Strategic Trading: How to Trade Head and Shoulder, Cup and Handle Chart Patterns 2023

Embark on a journey into the art of technical analysis with our guide on “How to Trade Head and Shoulder, Cup and Handle Chart Patterns.” These patterns, like guiding constellations in the financial sky, offer critical insights for traders. The head and shoulder pattern signals potential trend reversals, while the cup and handle pattern indicates a bullish continuation.

Learn to decipher these visual cues and leverage them for more informed trading decisions. This guide illuminates the intricacies of pattern recognition, providing you with a powerful arsenal in your trading toolkit.

Key Takeaways

- Understanding and identifying chart patterns such as head and shoulder and cup and handle can provide traders with an edge in the market.

- Both head and shoulder and cup and handle patterns are reversal patterns that require attention to detail and analytical thinking to interpret.

- Price action signals, such as breaking through support or resistance levels, increasing momentum, volume changes, and significant pullbacks, can indicate potential trend reversals.

- Establishing entry and exit strategies, managing risk through proper risk management and setting appropriate targets, are essential for successful trading.

Understanding Chart Patterns

Chart patterns are a common technical analysis tool used to evaluate the potential direction of an asset’s price. They can be used as an essential building block for gaining confidence in reading charts and making data-driven decisions.

Head and shoulder, cup and handle chart patterns are among the most popular tools used by traders when analyzing financial markets. These chart patterns can provide valuable insights into the psychology of market sentiment and indicate possible future price movements.

The head and shoulder pattern is created by a series of three peaks, with the middle peak being higher than those on either side. This pattern suggests a potential reversal in the current trend, with the price likely to move downwards after the formation is complete.

On the other hand, the cup and handle chart pattern forms a ‘u’ shape, with a handle appearing at one end that signals buying or selling pressure. This pattern is often seen as a bullish sign, indicating that the price may continue to rise after the handle formation.

Both these patterns offer useful clues for traders looking to capitalize on short-term price movements or longer-term trends in markets. By identifying and understanding these patterns, traders can have an edge over other participants in the market.

It is important to thoroughly understand these chart patterns before entering any trade. This knowledge allows traders to make informed decisions and increases their chances of success in the market.

Common Characteristics of Head and Shoulder and Cup and Handle Patterns

Both Head and Shoulder and Cup and Handle are technical chart patterns that share certain characteristics. Measuring volume, analyzing trends, attention to detail, analytical thinking, data-driven decisions are all key components of interpreting these charting techniques.

| Characteristic | Head & Shoulder | Cup & Handle |

|---|---|---|

| Reversal Pattern? | Yes | Yes |

| Volume Measurement? | Yes | Yes |

| Trend Analysis? | Yes | Yes |

| Attention to Detail? | Yes | Yes |

When examining a Head and Shoulder pattern on a chart, traders will look for three successive peaks in the price action. The middle peak should be higher than the other two peaks surrounding it. Additionally, volume should decrease as each successive peak is reached – this is an indication that the buyers have become exhausted with each new peak and sellers have taken control of pricing.

A cup and handle pattern is slightly different in that it consists of two distinct parts: a rounded bottom or “cup” formation followed by a flat or almost flat “handle” formation at the top of the cup shape. Traders will often use trendlines to help define these formations as they can indicate when buying pressure has weakened or when selling pressure has increased during both types of chart patterns.

How to Trade Head and Shoulder, Cup and Handle Chart Patterns?

Trading head and shoulders, cup and handle chart patterns involves identifying and capitalizing on specific technical patterns in financial charts. Here’s a concise guide on how to trade these patterns:

Trading Head and Shoulders Pattern:

The Head and Shoulders pattern is a popular chart formation signaling a potential trend reversal. It comprises three peaks: the left shoulder, head, and right shoulder, with the head being the highest point. To trade this pattern, follow these steps:

Identify the Pattern: Look for the distinctive shape with three peaks and two troughs. The head should be higher than the shoulders.

Confirmation: Wait for the price to break below the neckline (the line connecting the lows of the two shoulders). This validates the pattern.

Set Stop-Loss and Target: Place a stop-loss just above the right shoulder. Determine a target by measuring the distance from the head to the neckline, and project it downwards from the breakout point.

Trading Cup and Handle Pattern:

The Cup and Handle is a bullish continuation pattern. It resembles the shape of a tea cup with a handle. Follow these steps to trade it:

Identify the Pattern: Look for a rounded bottom (the cup) followed by a consolidation period with a slight downward drift (the handle).

Confirmation: Once the price breaks above the resistance level formed by the top of the cup, the pattern is confirmed.

Set Stop-Loss and Target: Place a stop-loss just below the lowest point of the handle. Calculate a target by measuring the depth of the cup and projecting it upwards from the breakout point.

Remember, these patterns are not foolproof and should be used in conjunction with other technical indicators and risk management strategies for more reliable trading decisions.

Identifying Key Price Action Signals

Analyzing key price action signals can be a critical part of interpreting technical chart patterns. When identifying triggers, it is important to look for specific elements in the pattern that indicate potential entry or exit points. These include:

- Price breaking through support or resistance levels

- Momentum increasing above a certain threshold

- Volume changes indicating the trend may reverse

- Significant pullbacks from previously established highs or lows

- Increasing divergence between price and indicators such as moving averages.

Analyzing trends and recognizing these signals can improve trading decisions by providing insight into when to enter or exit trades. Furthermore, understanding how to identify these signals will help traders make informed decisions based on data-driven evidence rather than relying on guesswork.

Attention to detail and analytical thinking are essential skills for accurately predicting market movements and taking advantage of opportunities as they arise. By using these strategies, traders can increase their chances of success and achieve greater belonging within the trading community.

Recognizing Reversal and Continuation Patterns

Recognizing price patterns such as reversals and continuations can assist traders in determining the direction of future price movements. By developing strategies based on these patterns, traders can identify potential opportunities to enter or exit a trade.

It is important for traders to keep in mind that price patterns are not infallible indicators of future trends, but rather signs that require further analysis. For instance, when recognizing reversal patterns like head and shoulders or cup and handle, it is essential to consider other factors such as volume levels and volatility.

Protective stop losses should also be used when trading with these patterns to help limit any losses incurred if the pattern does not play out as expected. With proper analysis of the charts combined with a well-thought-out strategy, traders may find themselves able to capitalize on potential price movements associated with reversal or continuation patterns.

Establishing entry and exit strategies will be discussed further in the next section.

Establishing Entry and Exit Strategies

When trading a financial instrument, establishing entry and exit strategies is essential. Identifying signals when to enter or exit a trade can be done through various methods such as technical analysis or fundamental analysis.

Additionally, risk management must be present in order to ensure the preservation of capital and maximize profits.

Lastly, setting targets for profit-taking and stop-loss orders are crucial tools that help traders secure their gains while mitigating losses.

Identifying Signals

Identifying signals of head and shoulder, cup and handle chart patterns is a complex process. To successfully identify these signals, traders must bring together their trading psychology with chart analysis:

- Understand the fundamentals of technical analysis

- Utilize trendlines to identify support and resistance levels

- Monitor volume for confirmation of breakouts or reversals in price action

- Analyze potential reward versus risk ratios before entering a trade

- Utilize momentum indicators to confirm if the current trend will continue.

Traders must use their analytical thinking and attention to detail coupled with data-driven decisions to ensure that they are making sound trades that will help them achieve their desired goals.

