Mastering Trader Psychology | Understanding Psychology of a Successful Trader 2023

Embark on a transformative journey into the world of trading psychology with our guide on “Understanding Psychology of a Successful Trader.” Beyond charts and indicators, the mind of a trader plays a pivotal role in navigating the complexities of financial markets. This guide delves into the intricacies of decision-making, emotional resilience, and discipline—the cornerstones of a prosperous trading career.

By dissecting the mindset of accomplished traders, we uncover the psychological strategies that underpin their success. Join us as we unravel the human element of trading, providing you with the insights and tools to cultivate the mindset of a victorious trader.

Key Takeaways

- Understanding and managing emotions such as fear and greed are essential for successful trading.

- Recognizing and overcoming biases, such as overconfidence and confirmation bias, is crucial for making rational trading decisions.

- Developing discipline, patience, and emotional control are key aspects of trading psychology.

- Conducting thorough market research, creating a comprehensive trading plan, and practicing risk assessment are important for success in trading.

What is Trading Psychology?

Trading psychology is the study of the psychological and emotional aspects of engaging in trading activities. It involves understanding how emotions, such as fear or greed, can influence decisions when participating in a financial market.

- Facing Fear is an important part of trading psychology as traders must be conscious of their fear responses and be able to understand what triggers them in order to make sound decisions.

- Greed Management is also necessary when it comes to making successful trades, as it helps traders avoid taking on too much risk at one time.

- Risk Assessment is also essential for any trader, as well-informed decisions are key to success; this means that understanding the risks associated with each trade should be part of a trader’s routine before placing any orders.

- Time Management is another important aspect of trading psychology; having clear goals and deadlines allows traders to focus on their strategies instead of getting sidetracked by other tasks.

- Mindfulness Training can help traders become more aware of their own mental processes, which can lead to better decision-making overall.

Understanding these elements are vital for success in the world of trading, forming the foundation for understanding the psychology behind a successful trader.

Understanding Psychology of a Successful Trader

Investigating the psychological elements that contribute to profitable trading is paramount. The successful trader must possess a strong sense of self-discipline, emotional control, and risk management in order to succeed.

Market research, a comprehensive trading plan, and an understanding of their own psychology are key components for success. For instance, having a clear strategy helps traders avoid making decisions based on emotions such as fear or greed.

Additionally, it is important for traders to have an awareness of their own strengths and weaknesses when it comes to managing risk.

To be successful at trading, one must also identify opportunities through market research and understand how different strategies can be applied in order to achieve success.

Types of Biases that Impact Traders

Analysing the various biases that may impact traders is an important part of developing a successful trading strategy. Traders can be prone to Overconfidence bias, Fear bias, Loss aversion, Confirmation bias, and Anchoring bias.

- Overconfidence bias involves overestimating one’s own abilities, which can lead to taking on excessive risk.

- Fear bias relates to the fear of losses or missing out on profits due to lack of knowledge or understanding.

- Loss aversion is when a trader experiences more regret for losses than joy from gains and may cause them to take fewer risks in their trades.

- Confirmation bias happens when traders seek information that confirms their existing beliefs about securities and markets instead of challenging those beliefs.

- Lastly, Anchoring Bias occurs when traders rely too heavily on initial pricing as a reference point for subsequent trades rather than relying solely on current market conditions.

Understanding these biases is critical for successful trading as it can help identify areas of potential weakness and improve trading performance moving forward. This will ultimately lead into overcoming and mitigating any biases that could have negative impacts on trading decisions.

Overcoming and Mitigating trading Biases

Developing strategies to overcome and mitigate trading biases can be an important factor in improving trading performance. A trader’s success often depends on their ability to recognize, address, and manage fear-based decisions and emotional reactions that lead to cognitive biases. This requires a risk taking attitude and the willingness to accept that losses are part of the process.

Developing strategies can help traders identify common triggers for fear-based decision making, as well as develop techniques to increase awareness of how these emotions affect their decision making process.

One strategy is mindful trading which involves conscious regulation of thoughts, feelings, and behaviors as they relate to trading activities. This helps traders become aware of their emotional reactions before they make a trade, allowing them more time for rational thought processes rather than being driven by impulse or emotion.

Other strategies include:

- Setting realistic goals with specific objectives

- Diversifying portfolios

- Using stop loss orders

- Keeping accurate records

- Developing an understanding of market dynamics

- Learning about different types of investments

- Remaining objective about trades regardless of outside factors

- Focusing on long-term gains instead short-term profits

With practice, traders can reduce cognitive biases while adhering to sound principles that will ultimately lead to improved performance in the financial markets.

Key Aspects of Trading Psychology

The development of trading psychology is essential for successful trading.

Discipline, patience, control over emotions, and the ability to overcome bad habits and biases are core aspects of a trader’s psychological makeup.

Dealing with losses and extended drawdown periods is also a crucial skill that traders must possess.

All of these components must be cultivated in order to achieve desirable outcomes from trading activities.

Discipline

Discipline is essential for successful trading, as it requires the trader to adhere to a specific set of rules and guidelines. Risk taking, fear management, and mental discipline are all key elements that need to be incorporated in order to make sound decisions.

Motivation building is necessary in order to stay focused on one’s objectives and not succumb to emotional pressure. Acceptance cultivating helps traders understand that failure isn’t always bad–it often provides them with valuable insight into their approach.

Patience

Patience is an essential factor for traders as it enables them to make decisions without being influenced by short-term market conditions. Patience can be a major asset in trading psychology, allowing traders to manage risk and avoid emotional mistakes.

It helps traders develop the psychological resilience needed to maintain their composure during losses, while still taking advantage of opportunities when they arise. A patient trader will analyze the market more effectively and make sound decisions based on accurate analysis.

| Trading Psychology | The study of how people behave when trading stocks, currencies, commodities etc. |

| Risk Management | Process of minimizing potential losses from investments or trades. |

| Market Analysis | Researching and evaluating financial markets for investment purposes. |

| Emotional Control | Ability to manage emotions in order to make rational decisions about trading activities. |

| Psychological Resilience | Mental ability to cope with stressful events in a positive way that maintains overall wellbeing. |

Dealing with losses and extended drawdown periods

Dealing with losses and extended drawdown periods can be challenging for traders. It requires careful risk management and emotional control in order to make rational decisions. Accepting losses is a difficult process that involves facing fear of the unknown and developing resilience to remain focused on achieving goals.

Managing stress levels in this situation is essential. It allows traders to maintain focus and keep their emotions in check. Developing strategies to cope with losses provides much needed control over emotions during these testing times. It enables traders to move forward without being weighed down by past failures.

This is especially important when it comes to controlling emotions.

Control over emotions

When it comes to dealing with losses and extended drawdown periods, controlling emotions is essential for successful trading. Risk management, emotion regulation, psychological resilience, goal setting, and self-awareness are crucial to understanding the psychology of a successful trader.

To manage emotions effectively, it is important to establish risk management strategies that define acceptable emotional responses to market fluctuations. This can help traders stay calm and focused even in volatile situations. Additionally, developing positive coping mechanisms such as meditating or journaling can be helpful in regulating reactions in high-stakes situations.

Strengthening psychological resilience is another important aspect of managing emotions. This can be achieved by setting realistic goals and creating an environment that encourages success. By having clear objectives and a supportive trading environment, traders can build resilience and bounce back from setbacks more easily.

