Strategic Insights: How to Trade Wedge and Triangle Chart Patterns – Pro Tips 2023

Embark on a journey into the world of technical analysis with our guide on “How to Trade Wedge and Triangle Chart Patterns.” These patterns are powerful indicators that can unlock opportunities in the financial markets. A wedge signifies a potential trend reversal or continuation, while a triangle hints at an impending breakout.

Understanding the nuances of these patterns is key to making informed trading decisions. In this comprehensive guide, we delve into the intricacies, offering practical insights and strategies. Join us as we equip you with the knowledge to confidently identify and trade these patterns, enhancing your proficiency in the dynamic realm of chart analysis.

Key Takeaways

- Wedge and triangle patterns are commonly seen in the forex market.

- Proper analysis of these patterns involves understanding trend lines, support/resistance levels, and volume.

- Position sizing and money management are crucial elements in trading these patterns.

- Accurate identification of patterns is essential before entering a trade, and using risk management techniques can minimize potential losses.

Identifying Wedge and Triangle Chart Patterns

Identification of wedge and triangle chart patterns is a key factor in successful forex trading. As such, it is important for traders to develop an understanding of the various formations that can arise on a price chart.

Wedge and triangle patterns are two common formations that are regularly seen in the forex market, and they can be used as part of scalping strategies or longer-term risk management approaches. The wedge pattern is typically characterized by converging trendlines with both lines rising or falling at roughly equal angles.

Triangle patterns have three distinct points: a peak, followed by two troughs either side of the peak before another peak forms. This creates a ‘triangle’ shape on the price chart.

Knowing how to recognize these chart patterns is critical when it comes to making profitable trades in the forex market. In order to effectively analyze wedge and triangle chart patterns, traders must understand how to interpret their respective implications for price action.

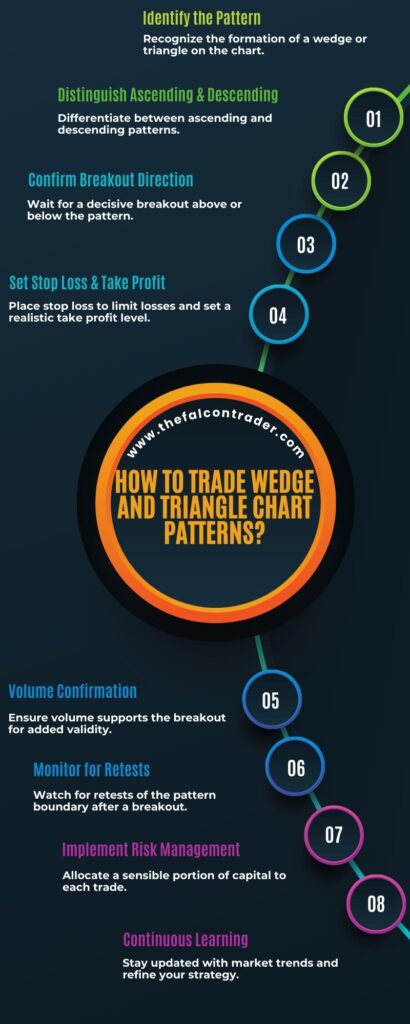

How To Trade Wedge And Triangle Chart Patterns?

| Step | Description |

| 1. Identifying Patterns | Wedge Patterns: Rising and Falling Wedges indicate potential trend reversals or continuations. Triangle Patterns: Ascending, Descending, and Symmetrical Triangles signal impending breakouts. |

| 2. Confirming with Indicators | Use volume and momentum indicators to validate the pattern. Higher volume during a breakout strengthens the signal. |

| 3. Setting Entry and Exit Points | Entry Point: Trade is executed after the price breaks out of the pattern. Above upper trendline for bullish, below lower trendline for bearish. Stop Loss and Take Profit: Determine based on historical support/resistance or Fibonacci extensions. |

| 4. Risk Management and Position Sizing | Allocate a small percentage (e.g., 1-2%) of total capital to a single trade. Determine position size based on the distance between entry and stop-loss levels. |

| 5. Monitoring the Trade | Keep a close watch on the position. Adjust stop-loss levels to lock in profits or limit potential losses. |

| 6. Adapting to Market Conditions | Be flexible and ready to adjust strategies based on changing market conditions. |

| 7. Continuous Learning and Practice | Regular practice, staying updated with market trends, and continuous learning are essential for refining trading strategies. |

Analyzing Wedge and Triangle Chart Patterns

Analyzing wedge and triangle chart patterns can be a complex task. Identifying these patterns requires a trader to have an understanding of the various characteristics that make up these formations, including trend lines, support/resistance levels, and volume.

Once identified, traders must then develop trading strategies to capitalize on these patterns. It is important for traders to understand how different types of wedges and triangles behave in order to properly craft their trading plan.

Identifying Patterns

Distinguishing wedge and triangle chart patterns requires careful consideration of their unique characteristics. Market timing is a key factor in chart reading, as both triangles and wedges can be classified as either continuation or reversal patterns depending on the direction of the trend prior to the formation.

Triangle patterns are characterized by converging trendlines that form an apex at some point in time, while wedges feature two diverging trendlines that slope towards each other. Each type has its own set of rules for identifying them correctly; for instance, rising wedges may indicate a bearish reversal whereas falling wedges could signal a bullish reversal.

With this knowledge in hand, traders can move onto the next step of analyzing their potential trading strategies.

Trading Strategies

Once traders have identified and distinguished the characteristics of wedge and triangle chart patterns, they can begin to analyze possible trading strategies. It is important to keep in mind that position sizing and money management are key elements when trading these chart patterns.

Traders must assess their risk tolerance, determine how much capital they are willing to allocate for each trade, set stop losses, and other key parameters before entering a trade. Setting appropriate take profit levels is critical for capturing the maximum reward potential of any given pattern.

Additionally, traders should consider exits based on technical indicators such as moving averages or support/resistance levels. These strategies can help maximize profits while managing risk exposure. By utilizing proper position sizing and money management techniques, traders can enhance their chances for success when trading wedge and triangle chart patterns.

With this knowledge in hand, the next step is understanding how to enter and exit these trades with precision.

Entering and Exiting Wedge and Triangle Chart Patterns

When trading wedge and triangle chart patterns in forex, two key considerations are identifying the pattern correctly and setting appropriate target prices, stop orders, and limits.

It is essential to accurately identify a wedge or triangle pattern before entering a trade as incorrect identification can lead to losses.

Once the pattern has been identified, traders should set targets, stops and limits accordingly in order to maximize potential profits and limit risks.

Identifying Patterns

It is important to accurately identify wedge and triangle chart patterns in forex trading. Swing Traders must study the charts for visual cues that will inform their market timing decisions.

The wedge pattern can be identified by a narrowing of price action, with a downward slope during bearish conditions or an upward slope during bullish conditions.

Triangle patterns are characterized by converging trendlines as prices move towards the apex of the triangle. To identify these patterns correctly, it is important to note the angle of each trendline and observe whether there is an increase or decrease in trading volume as prices approach the apex.

Setting Targets

Examining trends in price action can provide insight into potential entry and exit points for trades. Setting targets is a key part of managing risk when trading wedge and triangle chart patterns in Forex:

- Utilize stop-loss orders to protect against unexpected market movements.