Managing Risk

Managing risk is an essential part of any successful trading strategy. Protecting capital and managing exposure are key elements to consider when trading head and shoulder or cup and handle chart patterns. Risk management involves assessing market conditions, determining the amount of capital to put at risk, setting stop-loss levels, and limiting leverage. By taking these steps, traders can limit losses while still retaining the opportunity for profit if the trade works out in their favor.

| Asset Class | Capital Allocation | Stop-Loss Level |

|---|---|---|

| Stocks | 10% – 20% | +/- 5% |

| Futures Contracts | 2%-5% | +/- 1% – 2% |

| Forex Pairs or CFDs | 1%-2% | +/- 0.5%-1% |

Setting Targets

Establishing appropriate target levels is an important component of successful risk management when trading financial instruments. Target setting requires careful consideration in order to maximize profitability and minimize losses. To succeed, investors must take into account the following factors:

- Stop losses: Setting stop loss orders can help limit downside risks.

- Expected profits: Estimating potential gains based on previous trends and market conditions allows traders to set realistic profit targets.

- Risk-reward ratio: The ratio should be reasonable for a particular trade, as excessive risk may lead to greater losses than expected.

- Risk tolerance: Knowing one’s risk appetite helps ensure that target levels are set according to one’s individual goals and objectives.

- Profit taking: Taking profits at certain intervals helps investors lock-in gains while managing overall portfolio performance.

Utilizing Risk Management Strategies

Risk management is an essential component of trading. Identifying risks and mitigating potential losses are two key components of effective risk management.

Identifying Risk

Analyzing the risk associated with head and shoulder, cup and handle chart patterns can be a complex process. To ensure potential losses are minimized, it is important to recognize the importance of an effective risk management strategy:

- Considering the data to identify any potential risks

- Establishing contingencies for unanticipated events

- Understanding the likelihood of different outcomes

- Assessing how much capital loss is acceptable

- Utilizing analytical skills to make informed decisions

By taking these steps, investors can gain insight into possible risks while still making sound financial decisions that honor their values and goals.

This understanding can help mitigate losses as they trade head and shoulder, cup and handle chart patterns, leading them closer towards their investment objectives.

Mitigating Losses

Utilizing an effective risk management strategy can help to mitigate losses associated with financial decisions. Stop losses are essential tools used by traders for minimizing potential losses on a trade, by automatically closing a position when it reaches a predetermined price level. This type of protective measure can be utilized in head and shoulder, cup and handle chart pattern trading to limit the amount of capital at risk.

Through attention to detail and analytical thinking, data-driven decisions can be made that will enable traders to protect their investments while still allowing them to capitalize on profit opportunities. Understanding how stop losses work and properly implementing them into one’s trading strategy is key to maximizing returns while minimizing risk exposure.

Backtesting and Optimizing Results

Backtesting and optimizing results is a highly effective way to determine the success of trading head and shoulder, cup and handle chart patterns. By backtesting strategies, traders can use alternative indicators to gauge potential returns, assess the effectiveness of stop losses, and analyze how different market conditions may affect their trades. Additionally, optimization techniques enable traders to identify the best combination of parameters for their individual goals and risk appetite.

To maximize profits while mitigating losses, consider these tips:

- Use backtesting software to simulate multiple scenarios

- Identify optimal entry and exit points using alternative indicators

- Set realistic stop-losses commensurate with risk tolerance

- Take into account different market conditions when trading

- Perform ongoing tests to ensure consistency in results

Conclusion

In conclusion, understanding and effectively trading Head and Shoulder, Cup and Handle chart patterns can be a game-changer for your trading success. These patterns serve as invaluable guides, helping you navigate the complexities of the financial markets with confidence.

By incorporating these patterns into your trading strategy, you gain a competitive edge and the ability to identify potential trend reversals and breakouts. Remember, success in trading requires continuous learning and practice. So, as you embark on your journey to master these patterns, let this guide be your trusted companion, steering you toward profitable trading endeavors and financial growth.

References

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

- Technical indicators for forex forecasting: a preliminary study

Frequently Asked Questions

How Can I Tell the Difference Between a Head and Shoulder Pattern and a Cup and Handle Pattern?

A head and shoulder pattern is characterized by a peak followed by a lower peak, with a final peak that roughly equals the first. A cup and handle pattern has a curved “cup” shape followed by an uptrending line which acts as support resistance before reversing direction. Both are indicators of potential price reversal.

What Indicators Should I Use to Identify Key Price Action Signals?

To identify key price action signals, technical analysis should be used to focus on support and resistance levels. Attention to detail and analytical thinking is necessary for data-driven decisions and successful trading. Cultivating a sense of belonging through educated research can help traders make sound choices.

Should I Use the Same Entry and Exit Strategies for Different Chart Patterns?

Recent studies have shown that over 80% of traders use different entry and exit strategies for various chart patterns. It is important to utilize limit orders, stop loss, and trailing stops in order to make data-driven decisions with attention to detail. Doing so allows an individual to feel a sense of belonging in the world of trading while also protecting their account from potential losses.

What Is the Best Way to Manage Risk When Trading Head and Shoulder and Cup and Handle Patterns?

Divergence trading and trend lines are important tools for managing risk when trading head and shoulder or cup and handle patterns. Attention to detail, analytical thinking, and data-driven decisions are essential when making informed trading decisions. Belonging comes from understanding the market nuances associated with these chart patterns.

How Do I Backtest and Optimize My Results When Trading These Chart Patterns?

Developing backtests and evaluating performance are essential when trading chart patterns. Attention to detail, analytical thinking, and data-driven decisions are needed for successful optimization of results. Understanding the process is key to achieving desired outcomes.

Trading Insights: Why Doing Too Much Research Can Harm Your Trading – Expert Advice 2023

In the dynamic realm of trading, knowledge is power. Yet, there’s a hidden peril in an excess of information. “Why Doing Too Much Research Can Harm Your Trading” unravels the paradox of over-researching in the trading sphere. While thorough analysis is paramount, an inundation of data can lead to ‘analysis paralysis,’ inhibiting timely decision-making.

This guide delves into the art of striking a balance, offering insights into effective research practices that empower traders to navigate the markets with clarity and confidence. Join us on this enlightening journey as we unveil the delicate equilibrium between research and action, equipping you for a more decisive and profitable trading journey.

Key Takeaways

- Paralysis by analysis and overwhelm with data can lead to missed trading opportunities and irrational decisions.

- Overthinking and misinterpreting data can result in missing important market signals and making emotional trading decisions.

- Poor money management practices, such as psychological biases and mismanaging funds, can lead to significant losses and the downfall of traders.

- Finding balance and trusting intuition is important to prevent negative effects of over-analyzing, make informed decisions, and avoid bias and mental fatigue.

What Is Too Much Research

Definition of too much research in relation to trading can be relative and subjective. Generally, it refers to the amount of time spent researching potential investments that is disproportionate to the expected returns. For example, if a trader spends hours researching a single stock, but only invests a small percentage of their portfolio, then they may be categorized as doing too much research.

Too much research can also refer to excessive trading activity or attempting to time the markets consistently due to over-analysis of data.

Portfolio diversification is often critical in reducing risk associated with stock market investments; however, when individual traders become overly analytical and fail to properly diversify their portfolios by over-researching certain stocks or sectors they risk not only their particular investment but also their entire portfolio’s performance. Risk management should be at the forefront for any investor’s mind-set when analyzing an investment opportunity – spending more time than necessary on one particular asset could lead them astray from pursuing other potentially lucrative opportunities.

Ultimately, traders who do too much research may find themselves in a situation where they are unable to make informed decisions quickly and efficiently because they have invested so much effort into understanding one specific scenario that it clouds their judgment on other viable options available in the markets. It is important for investors to remember that there are risks associated with any decision made in the markets and taking too long analyzing data can cost them valuable opportunities which could otherwise improve their overall financial position.

Why Doing Too Much Research Can Harm Your Trading?