Practicing self-awareness techniques is also crucial in controlling emotions. By understanding individual strengths and weaknesses when trading, traders can make more informed decisions and avoid impulsive actions driven by emotions.

Ultimately, mastering the ability to control emotions is key towards achieving success in the markets. By implementing risk management strategies, developing positive coping mechanisms, strengthening psychological resilience, and practicing self-awareness, traders can improve their emotional regulation skills and increase their chances of successful trading.

Overcoming bad habits, biases, and other psychological pitfalls

Developing strategies to reduce the influence of bad habits, biases, and other psychological pitfalls is essential for traders hoping to improve their long-term success in the markets. FOMO trading, risk management, and money management represent potential areas of difficulty that can drastically affect a trader’s success.

Market psychology and fear-based decisions also play a significant role in a trader’s performance. Therefore, a disciplined approach involving mental preparation and self-awareness is crucial for mitigating these issues.

One important aspect of this approach is recognizing when emotions such as fear or greed are influencing trades. Traders need to understand how to act accordingly and not let these emotions dictate their decisions.

Additionally, it is important for traders to develop trading plans that they can stick with. This helps them avoid taking unnecessary risks and acting on impulse due to FOMO (fear of missing out).

Developing a Winning Trading Mindset

Creating a winning trading mindset is a crucial step for any trader looking to achieve success in the markets.

Keeping a journal of your activities, setting clear rules and understanding your emotions are all important components of developing this mindset.

Additionally, it is essential to conduct research and analysis and hone your mindset through ongoing practice and experience.

Journal your activity

Journaling activity is a critical step in understanding the psychology of a successful trader. It can provide several benefits, such as:

- Identifying and managing risk aversion, overconfidence bias, and fear of missing out

- Creating positive affirmations to help manage stress and emotional responses

- Acknowledging progress made on goals by tracking trades over time

Through journaling, traders are able to better understand their motivations, emotions, and behavior which leads to better decision making. It is also an important tool for staying disciplined in trading decisions while remaining mindful of the big picture.

Journaling helps traders stay focused on their long term goals rather than getting caught up in short term wins or losses. Ultimately, journaling can be used to develop good habits that will make traders more confident and successful in their trading endeavors.

Create your own rules

Establishing personal trading rules is an essential aspect of achieving success in the financial markets. Fearful trading and risk aversion can be minimized by making informed decisions and avoiding overconfidence bias.

Emotional control is also key, as traders must identify their emotional reactions to certain situations and plan accordingly. A successful trader will have a well-defined set of rules that they follow to ensure they remain disciplined during volatile market conditions and avoid losses due to rash decision-making.

Understand your emotions

Identifying emotional responses to certain market conditions is an important step for a trader in order to maximize success. It is essential that traders understand their reactions to risk, failure, and other challenging market conditions in order to remain emotionally controlled.

- Fear of failure can cause self-doubt and lead to costly mistakes.

- Mental endurance is needed when trading during turbulent times.

- Risk tolerance must be balanced with the right amount of emotional control.

Developing these skills creates a sense of belonging among successful traders and helps them on their journey towards mastering the markets.

Conduct research and analysis

Conducting research and analyzing related data is a key factor for traders looking to optimize their trading strategies. Risk assessment, financial literacy, and understanding of trading strategies are all required for successful trading.

Mental toughness and emotional balance also play an important role in determining the success of a trader. Regular research helps a trader become more familiar with the market trends, which can be beneficial in making decisions that minimize risk while maximizing returns.

Furthermore, financial literacy enables traders to make sound decisions related to investments by recognizing both short-term and long-term risks associated with different types of investment options. All these factors combined help create successful trading strategies that work best for an individual’s circumstances.

Hone your mindset

Honing one’s mindset is a key component of successful trading. Setting achievable goals, managing risk, and having the ability to view the markets from different angles are all essential for success in this field.

- Utilizing visualization techniques and developing emotional control can help traders achieve their objectives.

- Applying risk management strategies to reduce losses can lead to better results while trading.

- Being open-minded to diverging views on the market will increase understanding and give more insight into potential gains or losses when trading.

A trader’s mindset plays an important role in their success and should be continually honed throughout their journey in order to maximize returns with minimal risk.

Conclusion

In conclusion, “Understanding Psychology of a Successful Trader” unveils the often overlooked yet critical aspect of trading success: the human mind. By comprehending the psychological nuances that influence trading decisions, you gain a distinct edge in the dynamic world of finance. Through discipline, emotional intelligence, and self-awareness, you can navigate the markets with confidence and resilience.

Let this guide serve as a beacon, reminding you of the profound impact of psychology on trading outcomes. Armed with this understanding, you are poised to embark on a path of trading success, equipped with the mental fortitude to overcome challenges and seize opportunities in the ever-changing financial landscape.

References

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

- Evaluation of the profitability of technical analysis for Asian currencies in the forex spot market for short-term trading

- Could a trader using only “old” technical indicator be successful at the Forex market?

- A Forex trading expert system based on a new approach to the rule-base evidential reasoning

Frequently Asked Questions

What Strategies Should I Use to Become a Successful Trader?

To become a successful trader, one must develop discipline, utilize leverage wisely, build confidence in their trading decisions, track progress and set achievable goals. Working on these elements will help to increase chances of success in the financial markets.

What Are the Most Important Skills for a Trader to Possess?

On average, successful traders spend 80% of their time researching trends, evaluating risk, and developing discipline. Essential skills for traders include setting goals, analyzing results and understanding how to manage risk. Doing so will help traders achieve desired outcomes in a responsible manner and foster a sense of belonging.

What Kind of Risk Management Strategies Should I Use?

Risk management strategies should involve financial planning, market analysis, technology usage, and risk assessment. Trading psychology is also essential to assess potential risks and maximize returns.

How Do I Manage My Emotions When Trading?

Navigating the complex emotions of trading can be like walking a tightrope – it requires control, discipline and balance. Controlling fear, developing discipline and understanding risk tolerance are all essential to achieving success in trading psychology. Achieving emotional equilibrium is key for traders who seek belonging in this high-stakes world.

How Do I Stay Motivated When Trading?

Staying motivated when trading requires developing discipline, controlling fear, knowing limits and achieving balance. Focus on understanding the markets to stay motivated while also being mindful of personal goals.

Gaining Perspective: Importance of Multiple Time Frames – Trading Insights 2023

Embark on a journey of insightful trading with a focus on the “Importance of Multiple Time Frames.” In the dynamic world of financial markets, understanding price action across different time frames is akin to having a multi-dimensional lens. This comprehensive guide unveils the strategic advantages of analyzing charts on various scales, from minutes to days.

By aligning short-term trends with broader market movements, traders gain a holistic perspective, enhancing their decision-making prowess. Join us on this illuminating expedition as we equip you with the knowledge and techniques to harness the power of multiple time frames, ultimately elevating your trading acumen.

Key Takeaways

- Improved accuracy in identifying trends and making decisions

- Increased confidence in trading abilities

- More opportunities for better entry and exit points in trades

- Informed decisions when entering or exiting trades

What Is Forex Trading

Forex trading is an investment activity involving the buying and selling of currencies in order to gain a profit. It is a highly profitable yet risky venture, so it is important for investors to understand the structure of Forex trading and develop money management strategies before getting involved.