- Take profits at predetermined levels to maximize returns on successful trades.

- Be mindful of the underlying trend when setting targets—it’s important to stay aligned with it.

- Use sound money management practices, like limiting your exposure to any one trade or currency pair, to ensure you don’t overextend yourself financially.

Stops & Limits

Using proper risk management techniques, such as setting stops and limits, can help traders to limit their exposure to unexpected market movements. Stop losses are a useful tool for managing risk in Forex trading when using wedge and triangle chart patterns. A stop loss order will automatically close out a position if the price moves too far against the trader’s expectations.

Take profits also provide an important way to manage risk, allowing traders to lock in gains when their target is reached. Properly utilizing these tools allows traders to stay disciplined and maximize returns on their investments while limiting their losses in volatile markets. These strategies should be combined with other risk management tactics such as diversification and position sizing for maximum effectiveness.

This helps ensure that any negative outcomes can be minimized, providing peace of mind during periods of market uncertainty. Moving forward into the subsequent section about ‘risk management strategies for wedge and triangle chart patterns’, it is essential to understand how these tools work together in order to manage risk effectively.

Risk Management Strategies for Wedge and Triangle Chart Patterns

Risk management strategies are essential for successful trading of wedge and triangle chart patterns in the forex market. To help mitigate risk, traders should consider several key principles as part of their overall strategy:

- Position sizing – determine the maximum amount of capital to allocate towards each trade and stick to it.

- Money management – use stop-loss orders or trailing stops to minimize potential losses from unexpected market movements.

- Risk-reward ratio – calculate the expected return on investment (ROI) before entering a trade so that profits are greater than losses.

- Time frame – select an appropriate time frame for your trading style and adjust accordingly when needed to find optimal trades.

By following these principles, traders can protect their capital while still taking advantage of potential profits from wedge and triangle chart patterns in the forex market.

Additionally, understanding different types of risk is important for setting up effective risk management strategies that fit individual trading goals and objectives.

Types of Wedge and Triangle Chart Patterns

Having discussed the importance of risk management strategies for wedge and triangle chart patterns, it is also essential to become familiar with the types of these chart patterns. Generally speaking, wedge chart patterns can be bearish or bullish (upward or downward sloping), while triangle chart patterns can be ascending, descending, symmetrical, right-angled triangles, as well as other variations.

Regardless of the type of wedge/triangle pattern being traded, traders should always consider the risk-reward ratio when determining their entry/exit points. Furthermore, due to price dynamics in certain wedges/triangles that cause prices to break out in one direction or another after a period of consolidation.

Consequently, traders should also keep in mind that they may need to adjust their stop-loss levels accordingly. By considering all these factors when trading wedge/triangle chart patterns, traders can increase their chances of success. Ultimately this will allow them to position themselves better when interpreting these complex chart patterns.

Interpreting Wedge and Triangle Chart Patterns

Interpreting wedge and triangle chart patterns requires careful consideration of various factors such as price dynamics, risk-reward ratios, and potential entry/exit points. When trading these chart patterns, one should consider the following:

- Price action: analyzing how the market has moved in the past to develop an understanding of what may happen in the future.

- Technical indicators: using various techniques to measure momentum or other market conditions.

- Risk-reward Ratios: assessing potential profits versus potential losses associated with a trade setup.

- Entry/Exit Points: determining where to enter and exit a position based on price targets or technical signals.

These considerations are key for successful trading of wedge and triangle chart patterns, since they can help minimize risks while providing opportunities for potentially lucrative trades.

As such, it is important to understand them before engaging in any trades involving these chart patterns. With this knowledge, traders can better navigate the markets with confidence and avoid common mistakes when trading wedge and triangle chart patterns.

Common Mistakes to Avoid With Wedge and Triangle Chart Patterns

When interpreting wedge and triangle chart patterns, it is important to not fall prey to common mistakes. Psychological pitfalls can come into play when trading these types of patterns, leading to costly errors in judgment. To avoid such pitfalls, risk assessment must be taken into consideration before investing.

It is also important to understand the underlying trend and confirm the pattern with other indicators. In addition, traders should be aware of false breakouts which can result in losses if not dealt with properly. Furthermore, traders must keep emotions in check as fear or greed may lead to poor decision making.

Lastly, it is essential for traders to practice proper money management techniques and use appropriate stop loss orders that are tailored for each trade setup. By following these guidelines, traders can better ensure successful trades using wedge and triangle chart patterns on the forex market.

Conclusion

In conclusion, “How to Trade Wedge and Triangle Chart Patterns” unveils the art of leveraging technical analysis for successful trading. By mastering the nuances of wedge and triangle patterns, traders gain a competitive edge in identifying potential breakouts and trend reversals. However, it’s crucial to complement pattern recognition with effective risk management strategies.

As you delve into the world of chart analysis, let this guide be your trusted companion, providing you with the tools and insights needed to navigate the complexities of the financial markets. With diligence and practice, you can harness the power of these patterns to enhance your trading proficiency and achieve your financial goals.

References

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

- Evaluation of the profitability of technical analysis for Asian currencies in the forex spot market for short-term trading

- Could a trader using only “old” technical indicator be successful at the Forex market?

Frequently Asked Questions

What Other Chart Patterns Are Commonly Used in Forex Trading?

Other chart patterns commonly used in forex trading include head and shoulders, double/triple tops/bottoms, and flags. These trends can be identified through analysis of price action on charts and help traders make decisions about money management. Knowing how to properly identify these patterns is key to successful forex trading.

What Timeframes Are Best for Analyzing Wedge and Triangle Chart Patterns?

Statistics indicate that Forex traders often use price action and risk management to analyze wedge and triangle chart patterns. Best timeframes generally depend on the trader’s strategy, but higher time frames of 4 hours or more are generally favored due to their ability to provide a larger picture of market trends.

How Often Should I Look for Wedge and Triangle Chart Patterns?

Price action and risk management should be taken into consideration when looking for wedge and triangle chart patterns. Analyzing regularly can help traders identify potential trends, however frequency of analysis depends on market conditions, trading style and time frames. To maximize success finding these patterns, traders should stay up to date with market news and carefully monitor price movements.

What Are the Most Important Indicators to Use When Analyzing Wedge and Triangle Chart Patterns?

Analyzing wedge and triangle chart patterns requires an understanding of essential indicators, such as support/resistance levels, price action, and risk management. Accurately assessing these factors enables the trader to make informed decisions in a data-driven manner. Analysing with precision allows one to potentially maximize profits while minimizing losses.

Are There Any Other Tips or Strategies for Successfully Trading Wedge and Triangle Chart Patterns?

When trading wedge and triangle chart patterns, short term strategies and risk management are key to success. Utilizing a well-thought out plan that accounts for market volatility can help ensure profits while minimizing risks. Analyzing trends and taking advantage of opportunities in the short run can also lead to success.

Breaking the Trading Habit | How to Stop Getting Addicted to Trading 2023

Embarking on a journey to master the art of trading is exhilarating, but it’s crucial to tread carefully. “How to Stop Getting Addicted to Trading” is a compass for those seeking balance in the world of finance. Trading addiction can lead to impulsive decisions and financial instability.