Doing too much research can harm your trading for several reasons:

- Analysis Paralysis: When traders engage in excessive research, they may suffer from analysis paralysis. This means they become overwhelmed by information and find it challenging to make decisions. This can lead to missed opportunities or delayed actions, which can be costly in fast-moving markets.

- Confirmation Bias: Spending too much time on research may lead to confirmation bias, where traders seek out information that supports their existing beliefs. This can prevent them from seeing potential risks or alternative perspectives, leading to misguided trades.

- Diminished Focus on Execution: Excessive research can divert focus away from the actual execution of trades. Execution is equally important as research; even the best analysis is ineffective if not executed properly.

- Overfitting to Historical Data: Spending too much time on historical data can lead to overfitting. Traders may tailor their strategies to fit past market conditions perfectly, but these strategies may not perform well in real-time, dynamic markets.

- Emotional Impact: Extensive research can sometimes amplify emotional attachment to a trade. Traders may become overly confident or attached to their analysis, making it harder to cut losses or adapt to changing market conditions.

- Time Constraints: Research is time-consuming, and traders have limited time to act on opportunities. Spending too much time on research can result in missed trades or opportunities that arise suddenly.

- Information Overload: In today’s digital age, there’s a surplus of information available. Too much research can lead to information overload, making it difficult for traders to sift through the noise and focus on the most critical factors.

In trading, striking a balance between research and execution is crucial. A well-informed, yet efficient approach to research can help traders make timely, well-informed decisions without becoming bogged down by excessive analysis.

The Problem With Over-Researching

Excessive analysis and over-thinking trades can be a problem when researching investments. This is because it can lead to paralysis by analysis, where an individual becomes so focused on researching potential investments that they never actually make any decisions or take any action.

Additionally, too much research can cause investors to become overwhelmed with data and unable to come to a clear conclusion about which stocks or other investments are most likely to produce profitable returns.

Excessive Analysis

Analyzing markets and trades to the point of excessive detail can lead to over-thinking decisions. This kind of analysis, usually done through technical data or fear trading, can be detrimental to a trader’s success.

Being too focused on minutiae can cause traders to become overwhelmed with information and make irrational decisions based upon what may actually be false interpretations. Excessive analysis may also result in missing out on opportunities due to spending too much time analyzing instead of taking action.

Additionally, such in-depth research can lead to confusion and anxiety which may cause traders to hesitate in executing trades that could potentially yield positive results. Over-thinking trades is one of the key outcomes from excessive analysis and should be avoided at all costs for successful trading outcomes.

Over-Thinking Trades

Focusing too intently on the details of a trade can lead to over-thinking decisions and potentially inhibit successful trading outcomes. This can manifest in several ways:

- Missing Signals: When traders become overly focused on every small detail, they can miss larger signals from the market that could be more important.

- Emotional Triggers: These missed signals can create emotional triggers that cause traders to make poor decisions due to fear or greed.

- Over-Analysis: Too much analysis or research may lead to paralysis by analysis, which makes it difficult for traders to act quickly enough when necessary.

- Unnecessary Risk: In some cases, this over-analysis may also increase unnecessary risk as traders attempt to find the perfect trade setup and miss out on profitable opportunities.

Ultimately, doing too much research can harm a trader’s ability to make well-informed decisions and achieve desired trading results.

Trading should be approached with an analytical mindset but also tempered with insight about market trends and risk management strategies.

The Pitfalls of Unnecessary Analysis

Investigating the market with an overabundance of analysis can prove detrimental to traders. This is because excessive information can lead to confusion and complicate decision-making processes, resulting in a loss of focus on what matters most. By focusing attention on relevant data and ignoring the noise, traders are able to avoid making unnecessary mistakes that could potentially harm their trading. Moreover, too much information can cause a trader to become overwhelmed and unable to come to a final conclusion or actionable plan.

The key takeaway is that research should be done judiciously as it’s easy for traders to become absorbed in analysis paralysis when they have access to seemingly endless amounts of data. To reap maximum benefits from researching the market, traders must be mindful of how much time they spend researching and not let themselves get distracted by unnecessary details or irrelevant information.

Additionally, it’s important for them to take breaks often so that their minds remain sharp and focused on what really matters. Lastly, they should also strive for balance between doing enough research but not too much so that their decisions are based on sound evidence rather than speculation or guesswork.

Relying on Indicators and Over-Optimizing

When traders rely too heavily on technical indicators or expert advice, they can become too focused on short-term profits without considering long-term consequences. This can lead to increased risk taking and overtrading, which can have a negative impact on overall performance. Additionally, if these indicators are not used correctly, traders may be at an increased risk of making incorrect decisions that could cost them money in the future.

Furthermore, when traders attempt to optimize their strategies using complex algorithms and techniques such as backtesting or optimization, they may be more likely to make mistakes due to the complexity of the process. The result is often inaccurate results that do not accurately reflect real market conditions and could ultimately lead to losses instead of gains.

Finally, traders who focus excessively on optimizing their strategies may experience feelings of isolation and loneliness as they become increasingly disconnected from other market participants and lose sight of why they began trading in the first place: To belong in a community and share knowledge with like-minded people.

Risks Involved

- Increased Risk Taking

- Overtrading

- Inaccurate Results

Feelings Evoked

- Isolation

- Loneliness

Poor Money Management Practices

Mismanaging funds can lead to significant losses for traders. Poor money management practices often stem from psychological biases and emotional traps, which can lead to a trader’s downfall. To illustrate the point, see below for a 3×3 table with money management strategies that are considered good (left column) versus bad (right column).

| Good Money Management | Bad Money Management |

|---|---|

| Setting Stop-Losses | Ignoring Risk |

| Allocating Resources | Chasing Losses |

| Limiting Leverage | Over-Leveraging |

The left column of the table depicts sound money management principles; setting stop losses, allocating resources, and limiting leverage are all essential components of smart trading. On the other hand, ignoring risk, chasing losses, and over leveraging are all examples of poor money management practices. The consequences of not following these guidelines can be severe and costly in terms of lost profits. As such, it is important for traders to heed sound financial advice when managing their funds. This transition leads into the next topic: fear of missing out (FOMO), which often drives bad decisions in trading.

Fear of Missing Out (FOMO)

Fear of Missing Out (FOMO) is a psychological phenomenon that has become increasingly prevalent in trading. It can lead to impulsive decisions and irrational behavior. FOMO mentality can cause investors to make investments without proper research due to fear of missing out on potential profits or opportunities. This type of behavior can be dangerous for the investor, since it hinders their ability to properly assess market conditions and make informed investment decisions.

Furthermore, this psychological bias can also lead to overtrading which is another way in which too much research can harm an individual’s trading performance. Overtrading involves making multiple trades within a short period of time based on limited information and analysis. This results in increased risk exposure and decreased chances of success.

Finally, FOMO can also lead to excessive position sizing which increases the level of risk taken by the investor when entering into a trade. Excessive position sizing means that the investor will not be able to exit their positions quickly if losses start mounting up. This leads to further losses and financial difficulties for the investor in question.

Making Irrational Decisions

Making irrational decisions is a common pitfall for traders, especially when attempting to interpret market data. Overthinking decisions and misinterpreting data can lead to hasty, unwise trades that don’t consider the long-term consequences of their actions.

On the other hand, chasing trends without understanding their broader implications can also result in poor decision making. Traders may be tempted to jump on a bandwagon without fully understanding the underlying factors driving the trend, leading to potential losses.

Thus, it is important for traders to be cognizant of these pitfalls and strive to make informed decisions based on careful analysis of market data. Taking the time to thoroughly research and understand the factors influencing the market can help traders avoid impulsive and ill-informed decisions. By considering the long-term implications of their actions and analyzing market trends in a broader context, traders can make more rational and profitable decisions.

