithms is a crucial step in the process of algorithmic trading, provoking a sense of anticipation and curiosity in traders. Algorithm development involves creating mathematical models that generate trading signals based on various indicators, market data, and historical patterns. These algorithms are then backtested using historical data to evaluate their performance. Optimization techniques are employed to fine-tune the parameters of the algorithms to maximize profitability and minimize risk. This iterative process helps traders identify strategies that have the potential for success in different market conditions.

Execution of Trades

The execution of trades is a critical aspect of the algorithmic trading process. It involves implementing predefined criteria to enter and exit positions in the market.

Execution efficiency plays a significant role in determining the success or failure of algorithmic trading strategies.

By automating trades, algorithms can execute orders at high speeds and with minimal human intervention. This reduces the impact of emotions and manual errors.

Trade automation allows for quick reaction times, which can be crucial in fast-moving markets. Algorithms can take advantage of price discrepancies across multiple exchanges or assets simultaneously, leading to potential profit opportunities.

However, it is essential to monitor and adjust strategies continuously. This ensures they remain effective amidst changing market conditions and evolving trends without disrupting the execution process.

Monitoring and Adjusting Strategies

Monitoring and adjusting strategies is crucial in algorithmic trading to ensure effectiveness and profitability.

Monitoring involves keeping a close eye on market conditions, price movements, and other relevant factors to assess strategy performance.

If certain strategies are not generating desired results or if market conditions change, adjustments need to be made.

Risk management is an integral part of this process, helping to minimize potential losses and maximize profits.

Traders may adjust parameters like stop-loss levels or take-profit targets to mitigate risks and optimize returns.

They may also consider incorporating new indicators or modifying existing ones based on their analysis of market trends.

These continuous adjustments help traders stay adaptive and responsive to dynamic market conditions.

Common Strategies Used in Algo Trading

One commonly used strategy in algo trading is mean reversion, which involves identifying assets that have deviated from their long-term average and betting on them to revert back to the mean. This strategy is based on the belief that prices tend to fluctuate around a certain average value over time. When an asset’s price moves too far away from this average, it is expected to eventually return to it.

To implement mean reversion in algo trading, quantitative analysis techniques are employed to identify these deviations and determine when it is optimal to enter or exit trades. Traders may use statistical methods such as calculating standard deviations or Bollinger Bands to identify extreme price movements.

To provide a deeper understanding of common strategies used in algo trading, the following table presents three popular approaches:

| Strategy Name | Description | Advantages |

|---|---|---|

| Mean Reversion | Identifies assets that have deviated from their long-term average and bets on them reverting back | – Takes advantage of market inefficiencies – Can be applied across various asset classes |

| Trend Following | Identifies upward or downward trends and bets on the continuation of those trends | – Captures significant market moves – Reduces exposure during choppy markets |

| Arbitrage | Exploits price discrepancies between different markets or instruments for profit | – Generates low-risk profit opportunities – Capitalizes on temporary market inefficiencies |

These strategies serve as building blocks for developing more complex algorithms in algo trading systems. However, it is important to recognize that there are risks and challenges associated with implementing these strategies effectively without falling prey to pitfalls inherent in automated trading systems.

Risks and Challenges of Algo Trading

Risks and challenges arise in the implementation of algorithmic trading due to the complex nature of financial markets and the potential for unexpected market conditions. One of the main challenges is effectively managing risk. Algo traders must develop robust risk management strategies to protect against losses and ensure the long-term profitability of their trading activities. This involves setting limits on exposure, diversifying portfolios, and continuously monitoring market conditions.

Another challenge is the impact on market volatility. Algorithmic trading can contribute to increased market volatility, as automated systems respond quickly to changes in market conditions by executing trades at high speeds. This can lead to sudden price fluctuations and potentially exacerbate market swings.

Additionally, algo traders face technological challenges such as system failures or connectivity issues that could disrupt trading operations. They need reliable and efficient infrastructure to execute trades accurately and in a timely manner.