This guide explores practical steps and mindset shifts to help you regain control. From setting clear boundaries to diversifying your interests, we unveil a holistic approach to trading. Join us in this transformative journey towards responsible and fulfilling trading practices that lead to sustained success.

Key Takeaways

- Recognize the signs of forex trading addiction, such as excessive time spent researching the markets and frequent urge to check prices.

- Understand the risks of forex trading, including emotional trading and not following a plan.

- Set realistic trading goals by formulating plans, considering individual financial situation and risk tolerance, and avoiding becoming overly attached to trades.

- Manage time effectively by practicing mindfulness, setting realistic goals, sticking to a trading plan, and allocating leisure time away from forex trading.

Identify the Signs of Forex Trading Addiction

Identifying the signs of addiction to forex trading can help individuals recognize when their involvement has become problematic. Developing healthy habits, such as taking time away from screens and practicing moderation, are essential for avoiding excessive trading or gambling-like behavior.

People may not realize they have become addicted if they spend a great deal of time researching the markets or feel an urge to check prices frequently. The feeling of needing to be in control of the market and a sense of accomplishment when a trade is successful can also be indicators that someone is becoming overly invested in currency trading.

Other warning signs include being preoccupied with money making opportunities, spending more than one can afford, and neglecting professional or personal obligations due to excessive trading activity.

Recognizing these signs early on will enable people to build healthier habits before it becomes an issue with serious consequences.

How to Stop Getting Addicted to Trading?

Stopping addiction to trading in forex involves implementing disciplined strategies and seeking professional guidance if needed. Here are steps to break the cycle of addiction:

- Set Clear Goals and Limits: Define specific trading goals and establish clear limits for losses and gains. Stick to these limits rigorously.

- Create a Trading Plan: Develop a comprehensive trading plan that includes entry and exit strategies, risk management rules, and a well-defined trading schedule.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade or currency pair. Diversification helps spread risk.

- Implement Stop-Loss Orders: Utilize stop-loss orders to automatically exit a position if it reaches a predetermined level of loss. This helps mitigate potential heavy losses.

- Monitor Emotional Responses: Be mindful of emotional reactions to trading outcomes. Overcome impulsive decisions by following the rules of your trading plan.

- Limit Screen Time: Reduce the time spent monitoring charts and market news. Constant exposure can lead to impulsive decisions.

- Seek Professional Guidance: Consult with a financial advisor or therapist who specializes in addiction or trading psychology.

- Take Breaks: Step away from trading periodically. A break allows for a fresh perspective and prevents burnout.

- Practice Mindfulness and Self-Care: Engage in activities that promote mental and emotional well-being, such as meditation, exercise, and spending time with loved ones.

- Track and Evaluate Trades: Keep a detailed record of your trades, including the rationale behind each decision. Regularly evaluate your performance to identify strengths and areas for improvement.

- Consider Simulated Trading: Practice trading with virtual money in a simulated environment. This can help build confidence without the risk of real losses.

- Stay Informed but Avoid Overanalysis: Keep up with market news and trends, but avoid overanalyzing or obsessing over every piece of information.

Remember, trading addiction can have serious financial and emotional consequences. It’s crucial to seek professional help if you find it challenging to break free from addictive trading patterns.

Understand the Risks of Forex Trading

Risk assessment is an important factor to consider when engaging in foreign exchange transactions. As with any investment, there is always a risk of loss and it’s important to understand the risks associated with Forex trading before getting started.

| Emotional Trading | Avoiding Losses | |

|---|---|---|

| Fear | Not following a plan | Taking too much risk |

| Greed | Overconfidence | Not setting stop losses |

| Panic | Impulsive decisions | Ignoring leverage limits |

Investors should be aware that emotional trading can lead to making decisions which may not be well thought out and could result in significant losses. It is also important to set realistic expectations for success and avoid taking on more risk than one can afford to lose.

By understanding the risks involved in Forex trading, investors can create strategies that balance their need for return with their willingness to take on risk, thus avoiding significant losses. This compassionate yet knowledgeable approach will encourage audience members who desire belonging in the pursuit of their financial goals.

Set Realistic Trading Goals

Establishing realistic trading goals is essential to achieving success in the foreign exchange market. To make sure that you are setting attainable objectives, it is important to formulate plans and set limits. Consider factors such as your individual financial situation, risk tolerance, and the amount of time you can dedicate to trading before creating a plan for yourself. Knowing your own capabilities will help ensure that you are not overreaching and also allow you to adjust if needed.

Achieving success in forex trading requires dedication and hard work; however, having reasonable expectations allows traders to stay motivated while they work towards their goals.

Setting realistic goals also helps foster healthy habits by preventing traders from getting overly attached or invested in their trades. It can be easy to become emotionally involved with a trade when it’s going well or poorly; however, maintaining an objective outlook is key for staying on track and achieving long-term results.

By establishing realistic expectations from the beginning, traders can protect themselves against disappointment while still working diligently towards their ultimate goals. With this approach, traders can feel empowered as they navigate the foreign exchange market with confidence and purpose.

Managing time wisely is another important aspect of successful forex trading that should not be overlooked.

Manage Your Time Wisely

Organizing one’s available time is an essential part of successful foreign exchange trading. Practicing mindfulness and managing emotions can help one to use their time wisely when it comes to forex trading. To manage one’s time effectively, it is important to set realistic goals and stick to a trading plan that allows for ample rest and relaxation.

| Benefit | Activity | Result |

|---|---|---|

| Relaxation | Allocation of leisure time away from forex trading | Refreshment & Renewal of energy levels |

| Focus on Goals | Regular review of short-term objectives in conjunction with long-term strategies | Improved goal achievement & success rate over time |

| Stress Relief | Participation in activities outside the realm of forex trading such as exercise, socializing, or hobbies | Reduced stress levels & improved mental health |

Taking the necessary steps to manage one’s time efficiently will ensure that they are able to practice foreign exchange properly while avoiding addiction. Seeking professional help may also be beneficial if needed, as even experienced traders can find themselves overwhelmed by the pressures associated with Forex trading.

Seek Professional Help

Seeking professional assistance may be beneficial for those feeling overwhelmed by the pressures of foreign exchange trading. Professional help can offer an objective perspective and provide strategies to help manage the feelings associated with addiction to foreign exchange trading.

Seeking support from family and friends is also important, as they can provide emotional support and understanding during this difficult time.

Additionally, connecting with financial counseling services or support groups focused on helping individuals overcome their addictions to foreign exchange trading can also be beneficial. These groups offer a safe place for individuals to share their struggles, find resources and gain insight into how other people are managing the same challenges. By joining these types of groups, individuals can learn from each other’s experiences while gaining vital skills that will enable them to break free from their addiction to foreign exchange trading.

Taking part in activities outside of forex trading may also help reduce cravings and build new interests away from currency markets.

Conclusion

In conclusion, “How to Stop Getting Addicted to Trading” is your beacon of wisdom in the dynamic world of finance. By recognizing the signs of addiction and implementing mindful strategies, you can steer clear of the pitfalls that trading obsession can bring. Remember, successful trading isn’t just about profits—it’s about long-term financial well-being.

Let this guide serve as your companion, reminding you to approach trading with intention, discipline, and a balanced perspective. With these tools in hand, you’ll navigate the markets with confidence and secure a prosperous financial future.