Overthinking Decisions

Excessive analysis of decisions can lead to an inability to act. When trading, this kind of overthinking can have a detrimental effect on success. To prevent this, traders must have a solid understanding of the market and their own psychology.

Learning discipline: Understanding the importance of rules and making sure they are followed in order to stay disciplined in the market.

Studying Psychology: Developing an awareness of how emotions can influence trading decisions, and learning how to recognize and manage them for better results.

By taking these steps, traders will be able to make informed choices that will help them achieve their goals without overanalyzing every move they make.

It’s important to remember that too much research can end up doing more harm than good when it comes to trading.

Misinterpreting Data

Misinterpreting data can lead to incorrect and potentially costly decisions in trading. Financial literacy is essential when it comes to understanding and appropriately interpreting the data presented by media outlets.

Media bias can be a challenge for traders, as different sources may present conflicting information. It’s important to keep an objective mindset when considering all available data in order to make informed decisions that are based on reliable evidence.

Inadequate financial literacy may lead traders to misinterpret the facts, leading them astray from their true objectives of successful trading. To mitigate this risk, it is critical for traders to maintain a certain level of financial literacy so they can properly analyze the data presented and make sound choices when investing in stocks or other assets.

Chasing Trends

Chasing trends can be a dangerous strategy for traders, as it often involves investing in assets based on the current market conditions without considering long-term performance. This misplaced confidence in short-term trends may lead to emotional trading decisions that don’t align with investment goals.

Positive Outcome:

- Increased profits due to savvy timing of trades

- Ability to capitalize on sudden changes in the market

Negative Outcomes:

- Risky investments that could lead to large losses

- Difficulty evaluating whether or not an asset is overvalued or undervalued

The Value of Taking a Break

Taking a break from researching trading strategies may be beneficial in order to prevent potential negative effects of over-analyzing. Ignoring intuition and relying on emotion can lead to an excessive focus on data analysis, which can result in a lack of objectivity and the inability to capitalize on market opportunities quickly. This can cause traders to miss out on potentially profitable trades as they become too fixated on certain trends or indicators that are not supported by the current market conditions.

Additionally, constant research can lead to analysis paralysis, where traders become overwhelmed with information and unable to make decisions due to fear or uncertainty. Taking a break from research gives traders the opportunity for self-reflection and allows them to step back and evaluate their decisions objectively without feeling pressured by the ever-evolving markets. It also provides them with an opportunity to connect with their inner intuition, allowing them to make more informed decisions based on facts rather than feelings.

What to Do Instead of Too Much Research

Instead of engaging in excessive research, traders can benefit from taking a balanced approach to trading by utilizing both analytical and intuitive methods. By avoiding bias and mental fatigue associated with too much research, traders will be better equipped to make sound decisions that are based on logic rather than emotion.

In order to make the most informed decisions possible, traders should:

Analyze data:

- Utilize quantitative analysis tools such as technical indicators and chart patterns to identify trends and entry points.

- Monitor news sources for information about currency fluctuations and economic events that may impact the markets.

Follow gut instincts:

- Consider both fundamental and technical data when making trades.

- Have confidence in their own knowledge base and trust their intuition when it comes to making decisions.

By utilizing these strategies, traders can stay informed without overloading themselves with too much research. This will help them avoid bias caused by over-analyzing market conditions as well as the mental fatigue associated with too many hours spent researching the markets.

In addition, this approach allows them to tap into their inner wisdom while still remaining grounded in factual data so they can make more effective decisions that lead to greater success in trading.

Conclusion

In the grand tapestry of trading, the adage “less is more” holds profound relevance. “Why Doing Too Much Research Can Harm Your Trading” imparts a critical lesson: excessive research can obscure clear decision-making. While information is the lifeblood of trading, discernment is its beating heart.

By finding the sweet spot between analysis and action, traders can navigate the markets with precision. Let this guide be your compass, guiding you towards a more streamlined, effective approach to trading. With a discerning eye, you can transcend the noise, making decisions that are not only well-informed but timely, ensuring your trading journey is marked by success and prosperity.

References

- Why has FX trading surged? Explaining the 2004 triennial survey

- Computational learning techniques for intraday FX trading using popular technical indicators

- Heuristic based trading system on Forex data using technical indicator rules

- Technical indicators for forex forecasting: a preliminary study

Frequently Asked Questions

What Is the Best Way to Manage My Money?

The best way to manage money is through risk management and position sizing. Analyzing the potential risks, determining an appropriate size for a trade, and understanding the consequences of each decision are all crucial steps in successful investing. Knowing when to enter and exit a position is also important for achieving financial goals.

What Indicators Should I Use When Trading?

When trading, one should analyze market patterns and use psychological indicators to make informed decisions. It is important to weigh the pros and cons of each approach while understanding the impact on financial goals. Such an analytical approach can help traders achieve success with their investments.

How Can I Avoid Fomo?

Anxious investors should resist the urge to succumb to fear-driven trading and over analysis. Picture a lake, still and tranquil; like this, traders must remain unfazed by market turmoil, pressing on with calculated decisions rather than succumbing to FOMO. This approach will ensure wise decisions are made without sacrificing belonging in the trading world.

What Is the Best Way to Make Rational Decisions When Trading?

The best way to make rational decisions when trading is to practice risk management and develop a strong understanding of trading psychology. Aspiring traders must focus on developing an objectively sound approach to decision-making, while at the same time recognizing emotional influences that can impact their analysis.

How Often Should I Take Breaks When Trading?

Time management and emotional control are essential when trading. Taking regular breaks is important to ensure decisions remain rational and unbiased. Scheduling these breaks helps maintain focus, clear thinking, and healthy decision making.

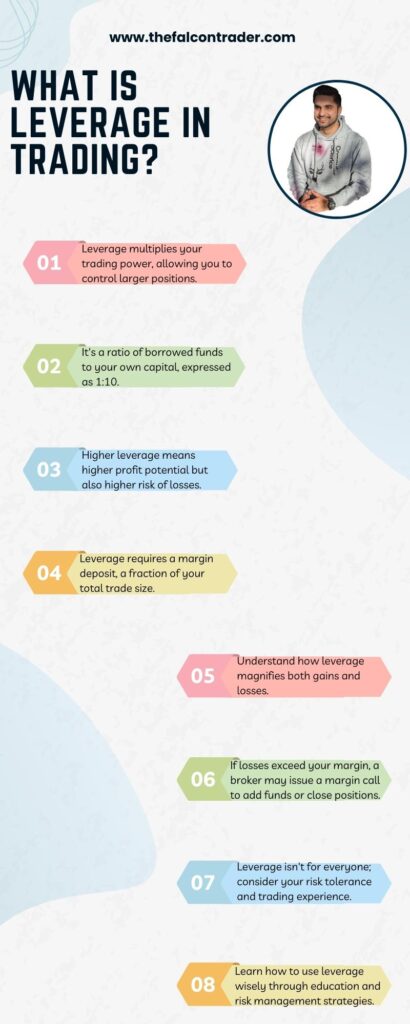

Unlocking Potential: What Is Leverage in Trading – Key Insights 2023

Delve into the dynamic world of trading with a clear understanding of “What Is Leverage in Trading.” This fundamental concept revolutionizes how traders approach the market, amplifying both potential gains and risks. Leverage is akin to a double-edged sword, offering the ability to control larger positions with a fraction of the capital.

In this comprehensive guide, we unravel the intricacies of leverage, empowering you with the knowledge to wield it wisely. Join us on this enlightening journey as we explore how leverage influences trading strategies and discover the pivotal role it plays in maximizing potential returns.

Key Takeaways

- Leverage in trading involves using borrowed funds to amplify potential returns or losses.