In summary, implementing algorithmic trading comes with various risks and challenges, including effective risk management strategies, the impact on market volatility, and technological considerations. These factors require careful planning and continuous monitoring to navigate successfully in order to maximize profits while minimizing potential pitfalls.

Understanding these risks and challenges is crucial when considering algo trading in different markets.

Algo Trading in Different Markets

Algorithmic trading is widely used in equities and stock markets due to its ability to quickly execute trades based on predefined rules.

In the forex market, algorithmic trading is particularly prevalent as it allows for high-frequency trading across different currencies.

Additionally, algorithmic trading has also gained popularity in commodities and futures markets where it can be utilized to analyze large volumes of data and execute trades efficiently.

Equities and Stock Markets

Equities and stock markets play a crucial role in the implementation of algorithmic trading strategies. Algorithmic trading, also known as algo trading, is heavily utilized in equities trading to analyze stock market data and execute trades at high speeds. This approach allows traders to take advantage of price discrepancies, market inefficiencies, and other patterns that can be detected through sophisticated algorithms.

To emphasize the importance of equities trading and stock market analysis in algo trading, consider the following sub-lists:

- Provides a diverse range of investment opportunities involving stocks issued by public companies.

- Enables investors to participate in the ownership of these companies.

- Involves analyzing financial statements, market trends, and other relevant factors to make informed decisions.

In the subsequent section about forex and currency trading, we will explore how algo trading is applied in this specific domain.

Forex and Currency Trading

The foreign exchange market, often referred to as the forex market, acts as a global marketplace where currencies are traded and exchanged. It is the largest financial market in the world, with an average daily trading volume of over $5 trillion.

The forex market dynamics are influenced by various factors such as economic indicators, geopolitical events, and central bank policies.

In recent years, technology has had a significant impact on currency trading. Algorithmic trading systems have become increasingly popular in the forex market, allowing traders to execute trades automatically based on predefined rules and algorithms. These systems can analyze vast amounts of data quickly and make instant trading decisions, leading to increased efficiency and liquidity in the market.

As we transition into the subsequent section about commodities and futures, it is worth exploring how these technological advancements have also affected other financial markets.

Commodities and Futures

Commodities and futures trading are important components of the financial markets that provide opportunities for investors to speculate on the future price movements of various tangible goods, such as agricultural products, energy resources, and precious metals. Commodity trading involves buying and selling physical commodities, while futures trading involves entering into contracts to buy or sell a commodity at a predetermined price on a future date.

To understand this subtopic further, let’s explore four key aspects:

- Price volatility: Commodities and futures markets are known for their inherent volatility due to factors like supply and demand dynamics and geopolitical events.

- Hedging strategies: These markets offer hedging opportunities for businesses involved in producing or consuming commodities by allowing them to lock in prices in advance.

- Speculation: Traders can speculate on the future price direction of commodities based on fundamental analysis or technical indicators.

- Leverage: Futures contracts allow traders to control larger positions with relatively smaller capital investments, amplifying potential gains or losses.

This discussion sets the stage for understanding the role of algo trading in these dynamic markets.

Future Trends in Algo Trading

One of the key areas for future development is the utilization of machine learning algorithms that can adapt and learn from market data to make more accurate predictions. This would enable traders to better understand market dynamics and adjust their strategies accordingly. Additionally, incorporating artificial intelligence can provide real-time analysis of vast amounts of data, allowing traders to identify patterns and trends that may not be immediately apparent.

Another area with promising potential is the use of natural language processing techniques to analyze news articles and social media sentiment. By understanding public sentiment towards certain stocks or commodities, traders can make more informed decisions about their investments.

Furthermore, there is a growing interest in utilizing blockchain technology in algo trading. Blockchain has the potential to improve transparency and security in trading operations by providing an immutable record of transactions.