References

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

- Evaluation of the profitability of technical analysis for Asian currencies in the forex spot market for short-term trading

- Could a trader using only “old” technical indicator be successful at the Forex market?

Frequently Asked Questions

What Is the Best Trading Platform to Use?

When selecting a trading platform, it is important to consider factors such as risk management and trading psychology. To create a positive experience, look for platforms that provide tools to help manage your risk and offer education on best practices. Additionally, seek out communities or support networks offering resources and advice from experienced traders.

What Are the Best Strategies for Successful Forex Trading?

Successful forex trading requires strategic risk management and stop loss orders to ensure profits while mitigating losses. A compassionate, knowledgeable approach is key, as it creates a sense of belonging and understanding which can lead to greater success.

What Is the Minimum Investment Amount for Forex Trading?

The minimum investment amount for forex trading depends on the type of trading, such as day trading or margin trading. However, most brokers require a small initial deposit to open an account and start trading. Additionally, it is important to understand the risks associated with forex trading before investing any money.

Are There Any Automated Trading Systems Available?

Yes, automated trading systems exist that use real-time data and market analysis to make decisions without human intervention. Such systems can provide convenience and accuracy while allowing traders to remain in control of their investments with minimal effort. They can also support a sense of belonging by helping traders feel like part of a larger community.

How Much Time Should I Devote to Forex Trading?

When trading Forex, it is important to balance risk management and market analysis with appropriate amounts of time devoted to trading. Allocating enough time to study markets and develop strategies will ensure successful trades without becoming overly addicted or overwhelmed.

Unlock Your Style: How to Know Your Trading Style – Proven Methods 2023

Embarking on a successful trading journey begins with a crucial self-discovery process – understanding “How to Know Your Trading Style.” Your trading style is the blueprint that aligns your personality, risk tolerance, and financial goals with the right strategies. In this insightful guide, we unveil the methods to identify your unique approach, be it day trading, swing trading, or long-term investing.

By honing in on your strengths and preferences, you’ll be equipped to make informed decisions in the fast-paced world of finance. Join us on this illuminating journey, as we empower you to define a trading style that resonates with your individuality and financial aspirations.

Key Takeaways

- Assess your strengths and weaknesses in forex trading to understand where you need improvement.

- Evaluate your risk tolerance and financial management skills to determine your comfort level with taking risks.

- Set clear trading objectives and strategies that align with your risk tolerance levels and financial goals.

- Understand the time commitment required for forex trading and choose the appropriate trading platform that suits your needs.

How to Know Your Trading Style?

Discovering your Forex trading style involves assessing your risk tolerance, time availability, and financial goals. Here’s a step-by-step process to help you identify your trading style:

- Risk Tolerance Assessment: Evaluate how comfortable you are with taking risks. Are you more inclined towards conservative, moderate, or aggressive trading? Risk tolerance guides your choice of trading style.

- Time Commitment: Determine how much time you can allocate to trading. Day traders require constant monitoring, while swing and position traders have more flexibility.

- Trading Frequency: Assess how often you want to execute trades. Day traders engage in multiple trades daily, while swing traders hold positions for days or weeks, and position traders for months or even years.

- Market Analysis Preference: Consider whether you’re more inclined towards technical, fundamental, or a combination of both analyses. This choice influences your trading style.

- Goal Clarity: Define your financial goals. Are you looking for short-term gains, long-term wealth accumulation, or something in between? Your objectives shape your trading style.

- Psychological Endurance: Reflect on how well you handle stress and market volatility. Different styles have varying levels of emotional resilience requirements.

- Trial and Error: Experiment with different styles on a demo account. This hands-on experience can provide insights into which style aligns best with your preferences and strengths.

Remember, there’s no one-size-fits-all approach. Your trading style should align with your unique circumstances and personality traits. Adapting and refining your style over time is common as you gain experience and a deeper understanding of the Forex market.

Assessing Your Knowledge and Experience

Assessing knowledge and experience is an important step when determining a forex trading style. An individual must evaluate their own strengths and weaknesses, as well as their risk tolerance level before engaging in the forex market.

- To accurately assess one’s knowledge and experience, it is necessary to understand the basics of forex trading, such as the different types of orders, currency pairs, and technical analysis tools. Additionally, it is important to understand risk management principles and consider one’s emotional aptitude for trading – often referred to as ‘trading psychology’.

- Having a grasp of these topics will enable an individual to properly assess their current capabilities. It also allows them to identify any gaps in their understanding that could hamper their progress in becoming a successful trader.

- Furthermore, by understanding the risks associated with forex trading prior to entering the market, an individual can better determine which strategies are appropriate for them based on their financial objectives and risk appetite. Ultimately, assessing knowledge and experience is essential for traders who wish to find success in the foreign exchange market.

Analyzing Your Risk Tolerance

Analyzing risk tolerance is an important step in determining one’s approach to forex trading. It involves understanding the psychological and financial components of risk management in order to identify a comfort level with which to trade.

Here are three key elements to consider when assessing one’s risk tolerance:

- Psychological: Evaluating how comfortable traders are with taking risks, including their beliefs about losses and gains associated with trades, and their emotional reactions to them.

- Financial Management: Understanding the amount of available capital that can be used for trading, and setting limits on how much can be risked per trade or overall investment portfolio.

- Investment Objectives: Knowing what goals are desired from trading, such as short-term profits or long-term asset growth, so that appropriate strategies can be implemented.

Evaluating Your Trading Objectives

When evaluating trading objectives, it is important to first identify the goals one wishes to achieve. This should include short-term and long-term objectives as well as risk tolerance levels.

It is then necessary to set realistic expectations for returns and consider the amount of capital available for investing.

Identify Goals

Identifying goals is an essential part of understanding one’s own forex trading style. This involves evaluating what type of trader one wants to be, and assessing the amount of risk they are willing to take on. In order to minimize losses and control risk, it is important for a forex trader to set clear objectives and create achievable goals.

These objectives might include:

- Creating a disciplined strategy through which profits can be maximized

- Making sure that losses are kept at a minimum

- Setting realistic expectations regarding potential returns from investments.

Set Expectations

Setting expectations is a necessary component in forex trading to ensure that potential returns are realistic and losses can be minimized. Adapting goals based on market conditions and analyzing choices to determine the best approach for any given situation helps traders stay within their comfort zone while still making progress.

Determining an acceptable risk-reward ratio, setting stop loss and take profit points, as well as monitoring performance of a trading system all help create an environment of success. To increase confidence, it is important to understand how to work with what is available in terms of time, resources, and knowledge.

| Action | Benefit |

| Analyze Choices | Increase Confidence |

| Adapt Goals | Stay Within Comfort Zone |

| Set Stop Loss/Take Profit Points | Minimize Losses & Maximize Returns |

| Monitor Performance | Create Environment For Success |

Assess Risk

Assessing risk is an essential step in successful forex trading. Risk management involves determining the maximum amount of capital one can tolerate to lose, as well as strategies for preserving it.

- Identifying and avoiding high-risk trades

- Setting stop loss orders

- Establishing appropriate leverage.

All of this helps build a secure foundation that allows traders to focus on long term profitability while ensuring capital preservation.

With proper risk assessment, traders can understand their level of commitment and create a balanced approach to their forex trading style.