In essence, the foreign exchange market is comprised of two main components: the spot market and the derivatives market. The former involves direct transactions between two parties, while derivatives are financial instruments that enable investors to speculate on future exchange rates without actually owning any currency.

Time frames are an integral part of Forex trading since they help traders determine when to enter or exit particular trades based on their risk tolerance. By analyzing different time frames such as daily charts, weekly charts, monthly charts, and longer-term trends, investors can get a better sense of where prices may be headed in the future.

This knowledge can then be used to make more informed decisions about when to trade and how much risk to take on any given trade. Ultimately, understanding different time frames within Forex trading can be essential for success in this volatile investment activity.

Importance of Multiple Time Frames

Multiple time frames are crucial in forex trading for several key reasons:

- Comprehensive Market Analysis: Examining multiple time frames allows traders to gain a holistic view of the market. By analyzing shorter time frames (e.g., 1-hour or 15-minute charts) alongside longer ones (e.g., daily or weekly charts), traders can identify both short-term trends and broader market movements.

- Confirmation of Trends: Utilizing multiple time frames helps in confirming the direction of a trend. For instance, if a currency pair is showing an uptrend on both the 1-hour and daily charts, it provides stronger confirmation compared to only relying on one time frame.

- Enhanced Entry and Exit Points: It enables traders to pinpoint more precise entry and exit points. For example, a trader may use a shorter time frame to identify an optimal entry point based on short-term indicators, while considering a longer time frame to ensure it aligns with the overall trend.

- Risk Management: Examining multiple time frames aids in risk assessment. By assessing the broader trend on longer time frames, traders can set stop-loss levels more effectively, reducing the risk of premature exits due to short-term volatility.

- Avoiding Overtrading: A myopic focus on one time frame can lead to overtrading, as traders may react impulsively to short-term fluctuations. Analyzing multiple time frames encourages a more disciplined and patient trading approach.

- Adaptation to Market Conditions: Different time frames are suitable for different market conditions. In volatile markets, shorter time frames can provide rapid insights, while longer time frames are more reliable during stable market conditions.

In essence, the importance of multiple time frames in forex trading lies in their ability to offer a comprehensive and nuanced understanding of the market, allowing traders to make well-informed decisions and manage risks effectively.

Benefits of Multiple Time Frames

Analyzing multiple time frames can provide traders with a more comprehensive outlook when entering the market. By evaluating risk and analyzing opportunities, traders can take advantage of the various benefits that come from using different time frames.

These advantages include:

- Improved Accuracy – Multiple time frames allow traders to identify trends and make better decisions based on a more complete picture of the market.

- Increased Confidence – As traders gain more information about the markets they are trading in, their confidence will increase leading to improved decision making abilities.

- Reduced Risk – By looking at multiple time frames, traders can identify potential risks before they enter positions which reduces their overall exposure to risk.

- More Opportunities – Multiple time frames unlock new opportunities by providing additional insights into both short-term and long-term market movements allowing for better entry and exit points in trades.

Identifying Market Trends

Identifying market trends is essential for successful forex trading as it helps traders to identify potential opportunities and risks. To gain insight into the current market sentiment and price action, traders should use multiple time frames when analyzing the market.

By studying different time frames, such as monthly, weekly, daily and intraday charts, a trader can get a more comprehensive picture of what is happening in the forex market. This allows them to better gauge the current trend direction or spot any emerging trends that could be beneficial for their trading strategy.

Additionally, looking at multiple time frames provides traders with an opportunity to understand underlying causes of movement in prices on various levels and timescales. This enables them to make more informed decisions when entering or exiting trades.

Therefore, incorporating multiple time frames into one’s analysis is an invaluable tool for forex traders who are looking to take advantage of profitable opportunities while avoiding unnecessary risks.

Setting up Multiple Time Frames

In order to gain a more comprehensive picture of the current market sentiment and price action, traders can benefit from incorporating multiple time frames into their trading strategies. Setting up multiple time frames allows traders to identify different trends and patterns that could not be seen on just one frame. This can help in developing strategies, managing risks, and making more informed decisions.

Here are four benefits of setting up multiple time frames:

- Analyzing long-term trend: By looking at higher time frames such as weekly or monthly charts, it is easier to identify longer-term trends which may not be visible on shorter time frames.

- Identifying entry and exit points: Lower time frames like daily or hourly charts can provide greater accuracy for entering positions as well as determining optimal exit points.

- Spotting divergences: Multiple time frames also allow traders to spot divergences between shorter-term price action and longer-term trends, which can signal potential reversals in the market.

- Seeing correlations: Having access to different data sets across various intervals gives traders the ability to look for correlations between different markets or securities that might otherwise go unnoticed.

Strategies for Multiple Time Frames

By utilizing multiple time frames, traders can develop strategies that are more comprehensive and provide greater insight into the current market conditions. Strategies for multiple time frames allow traders to take advantage of long term trends as well as short term scalping strategies. When used in conjunction with one another, they can create a powerful system that provides a comprehensive view of the market.

Using longer time frames allows traders to identify strong trends and capitalize on them. This is beneficial because it enables them to get in on the trend early and ride it out until the trend changes direction or stalls out completely. Additionally, longer time frames help traders identify potential reversals before shorter time frames do, which gives them an edge when trading these reversals.

Shorter time frames benefit scalpers by allowing them to quickly enter and exit trades without having to wait for long-term trends to play out. Scalping strategies also tend to be less risky than longer-term trades since they involve smaller positions and require less capital investment overall.

By using both long-term and short-term approaches, traders can reap the benefits of both while minimizing their risk exposure.

Overall, combining multiple timeframes is essential for successful forex trading as it gives traders an in-depth view of the market’s movements over different periods of time. With this knowledge, they are better equipped to make informed decisions about their trades and maximize their profits over the long run.

Risk Management With Multiple Time Frames

Utilizing multiple time frames is an effective way to manage risk in forex trading. Combining strategies from different time frames can provide a better understanding of the overall market trend and allow for more targeted risk management. Risk analysis on multiple time frames should include:

- Evaluating entry and exit points using short-term charts for precise timing;

- Considering medium-term trends when deciding whether to enter or exit a trade;

- Utilizing long-term charts to identify support and resistance levels;

- Examining all available data to assess potential risks associated with the trade.

By combining strategies from different time frames, traders can gain greater insight into the current market conditions, which allows them to make more informed decisions about their trades while managing risk more effectively.

Furthermore, trading using multiple time frames allows traders to take advantage of both short term and long term opportunities while reducing exposure to any single market condition or event.

Analyzing Volatility With Multiple Time Frames

When it comes to trading in the forex market, one of the most important aspects is analyzing volatility with multiple time frames. By utilizing different time frames when trading, traders can benefit from identifying short term trends while also being able to identify longer-term patterns. This allows for more informed decision making and a greater understanding of price movements.

Short term trading strategies such as scalping often require traders to use multiple time frames in order to identify entry and exit points in the market. By using multiple time frames, traders can gain an edge by spotting potential reversals or breakouts earlier than they otherwise would have been able to.

Furthermore, using multiple time frames allows traders to make decisions based on both short-term and long-term data – which gives them an advantage over those who are only looking at short-term trends.