- It allows traders to control larger positions with a smaller amount of capital.

- Using leverage can lead to higher returns and diversification of portfolios.

- However, it also amplifies both gains and losses, so careful risk management is necessary.

What Is Leverage in Trading?

Leverage in trading refers to the ability to control a large position in the market with a relatively small amount of capital. It allows traders to amplify their exposure and potentially magnify profits, but it also increases the risk of significant losses.

For instance, with a leverage of 10:1, a trader can control a $10,000 position with just $1,000 of their own capital. While leverage can enhance gains, it’s crucial to exercise caution and have a robust risk management strategy in place, as it can also lead to substantial losses if the market moves against the trader.

The Basics of Leverage in Trading

The basics of leverage in trading involve the use of borrowed funds to amplify potential returns or losses from an investment. Leverage allows traders to control a larger position with a smaller amount of capital, which can lead to increased profits if the trade goes in their favor. However, it is important to understand the pros and cons of using leverage in trading.

One advantage of using leverage is the potential for higher returns. By utilizing borrowed funds, traders can increase their exposure to market movements and potentially generate larger profits. Additionally, leverage enables traders to diversify their portfolios and participate in multiple markets simultaneously.

On the other hand, there are several risks associated with using leverage. One major concern is that leveraging amplifies both gains and losses. While it can result in substantial profits during favorable market conditions, it can also lead to significant losses if the trade moves against expectations.

Understanding margin requirements is crucial when engaging in leveraged trading. Margin refers to the collateral that traders must maintain in their accounts to cover potential losses. Different brokers have varying margin requirements, which dictate how much capital needs to be deposited as collateral for a leveraged trade.

Understanding Leverage Ratios

Understanding leverage ratios involves analyzing the relationship between borrowed funds and equity in financial transactions. Leverage advantages include the potential for higher returns on investment, as a small amount of capital can control a larger position.

This allows traders to amplify their gains if the market moves in their favor. Additionally, leverage can provide access to markets that would otherwise be inaccessible due to high capital requirements.

However, leverage also carries certain disadvantages. It magnifies losses as well, meaning that even a small adverse movement in the market can result in significant losses for leveraged positions.

Risks and Rewards of Trading With Leverage

One important consideration when utilizing leverage is the potential for both risks and rewards. Trading with leverage offers several benefits, such as the ability to magnify profits and access to larger positions in the market. By using borrowed funds, traders can amplify their gains and potentially achieve higher returns on their investments. Leverage also allows traders with limited capital to participate in markets that would otherwise be inaccessible to them.

However, it is crucial to acknowledge the potential dangers of trading with leverage. The main risk associated with leveraging is the increased exposure to losses. Since leveraged positions require a smaller initial investment, even a small adverse price movement can result in significant losses. Traders must carefully manage their risk by setting stop-loss orders and closely monitoring their positions.

Another danger of trading with leverage is overtrading or taking on excessive risks due to greed or lack of experience. Leveraged trading requires discipline and a thorough understanding of market dynamics. Without proper risk management strategies in place, traders may find themselves exposed to substantial financial losses.

Common Misconceptions About Leverage

A common misconception about utilizing leverage is that it guarantees higher profits in trading. However, this is a misunderstanding of the impact of leverage on trading performance. While leverage can amplify potential gains, it also magnifies potential losses. The use of leverage involves borrowing funds to invest in an asset, with the aim of increasing returns through the use of borrowed capital. It allows traders to control larger positions with a smaller amount of capital.

The impact of leverage on trading performance depends on various factors such as market volatility, risk appetite, and trading strategies. High levels of leverage can lead to significant financial risks if not managed properly. Traders need to carefully assess their risk tolerance and set appropriate stop-loss orders to mitigate potential losses.

Moreover, it is crucial for traders to have a thorough understanding of how leverage works before using it in their trades. They should consider factors such as margin requirements, interest rates on borrowed funds, and potential margin calls.

Different Types of Leverage in Trading

Different types of leverage in financial markets include operational, financial, and market leverage.

Leverage refers to the use of borrowed funds or debt to increase the potential return on investment. In margin trading, investors can borrow money from a broker to purchase securities. This allows them to control a larger position than they could with their own capital.

Operational leverage involves using fixed costs, such as rent and salaries, to amplify profits when sales increase. It allows companies to generate higher returns on equity through economies of scale.

Financial leverage is the use of borrowed funds to finance investments or acquisitions. It magnifies both gains and losses but can enhance returns if the cost of borrowing is lower than the return on investment.

The benefits of leverage in trading are important for investors seeking increased profitability and potential returns. By utilizing borrowed funds, traders can take larger positions in the market and potentially earn higher profits compared to what they would have achieved with only their own capital. Additionally, leverage enables investors with limited capital to participate in markets that would otherwise be out of reach for them.

However, it is crucial for traders to exercise caution when using leverage as it also amplifies losses. Excessive leveraging can lead to significant financial risks and potential bankruptcy if trades do not go as planned. Therefore, proper risk management strategies should be implemented when utilizing leverage in trading activities.

How to Calculate Leverage in Trading

In the previous subtopic, we explored the different types of leverage in trading. Now, let us delve into how to calculate leverage in trading and understand its importance.

Leverage is a crucial concept for traders as it allows them to amplify their potential profits or losses by using borrowed funds. To calculate leverage, one needs to determine the ratio between the trader’s own capital and the total position size.

The most commonly used formula for calculating leverage is:

Leverage = Total Position Size / Trader’s Capital

For instance, if a trader has a capital of $10,000 and opens a position worth $50,000, the leverage can be calculated as follows:

Leverage = $50,000 / $10,000 = 5:1

This means that the trader has a leverage ratio of 5:1 or 5 times their capital invested.

Understanding how to calculate leverage is essential because it helps traders assess their risk exposure. Higher levels of leverage magnify both profits and losses. While it offers the potential for significant gains, excessive leveraging can also lead to substantial losses if trades go against expectations.

Therefore, traders must carefully consider their risk tolerance and use appropriate leveraging strategies when engaging in trading activities. By calculating leverage accurately and managing it effectively, traders can optimize their chances for success while minimizing potential risks.

Tips for Using Leverage Responsibly in Trading

Risk management strategies are essential for traders to mitigate potential losses and protect their capital.

Calculating leverage ratios helps traders understand the amount of borrowed funds they are using relative to their own capital, allowing them to assess the level of risk involved.

Setting leverage limits is crucial in maintaining control over one’s trading activities and preventing excessive exposure to potential financial risks.

Risk Management Strategies

One effective approach to risk management in trading is the implementation of appropriate strategies. Portfolio diversification is a commonly used strategy that involves spreading investments across various assets, sectors, or regions to reduce exposure to any single investment. By diversifying their portfolios, traders can mitigate the potential losses from individual investments and achieve a more balanced risk-return profile.

Another important risk management strategy is the use of stop loss orders. These orders are set at predetermined price levels, and when triggered, they automatically execute trades to limit potential losses. Stop loss orders help traders control risks by ensuring that they exit positions before losses become excessive.

Both portfolio diversification and stop loss orders are essential components of a comprehensive risk management plan in trading. By incorporating these strategies into their trading activities, traders can minimize the impact of adverse market movements and protect their capital from significant losses.

Calculating Leverage Ratios

To calculate leverage ratios, financial analysts use a formula that compares an organization’s total debt to its equity. This calculation provides insights into the financial risk associated with an organization’s capital structure.

Leverage ratios are commonly used in financial analysis to assess the extent to which a company relies on borrowed funds for its operations. A higher leverage ratio indicates a greater proportion of debt relative to equity, which can increase both potential returns and risks.