Understanding Your Time Commitment

Understanding your time commitment is essential when trading forex. It involves not only considering the amount of time available to devote to trading, but also how frequently one wishes to trade and whether or not a reliable schedule should be established for trading.

Time availability, trading frequency, and schedule planning are all important elements that must be taken into account when determining one’s approach to trading forex.

Time Availability

Considering the time availability of the trader is important when determining a forex trading style. Traders should assess how much time they can commit to trading each day, week, and/or month. This will help them identify strategies that are both psychologically manageable and potentially lucrative.

Firstly, they need to consider whether they have enough available time to monitor their trades closely or if they need an automated system.

Secondly, traders should evaluate if there is enough free time for them to practice technical analysis or formulate complex strategies.

Trading Frequency

Establishing successful trading frequency requires an individual to consider their available resources and psychological needs.

Technical Analysis and Fundamental Analysis are two key approaches traders can use to gauge the market for trade opportunities. By understanding the difference between these two strategies, a trader can create a schedule that balances their needs with the time they have available.

| Technical Analysis | Fundamental Analysis |

| Examines price/volume data | Addresses underlying economic factors |

| Analyzes past patterns | Follows news & public announcements |

Through careful consideration of resources and objectives, traders can plan out a schedule that will help them reach their goals. This transition into schedule planning is critical for successful forex trading.

Schedule Planning

Creating a schedule for trading is an integral part of achieving success in the foreign exchange market. The most successful traders are able to effectively balance their portfolio diversification with their psychological preparation. To do this, it’s important to:

- Establish a regular routine that allows time both for trading and other activities

- Utilize tools like calendars and reminders to ensure you’re taking advantage of optimal market conditions

- Prioritize rest and relaxation to maintain the energy needed for effective trades.

Determining Your Trading Methodology

Analyzing one’s trading methodology can help identify one’s forex trading style. Risk management and money management are two key components of a successful strategy when it comes to foreign exchange trading.

By assessing the risks involved in each trade, traders can determine their level of comfort with different trades and make decisions accordingly. Money management involves setting limits on how much to invest in a particular trade, as well as setting stop-loss points to limit losses in the event that the price moves against the trader’s position.

Furthermore, this analysis should consider both short-term and long-term objectives and strategies for reaching them. For example, day traders tend to focus on shorter time frames while swing traders look at opportunities over longer periods of time.

Defining Your Trading Strategy

Having discussed the importance of determining one’s trading methodology, it is equally important to define a trading strategy. A trader must have a well-defined strategy that covers both entry and exit points as well as risk management. This will enable them to achieve their financial goals with minimal risk.

To create an effective strategy, traders should consider the following:

- Risk Management: It is essential to set up risk management parameters that help protect capital against unexpected losses or market movements.

- Financial Goals: Knowing what you hope to gain from trading and setting realistic goals can assist in developing an appropriate strategy.

- Analytical Skills: Traders need to develop their analytical skills in order to interpret price action and identify potential opportunities for entering and exiting trades successfully.

Developing a successful forex trading strategy requires discipline, dedication, and time; however it can be accomplished if done correctly. Having a clear understanding of the markets will help traders determine which strategies work best for them and ultimately lead them towards achieving their financial goals while managing risks effectively.

Choosing Your Trading Platform

Choosing an appropriate trading platform is a critical step in the forex trading process. It is essential to understand what features are available and how they might fit into one’s particular trading strategy, such as technical indicators and leverage strategies.

The various platforms offer different tools that can be used in designing successful trading strategies. It is important to select a platform that has the necessary features for traders to be able to identify beneficial trades and execute them quickly.

In addition, understanding the interface of the platform is crucial, as it needs to provide easy access to information about current market conditions and news updates. This enables traders to remain informed of changes in the market and make sound decisions when entering or exiting trades.

Furthermore, some platforms offer additional services such as automated order execution which can help improve overall performance by minimizing losses due to human error or overtrading.

The choice of platform should also take into account security concerns as many platforms have suffered from data breaches in recent years. Therefore, proper research must be conducted before selecting a platform so that users feel safe using it for their trading activities.

Additionally, factors such as cost, customer service availability and ease of use should also be taken into consideration when choosing a suitable forex trading platform.

Keeping Track of Your Performance

Tracking performance is an important part of forex trading in order to gauge the success of a strategy. To ensure that traders are getting the most out of their trades, it is important to keep track of how well they are performing as this can be used to identify areas needing improvement or opportunities that may have been missed.

Charting results from each trade and keeping tabs on any trends or patterns in the data is a great way to measure progress over time. Additionally, taking note of your emotions while trading can help you better understand your trading psychology and determine whether certain approaches work better for you than others.

By tracking performance, traders can make more informed decisions when it comes to future trades and position themselves to maximize gains.

- Monitor charts for trends and patterns in data

- Take note of emotions when making trading decisions

- Use feedback loops to adjust strategies based on past performance

Monitoring Your Emotional State

Recording one’s emotional responses while engaging in forex trading can provide insight into the effectiveness of certain approaches. This is especially important for those who are looking to develop a disciplined trading style, as emotions can often interfere with rational decision making. Understanding how to manage and process these emotions can help prevent stress and burnout from impacting performance.

While it may be difficult to remain conscious of one’s emotional state during trading, there are several methods that traders can employ to better monitor their feelings.

One such method is journaling which allows traders to review their thoughts and note any patterns that emerge in terms of when they experience the strongest emotional reactions. By understanding what triggers these responses, they can then begin formulating strategies for avoiding similar situations in the future or dealing with them effectively when they do arise.

Additionally, creating a checklist of sorts with reminders on how best to handle certain scenarios could also prove beneficial.

Finally, having an accountability partner who is familiar with your goals and objectives as a trader can be very helpful in providing feedback on areas where personal discipline needs improvement or offering support during times of emotional distress.

Ultimately, by maintaining awareness of our own mental states we have greater potential for success when it comes to managing risk and achieving long-term profitability in forex trading.

Conclusion

In conclusion, “How to Know Your Trading Style” is the pivotal first step towards becoming a successful trader. By recognizing your strengths, preferences, and risk appetite, you can align your approach with the style that resonates most with you. This self-awareness allows you to make decisions that are in harmony with your trading objectives and lifestyle.

As you embark on this journey, let this guide serve as your trusted companion, providing valuable insights and empowering you to navigate the financial markets with confidence and precision. With a clear understanding of your trading style, you’re poised to make informed decisions that pave the way for long-term success in the dynamic world of trading.

References

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

- Evaluation of the profitability of technical analysis for Asian currencies in the forex spot market for short-term trading

- Could a trader using only “old” technical indicator be successful at the Forex market?

Frequently Asked Questions

What Are the Risks Associated With Forex Trading?

Currency hedging and automated signals are two strategies used in forex trading, but they both carry risks. In particular, currency hedging can lead to unexpected losses due to changes in the exchange rate. Additionally, automated signals may not be accurate or reliable enough to generate profitable returns. Therefore, careful consideration is required when assessing these strategies for forex trading.

How Much Money Should I Invest in Forex Trading?

When considering forex trading, it is important to use effective risk management strategies and employ reliable trading techniques. It is wise to start with a small investment amount and gradually increase funds as one’s experience grows.

What Is the Best Way to Start Learning About Forex Trading?