Applying Technical Analysis to Multiple Time Frames

Technical analysis is an effective tool for traders to identify, analyze, and monitor trends in the forex market when taking into account multiple time frames.

By analyzing price action within different time frames, it helps traders to better understand how price changes over a period of time and can be used to determine potential entry or exit points.

Additionally, by monitoring volatility across multiple time frames, traders are able to adjust their strategies accordingly based on the current market conditions.

Identify Trends

Identifying trends in the forex market is an important part of successful trading. Traders must be aware of price sensitivity, use trend confirmation techniques, and watch multiple time frames to generate profits.

To identify trends in the forex market, traders can:

- Look at past data to determine how prices have moved over a given period;

- Analyze current price movements with technical indicators such as moving averages;

- Compare different time frames to understand the short-term and long-term trends;

- Monitor news events and economic releases that could influence currency pair volatility.

Analyze Price Action

Analyzing price action is important for traders looking to identify trends in the market. Price action theory, which emphasizes the importance of reading a chart’s raw price data, can be used to identify significant support and resistance levels. By analyzing these levels, traders can better understand what type of behavior should be expected from certain currency pairs over time.

Trend analysis is also an important tool in determining when a trend may start or end, and when it should be traded. This kind of analysis requires monitoring multiple time frames in order to make educated decisions about entry and exit points within the market. Analyzing both long-term and short-term trends allows for more accurate predictions about future price movements.

With a solid understanding of how to analyze price action, traders can then move on to monitor volatility in the market.

Monitor Volatility

Monitoring volatility in the market is crucial for comprehending potential price changes. Reading charts and analyzing price action over multiple time frames can provide insight on how the market may move, allowing traders to make informed decisions.

When monitoring volatility, these 4 points should be kept in mind:

- Monitor both short and long-term trends

- Track historical data for price levels being tested

- Pay attention to support and resistance levels

- Identify any potential opportunities or risks that may arise from changing market conditions.

Developing a Trading Plan With Multiple Time Frames

Constructing a trading plan that incorporates multiple time frames is a vital step in successful forex trading. Day traders may benefit from analyzing short-term charts to make quick profits, while long-term traders can use larger time frame charts to determine the overall direction of the market. Currency hedging strategies used on smaller time frames often require position sizing that can be adjusted based on risk tolerance and account size.

By utilizing multiple time frames, forex traders gain insight into how price movements interact across different periods of time which helps them make more informed decisions when entering or exiting positions. Additionally, understanding various correlations between different currency pairs allows for greater diversification and better portfolio management.

Ultimately, having a comprehensive trading plan with multiple time frames can reduce risk exposure and increase potential profits over the long term.

Conclusion

In conclusion, the “Importance of Multiple Time Frames” is the cornerstone of astute and informed trading. By juxtaposing different time scales, traders unlock a more comprehensive view of market dynamics. This strategic approach empowers them to identify opportune entry and exit points, as well as manage risk effectively.

As you delve into the intricacies of multiple time frame analysis, let this guide serve as your compass, providing valuable insights to navigate the complexities of financial markets. With a nuanced understanding of this essential technique, you’ll be poised to make more informed, strategic decisions, setting the stage for a successful trading journey.

References

- Can deep learning improve technical analysis of forex data to predict future price movements?

- Does high frequency trading affect technical analysis and market efficiency? And if so, how?

- Evaluation of the profitability of technical analysis for Asian currencies in the forex spot market for short-term trading

- Could a trader using only “old” technical indicator be successful at the Forex market?

Frequently Asked Questions

What Is the Best Time Frame for Forex Trading?

When it comes to forex trading, there is no single best time frame. Technical analysis and risk management should be used to determine an optimal combination of time frames. It is important to consider trends in different time periods and adjust accordingly.

Can an investor find a balance between reward and risk while trend following with multiple time frames?

Achieving the right mix of analysis is key, as longer time frames can provide more reliable signals but smaller frames may give earlier entries. Careful consideration must be taken when analyzing the market to ensure success.

What Is the Most Effective Strategy for Utilizing Multiple Time Frames?

An effective strategy for utilizing multiple time frames is to employ scalping methods while incorporating risk management. Detailed analysis of price movements and trends across varying time frames allows traders to identify optimal entry/exit points with greater accuracy. Additionally, such an approach helps ensure rational decision-making in the pursuit of profitable trades.

How Often Should I Adjust My Trading Plan According to Multiple Time Frames?

Adjusting a trading plan according to multiple time frames should be done based on price action and market sentiment. Understanding the underlying dynamics of the market is essential for successful trading, and adapting one’s strategy accordingly can lead to desirable results.

How Do I Manage Risk When Trading With Multiple Time Frames?

The key to managing risk when trading with multiple time frames is to utilise appropriate technical indicators and stop losses. Like a tightly-knit safety net, these tools can help protect traders from taking on too much risk in the market. Analyzing trends, volatility and momentum of each frame provides valuable insight into potential risks associated with trades. In addition, developing a comprehensive understanding of the markets’ behavior will further ensure risk management success.

Unmasking Trading Realities | Key Differences Between Demo Trading and Live Trading 2023

Navigate the intricate world of trading with a deep dive into the “Key Differences Between Demo Trading and Live Trading.” These differences form the very core of a trader’s journey. While demo trading provides a risk-free environment for practice, live trading exposes you to real market dynamics and emotions.

In this guide, we dissect these disparities, from the psychological aspects of trading live to the impact on decision-making. Join us in this enlightening exploration, where we unravel the nuances that distinguish the two, empowering you to make informed choices in your trading endeavors.

Key Takeaways

- Strategies that perform well in a demo trading environment may not yield similar results in live trading.

- Traders need to adapt their strategies based on current trends and market dynamics.

- Emotional control is crucial in live trading to avoid taking excessive risks or becoming overconfident.

- Effective risk management, including capital allocation and thorough analysis of historical data, is essential for successful trading.

Key Differences Between Demo Trading And Live Trading

While demo trading is an excellent learning tool, live trading brings real-world challenges and emotions that can significantly impact a trader’s decision-making. Both serve important purposes in a trader’s journey, with demo trading offering a safe space for practice and live trading putting skills to the test in the financial markets.

| Aspect | Demo Trading | Live Trading |

| Real Money at Stake | No real money is involved; you trade with virtual funds. | Involves real capital, risking your own money. |

| Emotional Impact | Minimal emotional impact; no fear of losing real money. | High emotional impact due to real financial risk. |

| Market Realism | Simulated market conditions; may not reflect real market behavior. | Real market conditions with actual price movements. |

| Execution Speed | Trades often execute instantly. | Execution speed can vary; may experience delays. |

| Risk Management | Risk-free; you can afford to be more aggressive. | Critical risk management; preservation of capital is vital. |

| Psychological Factors | Little psychological pressure; easier to experiment. | Strong psychological factors, including fear and greed. |

| Learning Experience | Suitable for learning strategies and platform familiarity. | Offers practical experience, teaching discipline and resilience. |

| Profit and Loss | Gains and losses are not real, impacting trader discipline. | Real financial consequences; profits and losses matter. |

| Trading Strategies | Testing new strategies without financial risk. | Implementing proven strategies for actual profit. |

Real-time Market Conditions

Real-time market conditions play a significant role in distinguishing demo trading from live trading. In demo trading, traders simulate real market conditions using virtual funds to practice their trading strategies without risking actual money. Live trading, on the other hand, involves the use of real funds and is subject to the volatility and unpredictability of the live market.