In conclusion, future trends in algo trading will continue to push the boundaries of technological innovation. The incorporation of machine learning, artificial intelligence, natural language processing, and blockchain will revolutionize how trades are conducted and managed. These advancements will undoubtedly have a significant impact on financial markets by improving prediction accuracy, increasing efficiency, enhancing risk management capabilities, and ultimately providing greater opportunities for traders.

| Technology | Advantages | Disadvantages |

|---|---|---|

| Machine Learning | Accurate predictions | Requires large amounts of training data |

| Artificial Intelligence | Real-time analysis | Complexity |

| Natural Language Processing | Informed decision-making | Interpretation challenges |

| Blockchain | Transparency & Security | Scalability issues |

Conclusion

In conclusion, “What Is Algo Trading?” unveils the realm of algorithmic trading, where technology merges with finance to create a seamless and efficient trading experience. As markets evolve, embracing this automated approach can give investors a competitive edge, enhancing trading accuracy and efficiency. With its lightning-fast execution and data-driven insights, algo trading provides a gateway to maximizing potential profits and minimizing human error. As you delve into the world of algorithmic trading, let this guide serve as your compass, navigating you through the intricacies of this revolutionary strategy. Embrace the future of trading with algo trading and embrace the opportunities it presents to elevate your trading endeavors to new heights.

References

- Forex trading and the WMR fix

- Reinforcement learning applied to Forex trading

- A Forex trading system based on a genetic algorithm

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

Frequently Asked Questions

What are the key components needed to set up an algo trading system?

To set up an algo trading system, key components include a robust trading algorithm, reliable data feeds, a powerful computing infrastructure, and efficient execution mechanisms. These components ensure the system’s effectiveness in executing trades based on predefined algorithms.

How does algo trading impact market liquidity?

Market liquidity is impacted by algo trading through its effects on market volatility. High frequency trading, a type of algo trading, can increase market volatility due to its rapid and large-scale transactions.

Are there any regulations or restrictions on algo trading?

Regulation and compliance play a crucial role in algo trading. Various regulations, such as the Dodd-Frank Act and MiFID II, aim to ensure transparency, fair competition, and risk management in algorithmic trading activities to protect market integrity and investor interests.

Can algo trading be used for long-term investments or is it mainly for short-term trading?

Algo trading can be used for long-term investments as it offers several benefits. Long term investment strategies, when implemented through algo trading, provide the advantage of systematic and disciplined execution, reduced emotional bias, and potential for better risk management.

What are some of the popular algorithmic trading platforms available in the market?

Some popular algorithmic trading platforms include MetaTrader, NinjaTrader, and TradeStation. These platforms offer advantages over manual trading such as faster execution and the ability to automate strategies based on predefined rules.

Gaining Edge: Importance of Trading System – Key Insights 2023

Embark on a transformative journey into the world of foreign exchange with a deep dive into the “Importance of Trading System.” In the dynamic realm of forex trading, having a robust and well-defined trading system is the cornerstone of success. This guide unveils the significance of a structured trading approach, empowering traders to navigate the complexities of the forex market with precision and confidence. Discover how a meticulously crafted trading system can streamline your decision-making, enhance risk management, and unlock the potential for consistent profits. Join us as we unravel the essential elements of a forex trading system and equip you with the tools to thrive in this thrilling financial landscape.

Key Takeaways

- Risk management plays a crucial role in forex trading, including determining risk levels for each trade, setting stop-loss orders, and using a disciplined approach.

- Implementing a trading plan is essential, which involves continuously evaluating its effectiveness, making necessary adjustments, and adhering to predetermined rules.

- Utilizing technical and fundamental analysis helps in making informed decisions, identifying patterns and trends, and navigating the forex market effectively.

- Staying informed about economic news and events is crucial, as they impact currency exchange rates, and adjusting strategies based on such news can lead to profitable opportunities.

Importance Of Trading System

A trading system holds immense importance in the world of trading. It serves as a structured framework that guides traders in making well-informed decisions. By defining entry and exit rules, risk management, and trade execution strategies, a trading system provides consistency and discipline, essential for success.

It minimizes emotional trading, a common pitfall, and increases the chances of achieving consistent results.