Understanding the fundamentals of forex trading is paramount to success. Diversion trading and money management are key components to consider. Taking courses, reading articles, or watching tutorials can be beneficial ways to start learning. Additionally, joining a community of experienced traders may provide insight into the complexities of the market and equip one with the tools they need for long-term success.

What Are the Advantages and Disadvantages of Automated Forex Trading?

Automated forex trading utilizes Artificial Intelligence to manage currency trades and leverage risk. Advantages include fewer errors, faster execution, and reduced cost; disadvantages include lack of customization and an inability to adjust quickly to changing market conditions.

How Do I Know When to Exit a Trade?

Navigating the market successfully requires identifying emotional traps, analytically calculating risk management, and methodically exiting when predetermined conditions are met. Such precision will provide a sense of belonging for any forex trader.

Unlocking Potential: Forex Trading Without Investment – Strategies 2023

Embark on a journey of financial empowerment with “Forex Trading Without Investment.” This innovative approach to the foreign exchange market opens doors for aspiring traders, allowing them to explore the world of forex without the need for substantial capital.

By leveraging demo accounts, educational resources, and strategic insights, traders can gain valuable experience and refine their skills before committing real funds. In this comprehensive guide, we unravel the strategies and tools that enable you to kickstart your forex trading journey without a significant initial investment. Join us as we empower you to navigate the forex market with confidence, laying the foundation for potential long-term success.

Key Takeaways

- Forex trading without investment allows for low-risk learning and experience.

- Traders can build their knowledge base without financial risk.

- Free access to training materials, resources, economic calendars, and price charts is available.

- Trial accounts provide a simulated platform for practice trades.

What Is Forex Trading

Trading foreign currencies, or forex trading, is a financial activity that involves exchanging one currency for another in order to make profits. It is the largest and most liquid market in the world, with an estimated daily turnover of over $6 trillion.

Technical analysis is used by traders to identify potential entry and exit points in the markets. This involves studying price charts and other data to identify trends and patterns which can be used to forecast future prices.

Currency pairs are another important concept in forex trading; these refer to two different currencies that are simultaneously traded against each other. Traders must understand how these pairs interact with each other in order to make informed decisions about their trades.

Forex trading also requires knowledge about risk management strategies such as stop-loss orders and leverage, as well as understanding how economic events affect exchange rates.

While forex trading does not require any investments up front, it does carry risks associated with speculative investing such as slippage, liquidity risk, counterparty risk, etc., so traders should always ensure they have sufficient capital reserves before entering into any trades.

Benefits of Doing Forex Trading Without Investment

Trading without investment can be a beneficial way to learn and gain experience in the Forex market. One of its key features is that it carries low risk since investors are not required to use real money.

Additionally, it also provides free access to training materials and resources for those who want to get familiar with the basics before investing actual funds.

As such, trading without investment can help traders build their knowledge base while minimizing exposure to financial risk.

Low Risk

Lowering risk when trading in the forex market without investment can be achieved with strategic planning and analysis.

- Short Selling: Taking a position in a security with the aim of profiting from a decline in its price.

- Leverage Trading: Utilizing borrowed capital to increase gains produced through investments.

- Technical Analysis: Examining past prices and trends to forecast future performance of a financial instrument.

- Fundamental Analysis: Assessing economic indicators, such as inflation rates, political stability, and other factors that might affect currency exchange rates.

Free Access

Many traders take advantage of free access to resources such as economic calendars, currency news, and price charts in order to make more informed trades. Free access gives them a great opportunity to practice different trading strategies without investing any real money. This is possible with trial accounts, which allow users to open a simulated account with virtual funds and use it for practice trades.

Additionally, these accounts can be used as a platform to test different strategies and techniques before finally investing real capital. Moreover, free access also allows traders to monitor market developments and research the latest trends in the forex industry without risking their own capital.

As such, it provides an invaluable resource for traders who are looking to find success in the forex market without investing substantial amounts of money.

Strategies for Trading Without Investment

Investing without capital can be achieved through the implementation of various strategies. Forex trading is one of the most popular methods for trading without an investment, although it does come with its own risks. In order to successfully navigate forex trading without an investment, there are certain strategies that should be implemented:

Strategy Selection

- Identify a method of trading that you are comfortable with and familiarize yourself with the tools available to support your strategy.

- Research different types of investments and choose one based on your experience level and risk appetite.

Risk Analysis

- Analyze potential risks associated with each trade, such as leverage or market volatility.

- Use stop loss orders to limit losses in case the market moves against you.

Tools and Resources for Trading Without Investment

Trading without investment presents certain challenges. One of these challenges is risk management. To successfully engage in forex trading without investment, it is important to have access to tools and resources that can help manage risks. These tools and resources include understanding the market and having knowledge of factors such as economic indicators, political developments, international trade agreements, and other key elements that influence the global currency markets.

Risk Management

Risk management is essential for successful forex trading without investment. The psychological preparedness and financial planning of the trader are paramount in minimizing risk exposure when trading without investment.

To ensure this, traders should consider:

Psychological Preparedness:

- Having a long-term strategy

- Maintaining emotional control during market volatility

Financial Planning:

- Determining how much capital to allocate to each trade

- Adhering to predetermined stop loss levels and profit targets

Market Knowledge

When trading in the Forex market, it is essential to have a good understanding of the financial markets. This knowledge should include both technical and fundamental analysis. Technical analysis involves analyzing past price movements and chart patterns to predict future price movements. On the other hand, Fundamental Analysis looks at economic indicators such as GDP growth, inflation rates, unemployment rates, etc., to determine how they may affect currency values.

The following table summarizes some of the key concepts related to market knowledge:

| Concept | Description | Examples |

| Technical Analysis | Examines historical data to predict future prices | Support/Resistance levels Moving averages Chart Patterns |

| Fundamental Analysis | Investigates economic factors that influence currency values | GDP Growth Inflation Rates Interest Rates |

Risks Associated With Trading Without Investment

Without making an investment, engaging in foreign exchange trading carries certain risks. Although there may be potential for high profits, the lack of capital can often result in a trader taking on higher than normal risks. This can have potentially serious consequences if not monitored and managed carefully. Additionally, without the resources and/or experience with which to understand the markets and develop a successful strategy, it is possible to incur large financial losses.

The risks associated with trading without investment include:

Not Being Prepared:

- Not having the knowledge or skills necessary to make informed decisions

- Not having sufficient practice sessions to become familiar with leverage strategies

Unrealistic Expectations:

- Setting goals that are too ambitious and unlikely to be achieved

- Failing to recognize when the market conditions are rapidly changing

Tips for Trading Without Investment

In order to mitigate the potential risks associated with engaging in foreign exchange trading without investment, it is important to employ certain strategies.

- Alternative markets, such as stock and commodity exchanges, can provide traders with relatively low-risk opportunities for trading without investment.

- Additionally, traders should develop a thorough understanding of risk management and diversification strategies to protect their capital from losses. Utilizing stop losses are also highly recommended when engaging in any form of currency trading.

- Additionally, implementing proper position sizing can help minimize the risk of overexposure to a particular market.

- Traders should also consider utilizing various trading strategies that allow them to benefit from fluctuations in currency prices without having to invest large amounts of capital upfront. This includes using leverage or margin accounts which enable investors to open positions larger than the amount of money they have available for trading.