One key difference between demo trading and live trading is the accuracy of live market analysis. Demo accounts provide historical data or delayed quotes, which may not accurately reflect current market conditions. Thus, traders relying solely on demo accounts may face challenges when transitioning to live trading where accurate and up-to-date information is crucial for making informed decisions.

Another important aspect affected by real-time market conditions is the efficacy of different trading strategies. Strategies that perform well in a simulated environment might not yield similar results in a live setting due to variations in price movements and liquidity levels. Traders need to adapt their strategies based on current trends and market dynamics when engaging in live trades.

In conclusion, real-time market conditions significantly differentiate demo trading from live trading by influencing the accuracy of analysis and affecting the effectiveness of various trading strategies. Understanding these differences is essential for traders seeking success in both simulated and real-market environments.

Moving forward, it is important to consider how emotional impact further contributes to distinguishing demo trading from live trading.

Emotional Impact

The emotional impact experienced during the execution of trades in simulated environments versus actual trading environments remains a critical aspect to consider. The ability to maintain emotional control is essential for successful trading, as emotions can cloud judgment and lead to poor decision making.

Here are four key differences in emotional impact between demo trading and live trading:

- Fear of loss: In live trading, the fear of losing real money can evoke strong emotions such as anxiety and stress, influencing decision making.

- Greed and overconfidence: When real money is at stake, traders may be tempted to take excessive risks or become overconfident after a few successful trades.

- Regret and hindsight bias: Live traders often experience regret if they make a wrong decision, leading to self-doubt and second-guessing their strategies.

- Pressure from time constraints: Unlike demo trading where there is no urgency, live traders face time pressure due to market fluctuations, which can exacerbate emotional responses.

Understanding these emotional differences is crucial for developing effective risk management strategies and maintaining discipline in the decision-making process. Traders must cultivate emotional control by practicing mindfulness techniques, setting realistic expectations, and adhering to well-defined trading plans. By managing emotions effectively, traders can enhance their overall performance in live trading environments while minimizing irrational decision making driven by emotions.

Risk Management

Risk management is an essential aspect to consider when engaging in trading activities, as it helps traders mitigate potential losses and maintain financial stability. Effective risk management involves various strategies and techniques that traders can employ to protect their capital allocation and optimize profits. One such strategy is trade analysis, which involves evaluating past trades to identify patterns, trends, and potential risks. By analyzing previous trades, traders can gain valuable insights into market dynamics and make informed decisions about future investments.

Capital allocation plays a crucial role in risk management. Traders need to determine the appropriate amount of capital to allocate for each trade based on their risk tolerance and overall investment strategy. Allocating too much capital increases the risk exposure, while allocating too little may limit profit potential. Therefore, a careful assessment of market conditions and individual trading goals is necessary for effective capital allocation.

Trade analysis also aids in identifying potential risks associated with specific trading strategies or assets. Through thorough analysis of historical data, traders can assess the probability of success or failure for different trade setups. This allows them to adjust their positions accordingly or even avoid potentially risky trades altogether.

In conclusion, risk management is vital for successful trading outcomes as it helps minimize losses and maintain financial stability. Capital allocation and trade analysis are key components of effective risk management that enable traders to make well-informed decisions based on objective data rather than emotions alone.

In addition to risk management techniques, psychological factors also play a significant role in distinguishing between demo trading and live trading situations.

Psychological Factors

Transitioning from a simulated trading environment to an actual live trading situation brings forth various psychological factors that can significantly impact traders’ decision-making processes and overall performance. These factors, often rooted in cognitive biases, have the potential to influence traders’ judgment and lead to suboptimal outcomes. Understanding and managing these psychological factors is crucial for traders seeking success in the financial markets.

- Loss aversion: Traders tend to feel the pain of losses more intensely than the pleasure derived from gains. This bias can result in irrational decisions such as holding on to losing positions for too long or prematurely closing winning trades.

- Overconfidence: Traders may overestimate their abilities and underestimate market risks, leading to excessive risk-taking behavior and poor risk management practices.

- Confirmation bias: Traders have a tendency to seek out information that confirms their existing beliefs while ignoring conflicting evidence. This bias can limit their ability to objectively assess market conditions and make sound trading decisions.

- Herding behavior: Traders are often influenced by others’ actions and opinions, particularly during times of uncertainty. This herd mentality can lead to irrational buying or selling decisions based on social validation rather than objective analysis.

Recognizing these cognitive biases and actively working towards mitigating their impact is essential for maintaining a rational decision-making process in live trading environments, ultimately improving traders’ chances of success in the financial markets.

Execution Speed

Execution speed plays a critical role in the trading process, influencing the ability of traders to capitalize on market opportunities and effectively manage their positions. In today’s fast-paced financial markets, where market volatility can change rapidly, executing trades quickly is essential for success.

Market volatility refers to the degree of price fluctuations in a particular financial instrument or market. When market conditions are volatile, prices can change significantly within short time frames. Traders need to be able to react swiftly to these changes in order to enter or exit positions at desired prices.

Different trading strategies require different execution speeds. For example, high-frequency trading strategies rely heavily on lightning-fast execution speeds as they aim to profit from small price discrepancies that may only exist for a fraction of a second. On the other hand, longer-term investors may have more flexibility when it comes to execution speed as their strategies are based on fundamental analysis and don’t require immediate action.

To achieve faster execution speeds, traders often employ advanced technological solutions such as algorithmic trading systems and direct market access (DMA) platforms. These tools allow traders to automate their trades and directly connect with exchanges or liquidity providers, reducing latency and enabling faster order processing.

Financial Impact

The previous subtopic discussed the importance of execution speed in differentiating demo trading from live trading. Now, let’s delve into another crucial aspect: the financial impact. This aspect focuses on how demo trading and live trading differ in terms of their effects on financial planning and investment strategies.

- Psychological Impact: Live trading involves real money, which can evoke a range of emotions such as fear, greed, and anxiety. These emotions can impact decision-making and potentially lead to impulsive actions.

- Risk Management: Demo trading allows for risk-free experimentation with various strategies, enabling traders to understand their risk tolerance levels without experiencing actual financial losses. In contrast, live trading requires prudent risk management to protect capital while maximizing returns.

- Market Realism: While demo accounts simulate market conditions to some extent, they cannot fully replicate the complexities encountered in real-time markets. As a result, traders may experience differences in price movements and liquidity when transitioning to live trading.

- Financial Planning: Live trading necessitates comprehensive financial planning that takes into account factors such as income goals, expenses, taxes, and retirement plans. This level of preparation is typically absent when using demo accounts.

Transitioning into the subsequent section regarding learning and growth opportunities, it is essential to recognize that both demo and live trading offer unique avenues for individuals seeking to enhance their knowledge and skills in the world of finance.

If interested you can read about candlestick charts here. Moreover, you can read more about technical analysis here.

Learning and Growth Opportunities

Learning and growth opportunities arise from the distinct characteristics and features offered by both demo trading and live trading.

Demo trading, also known as paper trading, provides traders with a simulated environment to practice their trading strategies without risking real money. It allows traders to familiarize themselves with the intricacies of the market, test different learning strategies, and gain confidence in their decision-making abilities. Moreover, demo trading enables individuals to evaluate their performance objectively by analyzing their trades and identifying areas for improvement.