Setting Leverage Limits

In leveraged trading strategies, the impact of leverage on trading profits is a crucial aspect to consider. Setting appropriate leverage limits is imperative to protect traders from excessive risk and potential losses. By limiting the amount of leverage used, traders can mitigate the potential negative effects that high leverage can have on their trading profits.

To illustrate this concept further, let’s consider a hypothetical scenario in which a trader uses different levels of leverage while executing trades. The table below showcases the impact of varying leverage ratios on trading profits:

| Leverage Ratio | Trading Profits |

|---|---|

| 1:1 | $100 |

| 5:1 | $500 |

| 10:1 | $1000 |

| 20:1 | $2000 |

As seen in the table, higher leverage ratios amplify both gains and losses. While using higher leverage may result in larger profits when successful trades are executed, it also exposes traders to greater risks if market conditions turn unfavorable. Therefore, setting appropriate leverage limits is essential for achieving sustainable and consistent trading profitability.

Conclusion

In conclusion, understanding “What Is Leverage in Trading” is pivotal for any trader looking to optimize their investment strategies. It grants the power to magnify gains, but also requires prudent risk management. By comprehending how leverage functions and incorporating it judiciously into your trading approach, you can unlock new dimensions of potential in the financial markets.

Let this guide serve as your compass, providing you with the knowledge and insights needed to navigate the complexities of trading with leverage. With knowledge comes power, and with power comes the potential for more informed, strategic, and ultimately successful trading endeavors.

References

- Opening an Account: How to Select a Forex Broker, and Set Up and Fund a Trading Account

- Forex Analysis: An Introduction and Comparison of Fundamental and Technical Analysis

- What Makes Currencies Move? An Exploration of the Key Forces That Cause Currencies to Fluctuate

- Pitfalls and Risks: Understanding the Risks of Forex and the Mistakes that New Traders Make

Frequently Asked Questions

What Are Some Common Mistakes Traders Make When Using Leverage?

Common misconceptions about leverage in trading can lead to mistakes such as inadequate risk management. Traders may underestimate the potential losses magnified by leverage, resulting in significant financial setbacks and potentially even account liquidation.

Is Leverage Available for All Financial Instruments?

Leverage is not available for all financial instruments. It has both pros and cons, such as the potential for increased profits but also higher risks. Understanding these risks is crucial in leveraged trading.

Can Leverage Be Adjusted During a Trade?

Adjusting leverage in real time can have a significant impact on risk management in trading. It allows traders to modify their exposure and potentially increase or decrease the level of risk depending on market conditions and their risk tolerance.

How Does Leverage Affect the Cost of Borrowing in Trading?

The impact of leverage on trading profits is a subject of interest to many investors. It is important to understand that while high leverage can potentially lead to higher profits, it also carries significant risks.

Are There Any Restrictions on the Amount of Leverage a Trader Can Use?

Restrictions on leverage in trading exist to mitigate potential risks. While leverage can amplify profits, it also magnifies losses. Traders must consider the pros and cons of using leverage, including the potential for significant financial gains or losses.

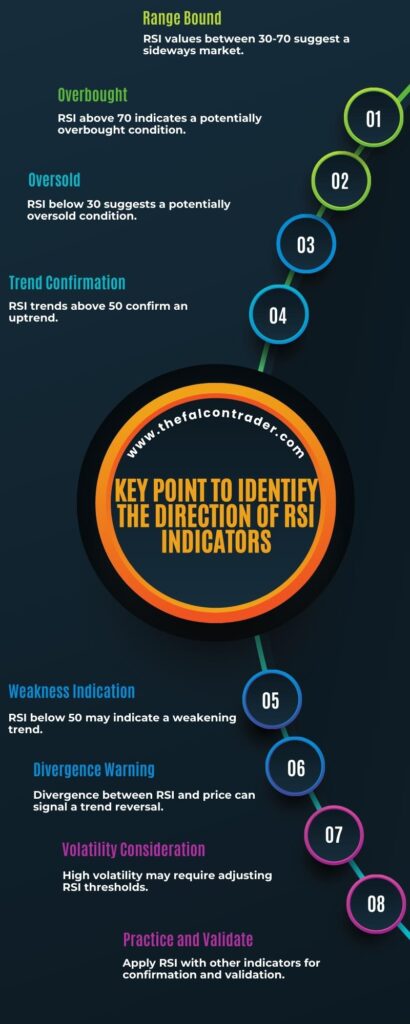

Unlocking RSI Indicator Secrets | Key Point to Identify the Direction of RSI Indicators 2023

Delve into the art of technical analysis with our guide on “Key Point to Identify the Direction of RSI Indicators.” Mastering the Relative Strength Index (RSI) is a pivotal skill for traders and investors alike. By deciphering the RSI’s signals, you gain valuable insights into potential market trends.

This guide illuminates the crucial factors for interpreting RSI movements, from overbought and oversold conditions to bullish and bearish divergences. Join us as we unravel the secrets to effectively using RSI indicators to make informed trading decisions, giving you a distinct edge in the dynamic world of financial markets.

Key Takeaways

- RSI measures price momentum and can identify potential reversals.

- RSI levels above 70 indicate overbought conditions, while levels below 30 indicate oversold conditions.

- RSI can confirm uptrends or downtrends observed through other indicators.

- RSI divergence, both bearish and bullish, can help identify trend reversals and potential trade opportunities.

Understanding RSI (Relative Strength Index)

The Relative Strength Index (RSI) is a commonly used technical indicator in financial analysis that measures the strength and magnitude of price movements to determine overbought or oversold conditions in a security. It helps traders identify potential trend reversals and generate buy or sell signals. Applying RSI in trend analysis involves analyzing the relationship between the RSI value and the price movement of a security over a specific timeframe. Traders typically use RSI in conjunction with other technical indicators to confirm trends and make more informed trading decisions.

One important factor to consider when interpreting RSI is the timeframe used. Different timeframes can result in different interpretations of RSI levels. For example, using a shorter timeframe may provide more frequent but less reliable signals, while using a longer timeframe may produce fewer but more reliable signals. Traders need to select an appropriate timeframe based on their trading strategy and risk tolerance.

In conclusion, understanding how to apply RSI in trend analysis and considering the importance of timeframe are crucial aspects of effectively utilizing this technical indicator. By incorporating these factors into their analysis, traders can gain valuable insights into market trends and make more informed trading decisions.

Now that we have discussed applying RSI in trend analysis and the importance of timeframe, we will move on to interpreting RSI levels for further insights into market conditions.

Key Point to Identify the Direction of RSI Indicators

One approach to comprehending RSI levels involves examining the numerical values in order to determine potential trends or shifts in market sentiment. The Relative Strength Index (RSI) is a technical indicator that measures the strength and speed of price movements. It provides insights into whether a security is overbought or oversold, which can be useful for identifying potential trend reversals.

An RSI value above 70 is considered overbought, indicating that the security may be due for a downward correction. Conversely, an RSI value below 30 is considered oversold, suggesting that the security may be due for an upward correction. Traders often use these overbought and oversold levels as signals to enter or exit trades.

Additionally, RSI can also be used to confirm trends observed through other technical indicators or chart patterns. For example, if a stock price is making higher highs and higher lows, and its RSI remains above 50, this could signal a strong uptrend. On the other hand, if a stock price is making lower highs and lower lows, and its RSI remains below 50, this could indicate a strong downtrend.

By analyzing RSI levels in conjunction with other technical indicators and chart patterns, traders can gain further confirmation of potential market trends and make more informed trading decisions.

| Condition | Interpretation |

|---|---|

| RSI > 70 | Overbought |

| RSI < 30 | Oversold |

| Price Uptrend & RSI > 50 | Confirmation of bullish trend |

| Price Downtrend & RSI < 50 | Confirmation of bearish trend |

Table: Interpreting Different Conditions of Relative Strength Index (RSI)

This analytical approach allows investors to assess market sentiment objectively based on numerical values provided by the RSI indicator.