Conclusion

In conclusion, “Forex Trading Without Investment” presents a unique opportunity for individuals to enter the dynamic world of forex trading without the need for a substantial financial commitment. Through the use of demo accounts and access to educational resources, traders can hone their skills and develop a deep understanding of the market.

As you explore this approach, remember that while it offers a risk-free environment, transitioning to live trading with real capital requires careful consideration and a solid trading plan. Let this guide be your starting point, providing you with the knowledge and tools to embark on a forex trading journey that aligns with your financial goals and aspirations.

References

- Technical indicators for forex forecasting: a preliminary study

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

- FOREX Trading and Investment

- Intraday FX trading: An evolutionary reinforcement learning approach

Frequently Asked Questions

What Is the Minimum Amount of Money Needed to Start Trading Without Investment?

Practice trading with demo accounts requires no minimum amount of money. This allows individuals to practice and gain experience without risking capital. Demo accounts are an ideal way to learn how to trade forex without investment, allowing users to develop strategies in a safe environment.

Are There Any Automated Tools or Programs Available to Help With Trading Without Investment?

Exploring the pros and cons of automated tools for market analysis, one can consider the potential gains that come from their use. With a careful assessment of risk versus benefit, such solutions may provide an opportunity to trade in the absence of investment.

What Are the Potential Tax Implications of Trading Without Investment?

Outsourcing costs and leverage strategies can have significant implications for taxation when trading without investment. It is important to consider the potential financial risks associated with such strategies, as well as potential tax liabilities.

Is It Possible to Make a Living Trading Without Investment?

It is possible to make a living trading without investment, if one has a strong understanding of the psychology of trading and risk management strategies. To do so, traders must be disciplined and carefully manage risks associated with their trades.

What Are the Best Strategies for Risk Management When Trading Without Investment?

Imagining a tightrope walker balancing precariously, one can relate to the importance of risk management when trading. Utilizing short term strategies and prudent money management are key to success. Analysing trends and taking calculated risks can help ensure profits over losses. Achieving balance between caution and boldness is essential for traders without investment.

Insights: Futures Trading vs Forex – Understanding the Variances 2023

Embarking on a journey in the financial markets presents a crucial choice: “Futures Trading Vs Forex.” Each avenue offers distinct opportunities and challenges, catering to different trading styles and risk appetites. Futures trading involves contracts to buy or sell an asset at a predetermined price on a specified future date, providing a structured approach to speculation.

Conversely, Forex (foreign exchange) trading centers on the dynamic world of currency pairs, where traders aim to profit from fluctuations in exchange rates. In this comprehensive guide, we’ll dissect the nuances of both, arming you with the knowledge to make informed decisions and navigate the world of trading with confidence.

Key Takeaways

- Futures trading involves contractual agreements to buy or sell assets, while forex trading is the global market for trading currencies.

- Futures trading allows for potential returns and risk management opportunities, while forex trading offers volatility for potential profits.

- Futures trading provides access to sophisticated trading tools and leverage to increase profits, while forex trading offers greater market exposure due to liquidity and lower fees compared to futures trading.

- Risks of futures trading include potential losses due to market fluctuations, open margin requirements, and leverage risks, while risks of forex trading include regulatory oversight, leverage risks, and the importance of risk management.

What Is Futures Trading

Futures trading is a form of derivatives trading that involves taking on contractual agreements to buy or sell certain assets at an agreed-upon price at a predetermined date in the future. It is typically used as a hedging tool, allowing traders and investors to manage their exposure to market movements, timing risk, and other factors. Futures contracts are highly leveraged investments, which means that they require only small margin requirements relative to the notional value of the underlying asset.

The ability to enter into futures contracts gives traders flexibility in terms of positioning themselves in different markets based on their expectations for prices and trends. This can be beneficial for those who want to diversify their portfolio with different kinds of investments while mitigating risks associated with volatile markets.

What Is Forex

Foreign exchange (FX) is a global market for the trading of currencies. It is one of the world’s most liquid, regulated markets and has become increasingly popular over the past decade. The main features of Forex trading include:

- Low cost – There are no commissions or fees associated with trading in Forex, making it a highly cost-effective way to invest;

- Leverage – Traders can use leverage to increase their potential returns; and

- 24-hour access – Unlike futures trading, FX markets are open 24 hours a day, seven days a week, allowing traders to take advantage of market movements whenever they occur.

In addition to these key features, another important factor in successful Forex trading is psychology. As with any type of investment there are risks associated with Forex and traders need to be aware of their own risk tolerance and create an appropriate strategy that allows them to manage their emotions effectively while still taking advantage of potential gains from the market movements.

Futures Trading Vs Forex

Futures trading and Forex (foreign exchange) trading are distinct financial markets with unique characteristics:

| Aspect | Futures Trading | Forex Trading |

| Market Focus | Buying and selling standardized contracts for commodities or financial instruments with delivery set for a future date. | Exchange of one currency for another in the foreign exchange market. |

| Underlying Assets | Tangible assets (e.g., commodities, financial instruments) | Currency pairs (e.g., EUR/USD) |

| Leverage | Generally lower leverage levels; margin requirements set by exchanges. | High leverage, allowing control of larger positions with a relatively small amount of capital. |

| Market Hours | Trading hours determined by the exchange and underlying asset. | Operates 24 hours a day, five days a week due to the global nature of the currency market. |

| Regulation | Regulated by bodies like the U.S. Commodity Futures Trading Commission (CFTC) and regulated exchanges. | Regulatory oversight varies by jurisdiction; no centralized exchange. |

| Costs | Incur additional costs like commissions and exchange fees. | Often lower transaction costs as it’s an over-the-counter market. |

| Risk Exposure | Specific risks related to the underlying asset (e.g., supply and demand dynamics, geopolitical events, weather conditions). | Mainly influenced by economic indicators, central bank policies, and geopolitical events; less direct exposure to specific asset risks. |

| Trading Styles | Suitable for a wide range of trading styles including day trading, swing trading, and position trading. | Highly liquid and suitable for various trading styles including scalping (short-term), day trading, and long-term investing. |

Remember, the choice between Futures and Forex trading depends on individual preferences, risk tolerance, and trading objectives. Both markets offer unique opportunities for traders with different preferences and objectives. It’s crucial to conduct thorough research and consider personal circumstances before engaging in either market.

Advantages of Futures Trading

Investors may find advantages in futures trading due to its ability to provide potential returns as well as risk management opportunities. Futures contracts are standardized agreements that allow an investor to buy or sell a certain asset at a fixed price on a predetermined date. This type of financial instrument can be used for hedging against price fluctuations and diversifying portfolio investments.

In addition, traders have access to sophisticated trading tools like algorithmic trading, charting packages, and other technical analysis tools. All of these features make futures trading attractive for many investors.

Futures markets also offer the advantage of leveraging capital using margin accounts which can increase profits from successful trades while limiting losses from unsuccessful ones. The use of leverage should be employed with caution though, since it magnifies both gains and losses. Risk management strategies such as stop-loss orders are essential when taking advantage of this feature so that losses can be minimized in case of unfavorable market conditions.

Advantages of Forex

Forex trading is a form of investment that offers various advantages to traders.