Furthermore, a well-designed trading system helps traders analyze historical data, backtest strategies, and refine their approach based on empirical evidence. It provides a clear roadmap, reducing guesswork and promoting objective decision-making. With the ability to adapt to different market conditions, a robust trading system enhances adaptability and resilience, vital traits for navigating the dynamic financial landscape.

In conclusion, a trading system is a cornerstone of successful trading, offering structure, consistency, and objective analysis. It empowers traders to stay disciplined, minimize emotions, and make informed choices based on thorough research and strategy testing. As a valuable tool, a trading system plays a pivotal role in achieving long-term trading goals.

Understanding the Basics of Forex Trading

To gain a comprehensive understanding of forex trading, it is essential to familiarize oneself with the basics and fundamental principles that underpin this financial market. Forex trading involves buying and selling currencies in order to make profits from fluctuations in exchange rates. It is important for traders to have a solid grasp of risk management techniques as well as market analysis strategies.

Risk management plays a crucial role in forex trading. Traders must be able to assess and mitigate potential risks associated with currency fluctuations, leverage, and market volatility. This involves setting stop-loss orders to limit losses and using proper position sizing techniques to manage risk effectively.

Market analysis is another key aspect of forex trading. Traders need to analyze economic indicators, political events, and news releases that can impact currency values. Technical analysis tools such as charts, patterns, and indicators are also utilized to identify trends and make informed trading decisions.

By understanding the basics of forex trading including risk management and market analysis techniques, traders can set clear goals and objectives for their trades. This allows them to develop effective strategies based on their individual preferences and risk tolerance levels. With these foundations in place, traders can proceed into the next section about setting clear goals and objectives without skipping a beat.

Setting Clear Goals and Objectives

Setting clear goals and objectives is essential for achieving success in the world of foreign exchange. Clear goal setting provides direction and focus, allowing traders to identify what they want to achieve and how they plan to get there. Effective objective planning helps traders stay disciplined and motivated, as it provides a roadmap for their trading activities.

One key aspect of clear goal setting is defining specific and measurable targets. By setting concrete goals, traders can better track their progress and evaluate the effectiveness of their strategies. Moreover, having clear objectives allows traders to prioritize their actions and allocate resources wisely.

Furthermore, clear goal setting promotes accountability. When traders have well-defined goals, they are more likely to hold themselves accountable for their actions and make informed decisions based on those objectives. This fosters discipline in trading practices.

In addition, effective objective planning enhances decision-making processes. Traders with clearly defined goals can assess potential trades more objectively by considering whether or not they align with their overall objectives.

In conclusion, setting clear goals and objectives is crucial for success in forex trading. It provides direction, focus, discipline, accountability, and improves decision-making processes. By incorporating these elements into their trading strategies, traders can increase their chances of achieving long-term profitability.

Developing a Trading Strategy

Developing a trading strategy involves constructing a well-thought-out roadmap that guides traders in navigating the complex world of foreign exchange, akin to an architect meticulously planning the blueprint for a grand structure. In this stage, traders must consider various factors and develop risk management techniques to mitigate potential losses. Additionally, backtesting strategies play a crucial role in refining and optimizing trading systems.

To create a successful trading strategy, here are five key elements to consider:

- Timeframes: Traders should determine the specific timeframes they will focus on when analyzing currency pairs. Different timeframes offer unique insights into market trends and price movements.

- Entry and exit points: Identifying optimal entry and exit points is essential for executing trades effectively. This involves using technical indicators or fundamental analysis to pinpoint favorable market conditions.

- Risk management: Developing effective risk management techniques is crucial in forex trading. Traders must establish appropriate stop-loss orders and position sizes to control potential losses.

- Money management: Successful traders understand the importance of managing their capital wisely. Implementing proper money management techniques, such as setting profit targets and adhering to them, can help maximize profits while minimizing risks.

- Backtesting strategies: Testing the effectiveness of a trading strategy using historical data can provide valuable insights into its performance over time. By identifying strengths and weaknesses through backtesting, traders can refine their strategies before implementing them in real-time markets.