On the other hand, live trading involves real money and exposes traders to the emotions associated with financial risk. This experience can be invaluable in developing discipline, resilience, and emotional control necessary for successful trading. Additionally, live trading offers an opportunity for immediate feedback on one’s performance as it directly impacts financial outcomes.

To optimize learning and growth opportunities in both demo and live trading scenarios, traders should focus on effective learning strategies such as setting clear goals, maintaining a journal of trades for self-reflection, seeking feedback from experienced traders or mentors, and constantly evaluating performance through rigorous performance evaluation techniques like tracking key metrics or using specialized software tools.

Conclusion

In conclusion, understanding the “Key Differences Between Demo Trading and Live Trading” is pivotal for any aspiring trader. While demo trading offers a safe space for honing skills, live trading brings the thrill and pressure of real financial markets. The transition demands emotional resilience and a refined strategy.

As you embark on your trading journey, let this guide be your beacon, reminding you of the critical variances that can influence your trading success. With a clear awareness of these distinctions, you can navigate the challenges and opportunities of both worlds, ultimately shaping yourself into a more proficient and profitable trader.

References

- Lessons from the evolution of foreign exchange trading strategies

- Application of neural network for forecasting of exchange rates and forex trading

- Multi-agent forex trading system

- Short-term predictions in forex trading

Frequently Asked Questions

How Can I Effectively Manage My Emotions While Live Trading?

Effectively managing emotions while live trading involves recognizing and understanding psychological factors that can impact decision-making. Strategies such as maintaining discipline, practicing mindfulness, and utilizing risk management techniques can help traders navigate the emotional challenges of live trading.

What Are Some Common Psychological Factors That Can Affect Trading Decisions?

Common psychological factors in trading decisions include fear, greed, overconfidence, and loss aversion. To manage emotions while live trading, traders can use strategies such as setting realistic goals, practicing mindfulness, and employing risk management techniques.

Is There a Recommended Risk Management Strategy for Live Trading?

An effective risk management strategy is crucial for live trading. Implementing a recommended risk management strategy can help traders minimize potential losses and protect their capital, thereby enhancing their chances of long-term success in the market.

How Can I Ensure That I Am Executing Trades at the Optimal Speed?

Optimal execution of trades at the desired speed can be ensured by implementing efficient trading strategies, utilizing advanced order types, and leveraging high-performance technology infrastructure. These factors contribute to minimizing latency and maximizing trade efficiency.

What Are Some Potential Financial Impacts of Live Trading That I Should Be Aware Of?

Potential financial risks of live trading include market volatility, slippage, and execution delays. The importance of trade execution speed lies in minimizing potential losses or missed opportunities due to price changes during the time it takes to execute a trade.

Analyzing Tools: What Are Indicators and Oscillators – In-Depth Explanation 2023

Delve into the dynamic world of Forex trading as we demystify “What Are Indicators and Oscillators.” In the ever-evolving landscape of currency markets, these tools are your compass, guiding you towards informed trading decisions.

Indicators and oscillators offer valuable insights into market trends, momentum, and potential reversals, empowering traders to navigate the complexities of Forex with precision. Join us on this illuminating journey as we explore how these powerful instruments can amplify your trading strategies, refine your entries and exits, and ultimately contribute to your success in the world of Forex trading.

Key Takeaways

- Indicators and oscillators are mathematical calculations used in technical analysis to identify patterns and trends in financial markets.

- Commonly used indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastic Oscillator, and Bollinger Bands.

- Indicators and oscillators help traders make informed decisions, identify entry or exit points, and confirm signals from other technical analysis tools.

- It is important to choose the right oscillator based on responsiveness, accuracy, and the trader’s strategy, and to consider the limitations of indicators and the need for additional analysis.

What Are Indicators and Oscillators?

Indicators and oscillators in forex trading are tools used to analyze price movements and predict future market trends. Indicators are mathematical calculations applied to a currency pair’s price, volume, or open interest data. They help traders identify potential buy or sell signals based on historical price patterns and trends.

Oscillators, on the other hand, are a specific type of indicator. They typically move within a fixed range, helping traders identify overbought or oversold conditions in the market. Popular oscillators include the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD).

In essence, both indicators and oscillators provide valuable insights into market dynamics, aiding traders in making informed decisions about their forex positions.

Understanding Technical Analysis

Understanding technical analysis involves studying various indicators and oscillators to identify patterns and trends in financial markets. Technical analysis is a method used by traders to forecast future price movements based on historical market data. It relies on the premise that past price and volume data can provide insights into future market behavior. Traders use a wide range of analysis techniques, including chart patterns, trend lines, support and resistance levels, moving averages, and momentum indicators.

Indicators are mathematical calculations applied to price or volume data to help identify potential trading opportunities. Commonly used indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastic Oscillator, and Bollinger Bands. These indicators provide traders with information about overbought or oversold conditions, trend strength, and potential reversal points.

Oscillators are a type of indicator that fluctuates between two extreme values to indicate overbought or oversold conditions. They can be useful for identifying potential turning points in the market. Examples of popular oscillators include the RSI, MACD histogram, and Commodity Channel Index (CCI).

The benefits of technical analysis lie in its ability to help traders make informed decisions based on objective data rather than relying solely on emotions or opinions. By using analysis techniques such as indicators and oscillators, traders can gain insights into market trends, volatility levels, and potential entry or exit points for trades. This knowledge can improve their chances of making profitable trades while managing risk effectively.

Types of Indicators

Categorizing these tools can be done based on their mathematical calculations and the type of information they provide to traders. Indicators and oscillators are commonly used in forex trading to analyze price movements and identify potential trends. They help traders make informed decisions by providing insights into market dynamics.

Some types of indicators include:

- Moving Averages: These indicators smooth out price data over a specified period, helping traders identify trends and potential reversal points.

- Bollinger Bands: These indicators consist of a moving average with an upper and lower band that represent the standard deviation from the average. They are used to identify overbought or oversold conditions.

- Relative Strength Index (RSI): This momentum indicator measures the speed and change of price movements. It is often used to determine if a currency pair is overbought or oversold.

- Stochastic Oscillator: This indicator compares a closing price to its price range over a given time period, indicating potential trend reversals.

- MACD (Moving Average Convergence Divergence): This indicator calculates the difference between two moving averages, signaling potential buy or sell opportunities.

Popular Oscillators

This discussion will focus on comparing and contrasting the Relative Strength Index (RSI) with the Stochastic oscillator.

These popular oscillators are commonly used by traders to analyze market trends and identify potential entry or exit points.

By understanding their unique characteristics and how they generate signals, traders can make informed decisions based on technical analysis.

In addition to the RSI and Stochastic oscillator, we will also examine the Moving Average Convergence Divergence (MACD) and Bollinger Bands.

These indicators provide valuable insights into market momentum and volatility.

RSI Vs. Stochastic

The Relative Strength Index (RSI) and Stochastic oscillator are two commonly used technical indicators in Forex trading that provide insights into potential overbought or oversold conditions in a market. Both indicators aim to identify price levels at which an asset may be due for a reversal or correction. While they serve similar purposes, there are some key differences between RSI and Stochastic:

- RSI is a momentum oscillator that measures the speed and change of price movements, indicating whether an asset is overbought or oversold.