One of the primary benefits of Forex trading is its volatility, which allows traders to potentially make substantial profits.

Another benefit is the access to leverage, which allows investors to control larger positions with a smaller capital outlay.

Volatility

Comparing the volatility of futures trading and forex, there are distinct differences between the two markets. When it comes to speculative investing, forex offers greater market exposure due to its higher liquidity.

Futures trading can be more risky due to the leverage associated with it:

- Leverage allows traders to open larger positions than their capital would normally allow.

- Volatility increases when a trader takes on too much risk by using too much leverage.

- Leverage also magnifies losses if trades do not go as planned.

These risks must be taken into consideration when deciding which market is best for an individual’s portfolio strategy. By understanding these differences in volatility, traders can make more informed decisions about where they should allocate their resources for maximum return on investment. Leverage plays a critical role in this decision-making process and will be discussed in detail in the next section.

Leverage

Leverage is a financial tool that can magnify both gains and losses in speculative investments. It enables traders to open larger positions with less capital, which provides the opportunity for greater potential returns but also carries higher risks. Leverage has different implications for forex trading compared to futures trading, particularly when it comes to risk management and capital preservation.

| Futures Trading | Forex Trading |

|---|---|

| Margin accounts have limited leverage | Higher leverage is available |

| Lower risk of margin calls due to exchange-defined limits on maximum leverages | No exchange-defined limits on maximum leverages |

| Greater liquidity | Lower liquidity than futures markets |

Liquidity

Moving from the topic of Leverage, Liquidity is another important factor to consider when trading Futures and Forex. It is essential for traders to have access to cost-efficient markets in order to make informed decisions on their trades. To achieve this:

- Knowing the liquidity of different assets will help a trader choose which one provides more advantageous market access.

- Understanding the spreads and fees associated with each asset will provide insight into cost efficiency and overall profitability.

- Being aware of any potential slippage or price gaps can prevent losses due to unexpected price movements during times of low liquidity.

Overall, it is crucial for traders to recognize how liquidity affects their trades so that they can make informed decisions on their investments in both Futures and Forex markets.

Differences Between Futures Trading and Forex

Analyzing the differences between futures trading and forex can help traders understand which type of financial instrument is best suited to their individual needs.

Futures contracts are a form of derivative trading, meaning they derive their value from an underlying asset, such as commodities or cryptocurrency.

Forex is a spot market that trades currency pairs. Trading with margin is available with both types of instruments but it carries higher risks for futures traders since losses can be greater than what was initially invested.

On the other hand, forex offers a wider variety of currency pairs and has no expiry date; there is always a buyer and seller in the market making it highly liquid. Additionally, the leverage offered by forex brokers tends to be higher compared to those offering futures contracts.

Lastly, when considering fees associated with each type of instrument, typically broker fees for futures trading are much higher than those associated with forex due to larger complexities in executing trades on exchanges.

This transition into looking at the risks of futures trading provides a more comprehensive understanding when comparing these two instruments.

Risks of Futures Trading

Futures markets are particularly volatile and can be risky for inexperienced traders. There are three main risks associated with futures trading that should be considered before entering into a contract:

- Market Impact – Markets can move quickly, leading to potential losses due to unforeseen market fluctuations or sudden changes in market sentiment.

- Open Margin – When trading futures, there is an open margin requirement that must be met at all times in order to keep a position open. If the margin requirements are not met, then positions may need to be closed quickly which could result in further losses.

- Leverage Risk – Leveraged instruments such as futures contracts offer high potential returns but also carry higher levels of risk compared to traditional investments due to their leverage structure. As such, it is important for traders to understand the leverage risk before entering into any leveraged instrument so they can make more informed trading decisions and manage their risk accordingly.

It is essential that individuals who wish to trade futures do so with caution and have a thorough understanding of the associated risks before making trades. This will allow them to protect themselves from any potentially damaging outcomes resulting from unforeseen market movements or other factors affecting their positions.

Risks of Forex

The risks of trading forex must be considered before entering into a position in the market. Many traders underestimate the importance of risk management, often with unfavorable results.

Regulatory oversight is one of the major risks for FX traders, since there is no central authority governing this global market and it can be difficult to determine whether or not an individual broker follows all applicable rules and regulations.

Leverage also plays a role in FX trading, as it can magnify both gains and losses; this means that traders must be aware of their risk tolerance before entering into a trade.

Additionally, trading psychology can have an effect on how successful someone is when trading currencies. This involves avoiding emotional decisions and understanding proper money management techniques such as setting stop-losses to help protect against large losses.

Ultimately, considering these various risks will help traders make more informed decisions regarding forex trading and improve their chances for success.

Strategies for Trading Futures

When trading futures, it is important to understand the different strategies that can be employed. Short selling and profit taking are two of the most popular methods used by traders.

- Shortselling involves borrowing a contract from a broker and then selling it in anticipation of prices dropping in the future. Once this occurs, the investor can buy back the contract at a lower price and return it to the broker for a profit.

- Profit taking is when an investor purchases contracts and sells them once they have increased in value. This method allows investors to capitalize on market trends while mitigating their risk exposure by avoiding holding onto contracts for extended periods of time.

- Another strategy often utilized is spreading, which involves buying one type of futures contract while simultaneously selling another type with similar characteristics but different expiration dates or delivery points. This enables traders to take advantage of fluctuations in pricing over time without necessarily needing to predict trends accurately in order to make money on their trades.

These strategies can help traders maximize profits when trading futures markets, however they should always be employed with caution as there are inherent risks associated with any kind of investment activity. With proper preparation and research these risks can be minimized making futures trading a potentially lucrative endeavor for those willing to invest their time properly into learning how these markets work before getting involved with real money transactions.

Strategies for Trading Forex

Investing in foreign exchange (forex) markets presents an opportunity for traders to capitalize on currency price movements. Strategies used to trade forex are similar to those used when trading futures, such as Fundamental Analysis and Technical Analysis.

- Fundamental Analysis focuses on macroeconomic indicators, which may include analyzing the political environment and economic data of a country or region to make predictions about how its currency will fare against others.

- Technical Analysis is based primarily on analyzing past market performance through the use of charts and other tools, making predictions about future prices based on this information.

Both strategies can be effective when trading forex.

Nevertheless, it is important that traders understand the risks involved with forex trading before entering into any trades. Leverage can increase potential gains but also carries greater risk than other forms of investing; thus, it is important for traders to practice sound money management techniques when engaging in this type of trading activity.

Additionally, due to the global nature of the forex market, there are certain geopolitical considerations that should be taken into account prior to entering a position in order to maximize profits while minimizing losses.

Tax Implications of Futures Trading and Forex

Tax implications of futures trading and Forex must be understood in order to make informed decisions about investments. Tax rules applicable to these investments differ from standard income tax regulations, providing certain potential benefits for traders, but also imposing additional liabilities.

It is important to understand the specifics of taxation related to futures trading and forex in order to benefit from the unique financial opportunities they provide while avoiding penalties or other legal consequences.

Tax Rules

The taxation of futures trading and forex trading generally follows the same guidelines. These include:

- A trader’s cost basis in a contract must be reported on a tax return.

- Short-term capital gains are taxed at the ordinary income rate, while long-term capital gains are taxed at a lower rate.