Developing a solid trading strategy is just one step towards achieving success in forex trading; choosing the right trading platform is another essential component that traders need to carefully consider without compromising on functionality or reliability.

Choosing the Right Trading Platform

Selecting the appropriate trading platform is a critical decision for traders, as it can significantly impact their ability to execute trades efficiently and achieve financial success in the dynamic world of foreign exchange. The right trading platform should provide a range of features that cater to the specific needs of individual traders. When choosing a trading platform, it is essential to consider factors such as reliability, user-friendliness, available tools and indicators, customization options, and access to real-time market data.

To help visualize the importance of selecting the right trading platform, consider the following table:

| Feature | Description |

|---|---|

| Reliability | Ensures uninterrupted access to markets |

| User-Friendliness | Intuitive interface for easy navigation |

| Tools and Indicators | Provides various technical analysis tools and indicators |

| Customization | Ability to personalize settings and layouts |

| Real-Time Market Data | Access to up-to-date information on currency pairs |

By carefully evaluating these trading platform features, traders can make informed decisions about which platforms best suit their needs. It is crucial for traders to feel a sense of belonging with their chosen platform since they will be spending considerable time using it.

Having selected an appropriate trading platform that meets their requirements, traders can then focus on implementing a robust trading plan. This involves formulating strategies based on thorough analysis and executing trades according to predetermined rules without emotional interference.

Implementing a Trading Plan

Once traders have chosen the most suitable trading platform, they can proceed to implement their trading plan, ensuring adherence to predetermined rules and strategies without succumbing to emotional biases. The successful implementation of a trading plan requires developing discipline and employing effective risk management techniques.

Traders must have the discipline to consistently follow their plan, even in the face of market fluctuations and potential losses. This involves executing trades based on objective criteria rather than being swayed by emotions such as fear or greed.

Furthermore, risk management techniques are essential for preserving capital and minimizing potential losses. Traders should determine an appropriate level of risk for each trade and set stop-loss orders accordingly. This helps protect against significant losses if the market moves in an unfavorable direction.

Implementing a trading plan also involves continuously evaluating its effectiveness and making necessary adjustments. By keeping meticulous records of past trades and analyzing performance metrics, traders can identify patterns or areas for improvement in their strategies.

In conclusion, implementing a trading plan is crucial for achieving success in forex trading. It requires developing discipline, adhering to predetermined rules, and employing effective risk management techniques. By doing so, traders increase their chances of making informed decisions based on sound analysis rather than impulsive emotions.

If interested you can read how to start future and options trading here. Moreover, you can read taxation in intraday trading here.

Utilizing Technical and Fundamental Analysis

Utilizing technical and fundamental analysis is crucial for forex traders to make informed decisions.

By using charts and indicators, traders can identify patterns and trends in the market, allowing them to predict future price movements.

Additionally, staying informed about economic news and events is essential as these factors can significantly impact currency values.

Traders who are knowledgeable about both technical and fundamental analysis have a greater advantage in navigating the forex market.

Using Charts and Indicators

Charts and indicators are essential tools in forex trading, providing traders with valuable visual representations of price movements and key technical analysis indicators. Here are four reasons why utilizing charts and indicators is crucial in forex trading:

- Using trendlines effectively: Charts allow traders to identify trends by drawing trendlines, which help determine the direction of the market and potential entry or exit points.