Identifying Bullish Signals in RSI

By examining numerical values and observing price trends, potential bullish signals can be identified in the Relative Strength Index (RSI). The RSI is a momentum oscillator that measures the speed and change of price movements. It provides insights into whether an asset is overbought or oversold. To identify bullish signals in the RSI, traders look for specific patterns and conditions.

One common pattern is the bullish divergence. This occurs when the price of an asset makes lower lows while the RSI makes higher lows. This suggests that despite downward pressure on prices, buying interest is increasing, indicating a potential reversal to the upside.

Another indicator of a bullish signal is when the RSI rises from oversold conditions (typically below 30) and crosses above its 50 level. This indicates a shift in momentum from bearish to bullish.

Additionally, traders also watch for breakouts from consolidation patterns accompanied by high RSI readings as they suggest strong buying pressure.

It’s important to note that these indicators are not foolproof and should be used in conjunction with other technical analysis tools for confirmation. Furthermore, proper risk management strategies should always be employed when trading based on RSI patterns.

Recognizing Bearish Signals in RSI

Recognizing bearish signals in the RSI involves analyzing price trends and numerical values to identify patterns and conditions that suggest a potential reversal to the downside. The Relative Strength Index (RSI) is a popular technical indicator used by traders and investors to assess the strength and direction of price movements in a given security or market.

When it comes to identifying bearish signals in the RSI, there are several key points to consider:

- Identifying oversold conditions in RSI: One way to recognize bearish signals is by looking for oversold conditions in the RSI. This occurs when the RSI falls below a certain threshold, typically 30. An oversold condition suggests that the asset may be due for a rebound or reversal to the downside.

- Using RSI for trend confirmation: Another method of identifying bearish signals is by using the RSI as a tool for confirming downtrend patterns. If the RSI remains below a certain level, such as 50, while prices continue to decline, it can be seen as an indication that selling pressure is strong and likely to persist.

- Using RSI for reversal signals: In addition to trend confirmation, traders also look for specific patterns or divergences in the RSI that signal potential reversals. For example, if prices are making lower lows but the RSI is making higher lows, it could indicate underlying bullish momentum building up and potentially lead to a price reversal.

By understanding these key points and carefully analyzing price trends and numerical values within the context of these conditions, traders can effectively recognize bearish signals in the RSI. This knowledge can then be applied in conjunction with other technical indicators or analysis techniques to make informed trading decisions.

Using RSI Divergence to Predict Price Reversals

Examining the divergence between price movements and the Relative Strength Index (RSI) can provide valuable insights for predicting potential reversals in asset prices. RSI divergence is a powerful tool used by traders to identify trend reversals and potential trade opportunities. By comparing the direction of price movements with the RSI indicator, traders can gain insights into the underlying strength or weakness of a trend.

Using RSI divergence in trend trading involves looking for discrepancies between price action and the RSI indicator. When an asset’s price makes higher highs while its RSI makes lower highs, it indicates bearish divergence. Conversely, when an asset’s price makes lower lows while its RSI makes higher lows, it suggests bullish divergence. These divergences often precede major reversals in asset prices.

Applying RSI divergence to determine trade entries involves waiting for confirmation signals before taking action. Traders may use additional technical analysis tools such as support and resistance levels or candlestick patterns to validate their trade decisions.

Conclusion

In conclusion, understanding the nuances of RSI indicators is a cornerstone of successful technical analysis. By honing your ability to identify overbought and oversold conditions, as well as discerning bullish and bearish divergences, you empower yourself to make astute trading decisions. The RSI provides a powerful tool to gauge market sentiment and potential trend reversals.

Let this guide serve as your roadmap to navigating the complexities of RSI analysis, enabling you to confidently interpret its signals and stay ahead of market movements. With a keen eye and a solid grasp of RSI dynamics, you gain a distinct advantage in the competitive landscape of financial trading.

References

- Opening an Account: How to Select a Forex Broker, and Set Up and Fund a Trading Account

- Forex Analysis: An Introduction and Comparison of Fundamental and Technical Analysis

- What Makes Currencies Move? An Exploration of the Key Forces That Cause Currencies to Fluctuate

- Pitfalls and Risks: Understanding the Risks of Forex and the Mistakes that New Traders Make

Frequently Asked Questions

How Can I Calculate the RSI Indicator for a Specific Time Period?

Calculating RSI values involves a mathematical formula that takes into account the average gains and losses over a specific time period. The interpretation of RSI readings is based on the level of overbought or oversold conditions in the market.

Are There Any Limitations to Using RSI as a Standalone Indicator for Predicting Market Direction?

The limitations of using RSI as a standalone indicator for predicting market direction include potential drawbacks in relying solely on RSI. These limitations encompass factors such as false signals, sensitivity to market conditions, and the need for additional analysis methods.

Can RSI Be Used Effectively in All Types of Markets, Such as Trending or Ranging Markets?

The effectiveness of RSI indicators in different types of markets, such as trending or ranging markets, depends on their pros and cons. In volatile markets, RSI can provide valuable insights but may also generate false signals. In choppy or sideways markets, interpreting RSI readings requires considering key thresholds and patterns to identify potential reversals or continuation of trends.

What Other Technical Indicators Can Be Used in Combination With RSI to Confirm Signals?

The confirmation of signals generated by the Relative Strength Index (RSI) can be achieved through the utilization of other technical indicators such as Moving Average Convergence Divergence (MACD) and Bollinger Bands.

Are There Any Specific Timeframes in Which RSI Is More Reliable for Predicting Market Direction?

The reliability of RSI indicators for predicting market direction may vary depending on specific timeframes. Further analysis is required to determine which timeframes consistently yield more reliable results in terms of prediction accuracy.

Proven Strategies: 2 Ideas That May Gear Up Your Trading Career – Boost Success 2023

Embarking on a successful trading journey requires more than just intuition; it demands a strategic approach. In this guide, we present “2 Ideas That May Gear Up Your Trading Career.” These innovative concepts have the potential to revolutionize the way you approach the markets. By incorporating these ideas into your trading strategy, you can unlock new avenues for growth and profitability.

From leveraging cutting-edge technology to implementing dynamic risk management techniques, we explore actionable steps to elevate your trading career. Join us as we delve into these powerful ideas, designed to empower you with the knowledge and tools needed to thrive in the dynamic world of trading.

Key Takeaways

- Utilizing advanced technical analysis tools and algorithmic trading strategies can enhance trading performance and decision-making process.

- Implementing risk management techniques such as risk assessment, position sizing, stop-loss orders, take-profit levels, and diversification is crucial for successful trading.

- Continuous learning through exploring different resources, attending conferences and workshops, and seeking mentorship helps expand market knowledge and stay competitive.

- Developing a personalized trading plan, including risk tolerance assessment, defining investment goals, market analysis, and cultivating discipline, patience, and emotional control, is essential for trading success.

2 Ideas That May Gear Up Your Trading Career

One of the key ideas to boost your trading career is to harness the power of advanced technical analysis tools. Utilize advanced technical analysis tools such as Fibonacci retracement levels, Bollinger Bands, and Ichimoku Cloud for deeper market insights. Employ customizable charting platforms to make real-time, informed decisions.

Incorporate algorithmic trading strategies to automate trades, eliminating emotional biases and enabling 24/7 trading. Develop programming skills or access algorithmic trading platforms for data-driven, optimized strategies.

By implementing these ideas, traders can enhance their careers with more informed, efficient, and profitable trading strategies. Staying adaptable to evolving market conditions is key to sustained success.