- Stochastic oscillator compares the closing price of an asset to its price range over a specified period, identifying potential turning points.

Comparing overbought and oversold conditions:

- RSI uses divergence analysis to identify potential reversals.

- Stochastic identifies overbought and oversold conditions by comparing the current closing price with the highest high or lowest low within a given timeframe.

Overall, both RSI and Stochastic can be valuable tools for traders to assess market conditions, but their methodologies differ slightly in how they analyze overbought and oversold conditions.

MACD and Bollinger Bands

MACD and Bollinger Bands are technical analysis tools commonly used by traders to identify potential trends, reversals, and volatility in financial markets.

The Moving Average Convergence Divergence (MACD) is based on the concept of moving averages and consists of two lines: the MACD line and the signal line. Traders analyze the crossovers between these lines to determine buy or sell signals. The MACD can also be used to identify divergence between price and momentum, which may suggest a potential trend reversal.

On the other hand, Bollinger Bands consist of an upper band, a lower band, and a middle band based on a moving average. Traders use Bollinger Bands to assess market volatility and identify potential overbought or oversold conditions. By analyzing price movements within the bands, traders can make informed decisions regarding trend analysis.

Overall, both MACD and Bollinger Bands provide valuable insights into market trends and help traders make informed trading decisions.

How Indicators and Oscillators Work

Indicators and oscillators in forex trading operate by utilizing mathematical formulas to analyze historical price data and generate signals for potential market trends. These tools have become an integral part of technical analysis, aiding traders in making informed decisions.

Benefits of using indicators and oscillators include:

- Identifying market trends: Indicators can help detect the overall direction of the market, whether it’s trending up, down, or sideways.

- Generating entry and exit signals: By analyzing price movements, indicators can provide signals for entering or exiting trades at opportune moments.

- Confirming price patterns: Indicators can validate chart patterns such as support and resistance levels, trendlines, and breakouts.

- Assessing momentum: Oscillators measure the speed and strength of price movements, indicating overbought or oversold conditions.

- Improving risk management: Indicators can assist in setting stop-loss levels or determining optimal profit targets.

However, relying solely on indicators and oscillators has its limitations:

- Delayed signals: Indicators are based on historical data, which means they may not accurately predict future price movements in real-time.

- False signals: Market conditions can change rapidly, leading to false trade signals generated by indicators that fail to adapt quickly enough.

- Lack of context: Indicators alone may not consider fundamental factors influencing markets, so additional analysis is necessary for a comprehensive understanding.

To maximize the benefits while mitigating limitations, traders often combine multiple indicators with other analytical techniques to form a well-rounded trading strategy.

If interested you can read about candlestick charts here. Moreover, you can read more about technical analysis here.

Using Indicators and Oscillators in Forex Trading

The use of indicators and oscillators is crucial in forex trading as they provide valuable insights into market trends and help traders make informed decisions.

Choosing the right oscillator is essential for accurate analysis, as different oscillators have varying characteristics and are suitable for different trading strategies.

Interpreting indicator signals requires a thorough understanding of their components, such as moving averages or price momentum, to accurately gauge market conditions and potential entry or exit points.

Importance of Indicators

One aspect to consider is the significance of utilizing indicators in forex trading. Indicators play an important role in analyzing market trends and making informed trading decisions. Interpreting indicator data can provide valuable insights into price movements, volatility, and potential entry or exit points for trades.

Here are five benefits of using indicators:

- Improved decision-making: Indicators help traders identify potential opportunities and make more informed decisions based on objective data.

- Trend identification: Indicators can assist in identifying market trends, allowing traders to align their strategies with the prevailing direction.

- Confirmation of signals: Indicators can act as a confirmation tool, validating other technical analysis tools or signals before executing a trade.

- Risk management: Indicators provide insights into market conditions and volatility, aiding in risk assessment and management.

- Strategy development: By analyzing indicator data over time, traders can develop and refine their trading strategies for better performance.

Incorporating indicators into forex trading allows for a more comprehensive analysis of the market and enhances the overall trading experience.

Choosing the Right Oscillator

When selecting an oscillator, it is crucial to consider its responsiveness and ability to capture price fluctuations accurately. The choice of the right oscillator plays a significant role in developing a successful forex trading strategy. Traders need to analyze market trends and identify suitable oscillators that align with their chosen strategies.

There are various types of oscillators available, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator, among others. Each oscillator has its own strengths and weaknesses, which should be evaluated based on the trader’s specific requirements.

Interpreting Indicator Signals

To effectively interpret signals from technical analysis tools, it is essential to understand their underlying mathematical formulas and the concepts they represent. This knowledge allows traders to make informed decisions based on indicator trends and crossovers.

When interpreting indicator trends, traders should consider the direction and strength of the trend. A steep upward or downward slope indicates a strong trend, while a flat line suggests a lack of momentum.

Additionally, analyzing indicator crossovers can provide valuable insights into market conditions. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, indicating potential buying opportunities. Conversely, a bearish crossover happens when a shorter-term moving average crosses below a longer-term moving average, suggesting potential selling opportunities.

Common Mistakes to Avoid

A common mistake to avoid in forex trading is relying solely on indicators and oscillators without considering other factors that may influence market movements. While indicators and oscillators are valuable tools for technical analysis, they should be used in conjunction with other forms of analysis to make informed trading decisions.

One of the most frequent mistakes made by traders is an over-reliance on indicators and oscillators without proper utilization. Traders often fall into the trap of thinking that these tools alone can accurately predict future market trends. However, it is important to remember that indicators and oscillators are based on historical price data and mathematical calculations. They provide insights into past market behavior but cannot guarantee future outcomes.

Another mistake is using too many indicators at once, leading to information overload. This can result in conflicting signals and confusion, making it difficult for traders to make effective decisions. It is crucial to select a few key indicators that align with one’s trading strategy and focus on their signals rather than becoming overwhelmed by a multitude of conflicting information.

In conclusion, while indicators and oscillators play a crucial role in forex trading, they should not be relied upon as the sole basis for decision-making. It is important for traders to consider other factors such as fundamental analysis, economic news releases, and market sentiment when interpreting indicator signals. By integrating multiple forms of analysis, traders can improve their chances of making successful trades.

Transition: Now that we have discussed some common mistakes to avoid when using indicators and oscillators in forex trading, let’s explore some best practices for effectively utilizing these tools in the next section.

Best Practices for Using Indicators and Oscillators

In order to effectively utilize these tools, it is important for traders to carefully select a few key indicators or oscillators that align with their trading strategy and focus on the signals provided by these selected tools. By following some best practices for indicator selection, traders can improve their decision-making process and avoid common pitfalls in using indicators and oscillators.

Some best practices for indicator selection include:

- Understanding the purpose: Traders should have a clear understanding of the purpose of each indicator or oscillator they choose. This includes knowing whether it is a trend-following or trend-reversal indicator, its calculation method, and any limitations associated with its use.

- Analyzing historical performance: It is crucial to analyze the historical performance of indicators and oscillators before incorporating them into a trading strategy. This helps traders assess their effectiveness in different market conditions.

- Considering correlation: Traders should consider the correlation between different indicators and oscillators when selecting them. Using multiple tools that provide similar signals may not necessarily improve accuracy but can introduce redundancy.