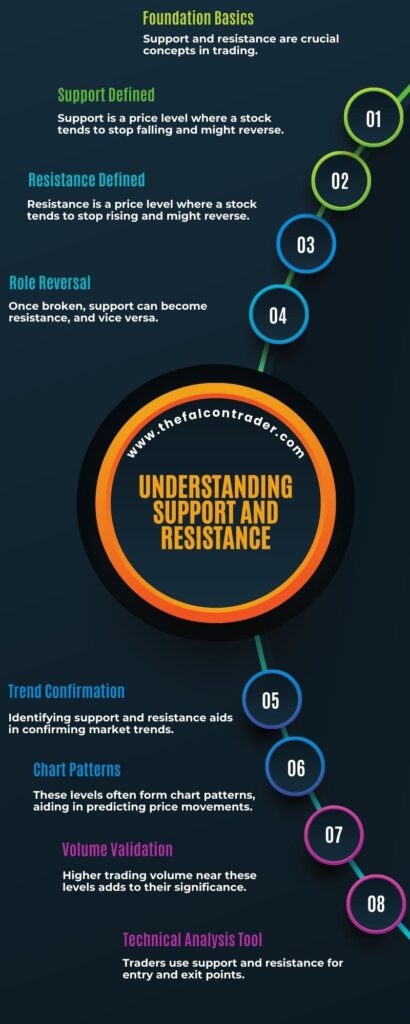

- Identifying support and resistance levels: Charts display historical price levels where the market has previously struggled to break through (resistance) or found support (support). These levels can be used to make informed trading decisions.

- Analyzing patterns: Indicators on charts provide insights into various patterns such as head and shoulders, double tops/bottoms, triangles, etc., helping traders anticipate future price movements.

- Timing trades: By analyzing charts and indicators, traders can identify optimal timing for entering or exiting trades based on signals generated by these tools.

Understanding how to read charts and interpret indicators allows traders to make informed decisions when trading forex. Additionally, staying informed about economic news and events further enhances their ability to navigate the markets successfully.

Staying Informed About Economic News and Events

The previous subtopic discussed the use of charts and indicators in forex trading, providing traders with a visual representation of market trends. Building on this foundation, staying informed about economic news and events is crucial for successful trading.

The impact of economic news on currency exchange rates cannot be understated. Economic indicators such as GDP growth, inflation rates, and employment data can greatly influence the value of currencies. Traders who stay updated on global economic events are better equipped to anticipate market movements and make informed trading decisions.

By monitoring economic news releases, central bank statements, and geopolitical developments, traders gain valuable insights into the factors driving currency fluctuations. This knowledge allows them to adjust their strategies accordingly and capitalize on profitable opportunities.

With a solid understanding of the importance of staying informed about economic news and events, we can now delve into testing and optimizing our trading system to maximize profitability without compromising risk management.

Testing and Optimizing Your Trading System

Testing and optimizing a trading system is often overlooked, despite its crucial role in achieving successful outcomes and maximizing profits. Backtesting strategies allow traders to evaluate the performance of their system using historical data, giving them insights into how it would have performed in different market conditions. This process helps identify any flaws or weaknesses in the system, allowing for necessary adjustments or improvements to be made.

One important aspect of testing a trading system is evaluating the risk-reward ratio. This involves analyzing the potential profit versus the potential loss on each trade. By ensuring that the potential rewards outweigh the risks, traders can increase their chances of profitability over time.

Optimizing a trading system involves fine-tuning various parameters such as entry and exit points, stop-loss levels, and position sizing. Through rigorous testing and optimization, traders can identify optimal settings that maximize profits while minimizing risks.

Continuous learning and improvement are essential components of successful forex trading. Once a trading system has been tested and optimized, it is important to continue monitoring its performance and making necessary adjustments based on changing market conditions.

Overall, testing and optimizing a trading system are critical steps in achieving consistent profits in forex trading. By diligently backtesting strategies and evaluating risk-reward ratios, traders can enhance their decision-making processes and increase their chances of success in this dynamic market environment.

Continuous Learning and Improvement

Continuous learning and improvement are crucial for traders to stay ahead of the ever-evolving forex market, enabling them to adapt their strategies and seize new opportunities with confidence. To achieve success in forex trading, traders must engage in continuous practice, self-reflection, and improvement.

One key aspect of continuous learning is practicing trades regularly. By executing trades consistently, traders can gain valuable experience and refine their skills. This hands-on approach allows them to identify strengths and weaknesses in their strategies and make necessary adjustments.

Self-reflection is another important component of continuous improvement. Traders should analyze their past trades to understand what worked well and what didn’t. This introspection helps them learn from their mistakes and develop more effective trading techniques.