Idea #1: Utilizing Advanced Technical Analysis Tools

Utilizing advanced technical analysis tools is a widely recognized strategy employed by traders to enhance their trading performance. These tools provide traders with valuable insights into market trends, patterns, and potential price movements. One such tool is automated trading systems, which use algorithms to execute trades based on pre-defined rules and parameters. By automating the trading process, these systems eliminate human emotions and biases from decision-making, leading to more disciplined and consistent execution of trades.

Another important tool in technical analysis is price action analysis. This approach focuses on analyzing past price movements to predict future market behavior. Traders who employ this technique study charts, candlestick patterns, support and resistance levels, as well as other indicators to identify potential entry and exit points for trades. Price action analysis helps traders understand market psychology and sentiment, allowing them to make informed decisions based on historical price data.

Idea #2: Incorporating Algorithmic Trading Strategies

Incorporating algorithmic trading strategies allows for the implementation of systematic and automated processes in financial markets. Automated trading systems, also known as algorithmic trading systems or black-box trading systems, use computer algorithms to execute trades based on predefined rules and conditions. These systems are designed to take advantage of market inefficiencies or to follow specific trading strategies. By automating the execution process, algorithmic trading can help traders achieve greater efficiency, speed, and accuracy in their trades.

One key aspect of algorithmic trading is the ability to backtest strategies. Backtesting involves applying a set of predefined rules to historical market data to assess how well a particular strategy would have performed in the past. This allows traders to evaluate the performance and effectiveness of their strategies before implementing them in live markets. Backtesting can help identify potential flaws or weaknesses in a strategy, enabling traders to refine and optimize their approaches.

By incorporating algorithmic trading strategies and utilizing automated trading systems with robust backtesting capabilities, traders can eliminate emotional biases from their decision-making processes and make more objective and data-driven decisions. This can lead to improved consistency and discipline in executing trades.

Transitioning into the next section about ‘idea #3: implementing risk management techniques,’ it is important for traders using algorithmic strategies to also consider risk management as an integral part of their overall approach.

Other Ideas That May Gear Up Your Trading Career

Idea #3: Implementing Risk Management Techniques

Implementing risk management techniques is essential in algorithmic trading to protect against potential losses and ensure the long-term sustainability of trading strategies. Risk assessment plays a crucial role in identifying and quantifying the potential risks associated with a specific trading strategy. By assessing various factors such as market volatility, liquidity, and historical data, traders can gain insights into the potential risks they may face.

One key aspect of risk management in algorithmic trading is position sizing. This involves determining the appropriate size or allocation of capital for each trade based on risk tolerance and expected returns. Position sizing helps traders limit their exposure to individual trades while still allowing for potential profit generation.

To implement effective risk management techniques, traders often employ tools such as stop-loss orders and take-profit levels. Stop-loss orders automatically close out a position when it reaches a predetermined price level, limiting potential losses. Take-profit levels allow traders to secure profits by automatically closing out profitable positions at target price levels.

Additionally, diversification is another important risk management technique used in algorithmic trading. By spreading investments across different asset classes or markets, traders can reduce the impact of any single trade or market event on their overall portfolio performance.

Idea #4: Expanding Market Knowledge Through Continuous Learning

Continuous learning plays a crucial role in expanding market knowledge for algorithmic traders. To stay competitive and relevant in the ever-evolving financial markets, algorithmic traders must continuously seek opportunities to expand their resources and enhance their understanding of market dynamics. This entails actively engaging in ongoing education, staying up-to-date with industry trends, and seeking mentorship from experienced professionals.

Expanding resources is essential for algorithmic traders to gain a deeper understanding of various trading strategies, technical indicators, and market data sources. By exploring different resources such as research papers, academic journals, and online forums, traders can access a wealth of information that can inform their decision-making processes. Additionally, attending conferences and workshops provides valuable networking opportunities where traders can connect with like-minded individuals who share similar interests and goals.

Seeking mentorship is another effective way for algorithmic traders to expand their market knowledge. By learning from experienced professionals who have successfully navigated the complexities of the financial markets, aspiring traders can gain insights into best practices, risk management techniques, and innovative trading strategies. Mentors can provide guidance on how to interpret market signals accurately and effectively adapt trading algorithms to changing market conditions.

Idea #5: Developing a Personalized Trading Plan

Developing a personalized trading plan requires careful consideration of individual risk tolerance, investment goals, and market analysis. A well-designed trading plan serves as a roadmap for traders, helping them navigate the complex and dynamic world of financial markets.

To create an effective trading plan that aligns with one’s objectives and risk appetite, traders should take into account several key factors:

- Risk Tolerance: Traders must assess their willingness to accept losses and fluctuations in their portfolios. Understanding one’s risk tolerance is crucial in determining appropriate position sizing and risk management strategies.

- Investment Goals: Defining clear investment goals enables traders to identify suitable trading strategies that align with their desired outcomes. Whether the goal is capital preservation, income generation, or growth-oriented investments, having a specific objective helps guide decision-making.

- Market Analysis: Traders need to analyze various aspects of the market such as trends, volatility patterns, and economic indicators. Applying technical analysis techniques alongside fundamental analysis can provide valuable insights for identifying potential trading opportunities.

- Trading Psychology: Emotions play a significant role in trading success or failure. Developing discipline, patience, and emotional control are essential for executing trades based on the predetermined plan rather than succumbing to impulsive decisions driven by fear or greed.

Incorporating backtesting strategies within the trading plan allows traders to evaluate the historical performance of their chosen strategies before implementing them in real-time scenarios. By simulating past market conditions and analyzing how different strategies would have performed historically, traders can gain confidence in their approach and make informed decisions based on empirical evidence rather than speculation.

Conclusion

In conclusion, “2 Ideas That May Gear Up Your Trading Career” serve as catalysts for elevating your trading prowess. By adopting a forward-thinking approach and embracing innovative strategies, you can position yourself for success in the ever-evolving financial landscape. These ideas, rooted in practicality and market insights, have the potential to reshape the trajectory of your trading journey.

As you implement these concepts, remember to monitor their impact and adjust your approach accordingly. Let this guide be a beacon of inspiration, guiding you towards a more dynamic and prosperous trading career. With the right ideas and the determination to execute them, you have the potential to achieve remarkable results in your trading endeavors.

References

- Forex Analysis: An Introduction and Comparison of Fundamental and Technical Analysis

- What Makes Currencies Move? An Exploration of the Key Forces That Cause Currencies to Fluctuate

- Pitfalls and Risks: Understanding the Risks of Forex and the Mistakes that New Traders Make

- Trading Strategy: Using a Combination of Analytical Tools to Develop a Trading Strategy

Frequently Asked Questions

How Can I Access and Learn to Use Advanced Technical Analysis Tools?

Accessing and learning to use advanced technical analysis tools can be achieved through enrolling in advanced technical analysis courses. Additionally, traders can explore the best platforms for these tools, which provide comprehensive features and resources for effective trading strategies.

What Are Some Popular Algorithmic Trading Strategies That I Can Incorporate Into My Trading?

Algorithmic trading strategies are widely used in the trading industry. Popular trading algorithms such as trend following, mean reversion, and breakout strategies can be incorporated into one’s trading approach to enhance decision-making processes and potentially improve overall performance.

How Do I Determine the Appropriate Risk Management Techniques to Implement in My Trading?

Determining appropriate risk management techniques for trading involves evaluating one’s risk tolerance, market conditions, and financial goals. This analysis should be incorporated into a personalized trading plan to mitigate potential losses and optimize long-term profitability.

What Are Some Recommended Resources or Methods for Continuous Learning and Expanding Market Knowledge?