- Testing on demo accounts: Before using indicators and oscillators on live accounts, it is advisable to test them thoroughly on demo accounts. This allows traders to gain familiarity with the tools without risking real funds.

- Regular evaluation: Traders should regularly evaluate the performance of selected indicators and oscillators to ensure they continue to align with their trading goals. Adjustments or replacements may be necessary if certain tools prove ineffective over time.

Conclusion

In conclusion, understanding “What Are Indicators and Oscillators” is pivotal for traders seeking to thrive in the Forex market. These tools, when used effectively, provide essential information on market conditions, helping traders make informed decisions.

From identifying entry and exit points to gauging trend strength and potential reversals, indicators and oscillators are invaluable allies in the trader’s toolkit. As you embark on your Forex trading journey, let this guide be your source of knowledge and inspiration, empowering you to harness the power of these tools for optimal trading outcomes. Embrace the possibilities that indicators and oscillators offer and elevate your Forex trading game to new heights.

References

- Lessons from the evolution of foreign exchange trading strategies

- Application of neural network for forecasting of exchange rates and forex trading

- Multi-agent forex trading system

- Short-term predictions in forex trading

Frequently Asked Questions

Are Indicators and Oscillators the Only Tools Used in Forex Trading?

Fundamental analysis can be used alongside indicators and oscillators in forex trading. Limitations of relying solely on indicators and oscillators include their inability to consider fundamental factors and the potential for false signals.

How Can I Choose the Most Suitable Indicators and Oscillators for My Trading Strategy?

Choosing suitable indicators and oscillators is crucial for a successful forex trading strategy. Their selection greatly impacts trading outcomes. Knowledge, analysis, and attention to detail are necessary when considering the most appropriate tools for one’s specific approach.

Can I Rely Solely on Indicators and Oscillators to Make Profitable Trades?

The reliance solely on indicators and oscillators for profitable trades in forex trading is questionable. Fundamental analysis plays a crucial role, while understanding market conditions and trends is vital to effectively utilize these tools.

Are There Any Indicators or Oscillators That Work Best for Specific Currency Pairs?

The effectiveness of indicators and oscillators in forex trading varies depending on the specific currency pairs. Certain indicators, such as those suitable for scalping, may work better for certain pairs, while oscillators may be more effective in trend trading.

How Often Should I Update My Indicators and Oscillators to Ensure Their Effectiveness in Forex Trading?

To ensure the effectiveness of indicators and oscillators in forex trading, determining the best time frame to update them is crucial. Additionally, optimizing their settings for maximum effectiveness can enhance trading outcomes.

Unlocking Insights: How Do Double Top and Double Bottom Chart Patterns Work – Comprehensive Guide 2023

Embark on a journey into the fascinating realm of technical analysis with an exploration of “How Do Double Top and Double Bottom Chart Patterns Work.” These patterns serve as crucial indicators in deciphering market trends, offering invaluable insights to traders and investors. A ‘Double Top’ signifies a potential trend reversal, where an uptrend may transition into a downtrend.

Conversely, a ‘Double Bottom’ marks a shift from a downtrend to an uptrend. In this comprehensive guide, we unravel the intricacies of these patterns, providing actionable strategies to enhance your trading prowess. Join us as we delve into the world of chart analysis and empower you with the knowledge to make informed investment decisions.

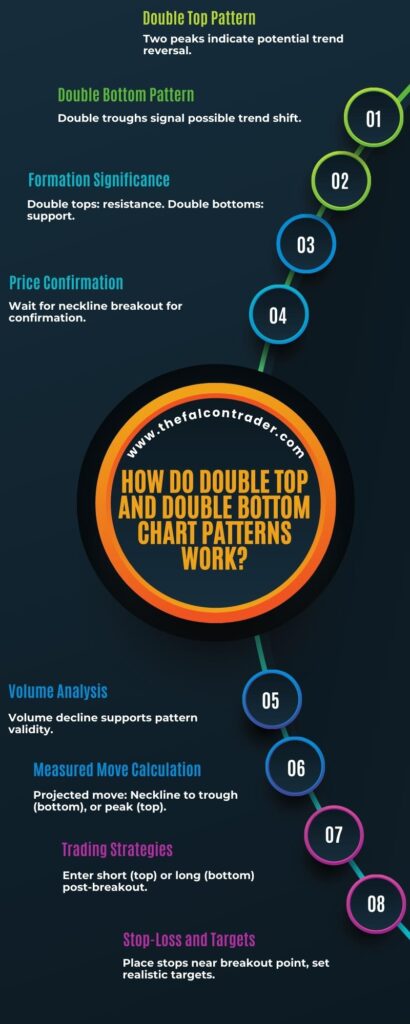

Key Takeaways

- Double top and double bottom patterns are widely used chart patterns in technical analysis to identify potential price trends.

- These patterns are formed due to resistance or support levels at specific price points, influenced by traders’ emotions and reactions to market news or events.

- Double top pattern occurs when the price increases, decreases, and then increases again without surpassing the initial high level, indicating a potential reversal from an uptrend to a downtrend.

- Double bottom pattern occurs when the price decreases, increases, and then decreases again without going below the initial low level, suggesting a potential reversal from a downtrend to an uptrend.

What Is a Double Top/Double Bottom Chart Pattern

A double top/double bottom chart pattern is a chart formation that occurs when there is resistance or support at a particular price point. Technical indicators and money management strategies are used to identify these patterns.

The double top pattern appears after a security’s price has increased, then decreased, and then increased again, but not beyond the initial high level before decreasing.

Similarly, the double bottom pattern appears after the security’s price has decreased, then increased, and then decreased again but not beyond the initial low level before increasing.

The formation of this type of chart pattern can be attributed to traders’ emotions as they react to market news or events. Buyers tend to become more cautious once prices have reached certain levels during an uptrend or downtrend which results in less buying pressure causing prices to reverse direction.

Therefore, traders should be able to recognize this type of chart pattern in order to take advantage of potential opportunities or avoid potential losses from trading breakouts that may not occur.

How Do Double Top and Double Bottom Chart Patterns Work?

Double top and double bottom chart patterns are technical analysis patterns used in financial markets, particularly in stock trading, to identify potential trend reversals. Here’s how they work:

Double Top Pattern:

Formation: The double top pattern occurs after a prolonged uptrend in a security’s price. It consists of two peaks at approximately the same price level, separated by a valley (trough) in between. This formation resembles the letter “M.”

Significance: The double top pattern suggests that the previous uptrend may be losing momentum, and a trend reversal to the downside could be imminent. It indicates that buyers have failed to push the price higher twice, and selling pressure may be increasing.

Trading Strategy: Traders often look for a confirmed breakdown below the trough (valley) that separates the two peaks to confirm the pattern. This breakdown can be seen as a signal to sell or short the asset, anticipating a downtrend.

Double Bottom Pattern:

Formation: The double bottom pattern is the opposite of the double top. It occurs after an extended downtrend and consists of two troughs at approximately the same price level, separated by a peak in between. This formation resembles the letter “W.”

Significance: The double bottom pattern suggests that the previous downtrend may be losing steam, and a trend reversal to the upside could be on the horizon. It indicates that sellers have failed to push the price lower twice, and buying pressure may be increasing.